Table of Contents

Estimated reading time: 11 minutes

RBNZ Previously Said It Was “Too Early” For a Central Bank Digital Currency:

Back in June 2018, we reported on a bulletin from the Reserve Bank of New Zealand. It discussed how a digital currency could be issued by a central bank and what the pros and cons of this would be. See: RBNZ on Central Bank Digital Currency and Negative Interest Rates

A few weeks later, the Reserve Bank Deputy Governor Geoff Bascand delivered a speech and gave the RBNZ’s position on issuing an official digital currency. The verdict overall was “not now”.

The interestingly titled speech “In Search of Gold: Exploring central bank issued digital currency” was delivered to Payments New Zealand. The content was based upon the 3 Reserve Bank Bulletins on digital currencies which we had previously also reported on extensively in 2018. See:

1. RBNZ Cryptocurrency to Replace NZ Physical Currency with a Digital Alternative?

2. Update on the War on Cash: Australia Moving to Cashless Society? + RBNZ on Digital Currency

3. RBNZ on Central Bank Digital Currency and Negative Interest Rates

Back in 2018, the Deputy Governor said the RBNZ had been exploring whether a central bank issued digital currency would “better meet the needs of the public”. He said,

“Issuing a central bank digital currency would ensure public access to legal tender money regardless of the presence of cash.”

An advantage would be that a digital currency is

“easier and faster to distribute around the country than banknotes because it doesn’t need to be transported, but there would be new infrastructure costs if a central bank digital currency were introduced. “We’re also interested in whether a central bank digital currency could bring improvements to the payments system. Here the pros and cons very much depend on how the digital currency is designed. Digital currencies with central control can improve efficiency but potentially at the expense of reduced resilience. At this time, a blockchain-type of official digital currency would reduce the efficiency of the payments system.”

He also commented on the impact a digital currency would have on financial stability.

“One of the most important contributions a central bank makes to prosperity is supporting financial stability. We couldn’t issue a digital currency if it might undermine financial stability, and there are considerable risks on this front”.

The overall conclusion of the speech was that it was too early for a CBDC to be issued:

“The payments industry is dynamic and the Reserve Bank is searching for ways to harness new technologies and do things better. Maintaining trust and confidence in our currency, and in the payments and banking system means that in a gold rush we must be a very considered prospector; we have New Zealand’s financial system at stake. Currently, it is still too early to determine whether a digital currency should be issued”.

You can read the full speech here.

RBNZ Latest Views on CBDC: No Longer “Too Early”

Well it looks like it is no longer “too early” to determine whether a central bank digital currency (CBDC) should be issued in New Zealand.

Last month the RBNZ released their Statement of Intent for 2021 to 2024. They said they will be investigating the future of money, including the need for digital money issued by the Bank to the general public (i.e. a central bank digital currency [CBDC]).

The Reserve Bank stated [emphasis added is ours]:

“A CBDC could be complementary to cash and would provide many of the benefits of cash. It could also provide digital fiat money and ensure the role of fiat money is preserved into the future. We will consult the public on the high-level public policy cases surrounding CBDC and develop a work plan to test the perceived benefits and challenges.”

Then earlier this month the New Zealand central bank confirmed they would be consulting the public over the rest of 2021. They will consider “what a resilient and stable cash and currency system in New Zealand might look like, and how we might best respond to digital innovations in money and payments.”

The RBNZ:

“…will look at the potential for a Central Bank Digital Currency (CBDC) to work alongside cash as government-backed money, issues arising from new electronic money forms including crypto assets (such as BitCoin) and stable coins (such as proposed by a Facebook-led consortium), and how the cash system might need to change to continue to meet the needs of users.”

Reading Between the Lines: Where Are We Heading With CBDC’s?

Of course the rationale for the implementation of a central bank digital currency is couched in the need to “better meet the needs of the public”.

The Reserve Bank uses flowery terms such as a “new stewardship mandate for cash and a broader currency system that supports the prosperity and wellbeing of New Zealanders“. The RBNZ’s new focus on climate change and also incorporating Maori culture are other distractions from what the central bank really does. That is to guarantee a loss of purchasing power of the Kiwi dollar every year. “Inflation targeting” might sound good. But a guaranteed loss of purchasing power of the Kiwi dollar every year is what it actually means.

But we got a little sidetracked there. Can we do some reading between the lines to see where all this central bank digital currency talk may be heading?

To us there are a few key points dotted amongst the many press releases from the RBNZ on the topic of CBDC.

The bold section we highlighted earlier looks to be the main reason for this review. Namely to, “…ensure the role of fiat money is preserved into the future”. Because the central bank would have no reason to exist if fiat money didn’t exist!

The latest press release also states:

“…digital forms of payment are the preferred way of paying for the majority of us, and that the future will undoubtedly involve less cash. Our job is to ensure that these transitions work for all New Zealanders.

“The potential for a Central Bank Digital Currency to help address some of the downsides of reducing physical cash use and services is something we want to explore for New Zealand. A CBDC, similar to digital cash, might well be part of the solution, but we need to test our assessment of the issues and proposed approach before developing any firm proposals.”

Source.

In a speech last October the deputy governor Christian Hawkesby also stated:

“…it has become clear that the cash system as it stands will not be sustainable in a world where cash is used less and less. This requires a broader response with either a series of changes to the cash system or a transformational redesign of the entire system.“

Source.

The words we have bolded are significant. A “transformational redesign” of the use of cash looks to be on the cards.

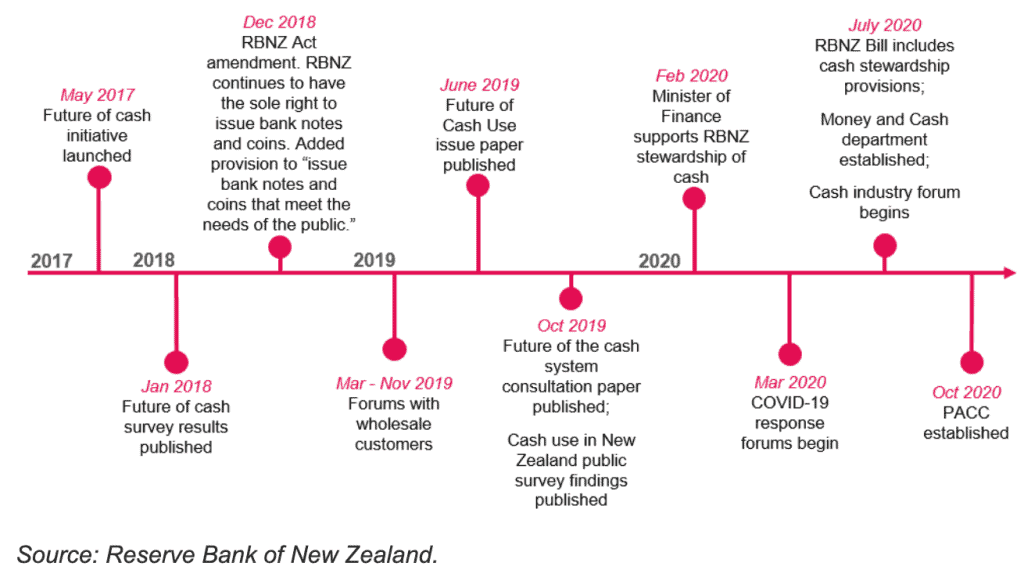

Quite a lot has happened since 2018 including some legislative changes as shown below. Changes to the way cash is used seem inevitable.

To us it seems the CBDC is being positioned as the “obvious answer” to the reduction in cash usage. A CBDC will “solve” all these issues such as not enough bank branches or ATMs. Along with the rising per transaction cost as less cash is used.

But the removal of cash is not better for the public. But then again a monetary system based upon debt isn’t either. Neither is the requirement of yearly loss of purchasing power through inflation. But we still have both of those currently!

The real risk of the loss of cash is that the public no longer has an escape from the likes of negative interest rates. It also makes it much easier to implement the likes of “helicopter money”. This may even be how citizens are “encouraged” to take up the CBDC. Maybe we’ll be “given” some free CBDC in exchange for signing up for their new RBNZ “e-wallet”.

Whereas from the governments perspective, a major benefit of a CBDC is that they can track exactly what money you are receiving and spending. They could also effectively freeze someone out of the system. Plus bank runs become impossible as you can’t withdraw cash.

Cash Usage May Be Falling, But Cash in Circulation Continues to Rise

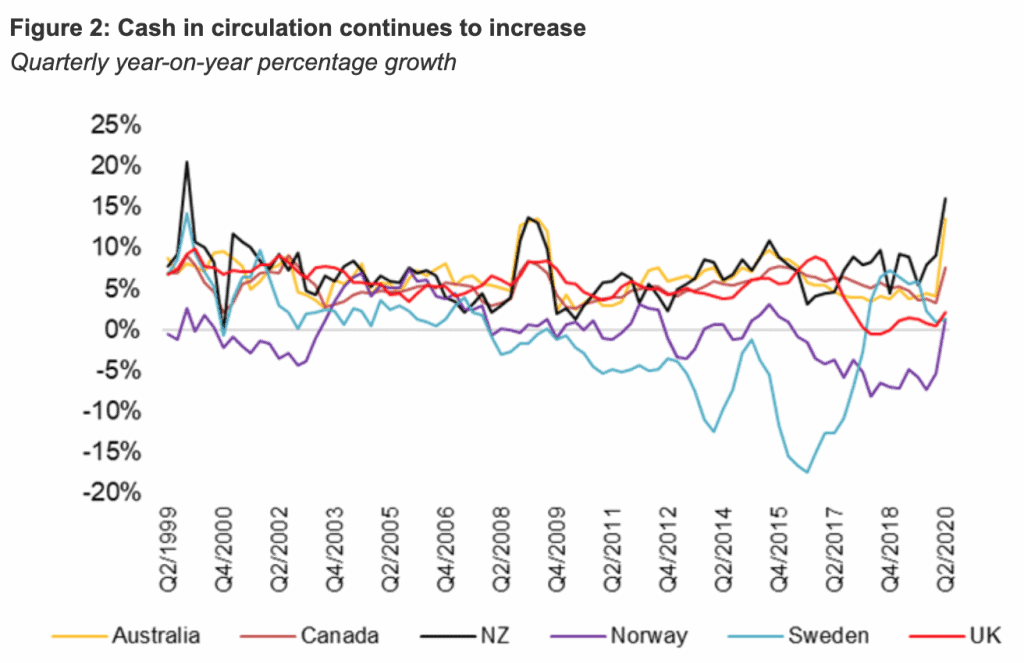

RBNZ surveys not surprisingly show that the publics use of cash continues to fall. However the amount of cash in circulation in New Zealand continues to rise, just as it has overseas.

This is simply a reflection of people hoarding cash due to the uncertainty of the past 18 months. In New Zealand cash holdings are even higher than during the 2008 financial crisis.

So that further reinforces the importance of cash remaining an option for people. But it looks like Mr Cash’s days are numbered.

Clues From Elsewhere – What Are Other Central Banks Up To?

Eswar Prasad, a professor of economics at Cornell University, noted that:

“a central bank digital currency would have major implications both for the running of monetary policy and for financial stability. Central banks may find it easier to implement a range of unorthodox policies, such as “helicopter drops” or “negative rates.” These policies would be applied directly in each individual’s central bank account, which would make them more powerful than if they had to go through the banking system.”

…While the Bank of Japan and the European Central Bank teamed up to study the technology underlying digital currencies, before concluding this was not mature enough to power the world’s main payment systems. The Bank of Canada and the Monetary Authority of Singapore have chosen to collaborate on a study, too. The Bank for International Settlements — of which 60 central banks are members — is spearheading the international efforts into the analysis of digital currencies.

Source.

Since that was written the BIS now lists 4 ongoing projects actively working on CBDC’s.

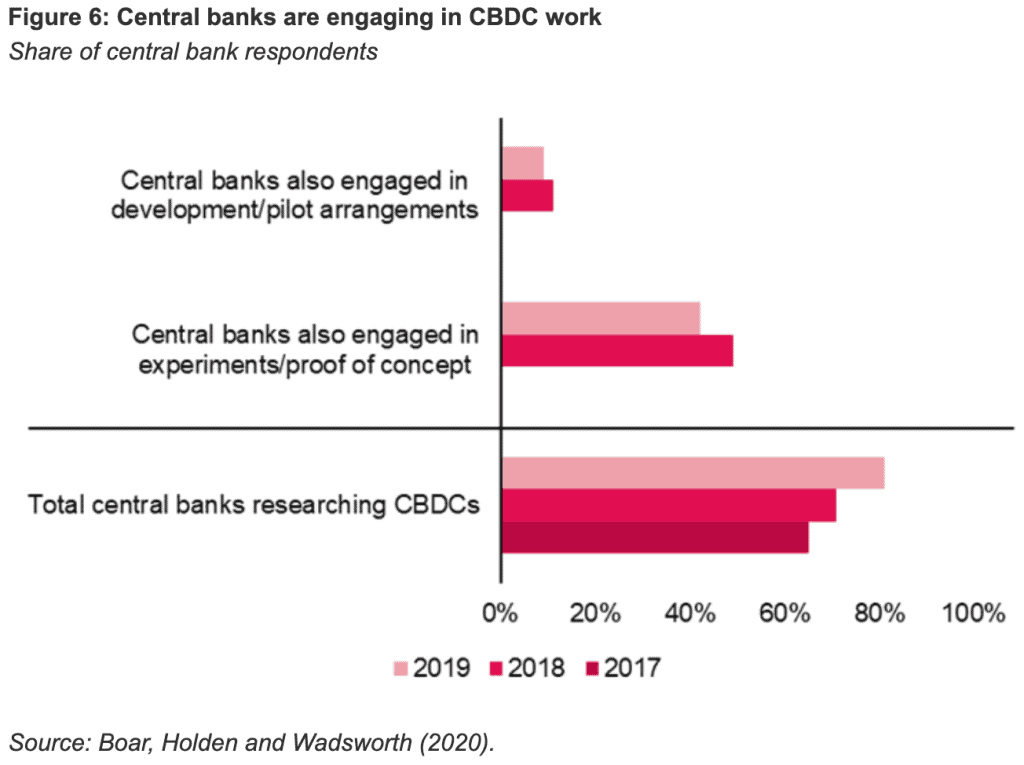

The RBNZ is among the 86% of central banks currently investigating CBDC’s.

The RBNZ is by no means a front runner. With many other central banks involved in experiments and proof of concept work. Or even for some, actual pilot programs.

For example the Norwegian central bank after 4 years of research recently announced:

“…it will start testing various solutions for a central bank digital currency as the world’s most cashless country moves to further decrease cash transactions, which now stand at roughly 4%.”

Source.

In May Sweden’s Riksbank announced that the central bank:

“…will work with commercial lender Handelsbanken to test how the country’s proposed digital currency – the e-krona – could handle payments in the real world.”

Source.

However last year, the Bahamas became:

“…the first country to introduce a CBDC nationwide (the sand dollar) and in April, the Eastern Caribbean became the first currency union central bank to issue digital cash.”

Source.

Watch This Space: CBDC’s Inevitable?

Overall it seems we just need to keep watching what other countries are up to. It is very unlikely that a central bank will issue a decentralised or anonymous digital currency. More like the exact opposite!

A survey in January by the Bank for International Settlements said central banks representing one-fifth of the world’s population are likely to issue their own digital currencies in the next three years.

So it does seem we are heading slowly but surely towards the removal of cash. Then the implementation of helicopter drops or negative interest rates becomes much more effective. A directly issued central bank digital currency would also make these central planner control tools much easier to manage.

However, on the positive, just because CBDC’s are implemented, it doesn’t mean they will “work”. They are merely a change in the current fiat currency environment. Not a fix. As to us it seems the system is on its last legs anyway. We still hope for our preferred monetary system, a decentralised free market for money. Where people would decide how they wish to transact with each other. See: The Gold Standard & A Free Market For Money: What Do We Think About It?

(Sign up below to be kept informed of global developments in the monetary system.)

But the existence of cash likely has a use by date. Meantime, ensure you have some savings and wealth outside of the banking system. See options available to buy gold and silver. You can also now learn How to Buy Gold and Silver with Bitcoin

Read more: Why You Should Become Your Own Central Bank – Even if Your Nation’s Central Bank Has Gold Reserves

Editors Note: This article was originally published 27 June 2018. Updated 28 July 2021 to include:

RBNZ Latest Views on CBDC: No Longer “Too Early”

Reading Between the Lines: Where Are We Heading With CBDC’s?

Clues From Elsewhere – What Are Other Central Banks Up To?

Watch This Space: CBDC’s Inevitable?

Pingback: The Chicago Plan: The Final Assault in the War on Cash - Gold Survival Guide

Pingback: Silver Outperforming Gold Again - Gold Survival Guide

Pingback: If New Zealand Introduces a Central Bank Digital Currency, How Will Gold or Silver Be Valued and How Will One Use Them? - Gold Survival Guide