Prices and Charts

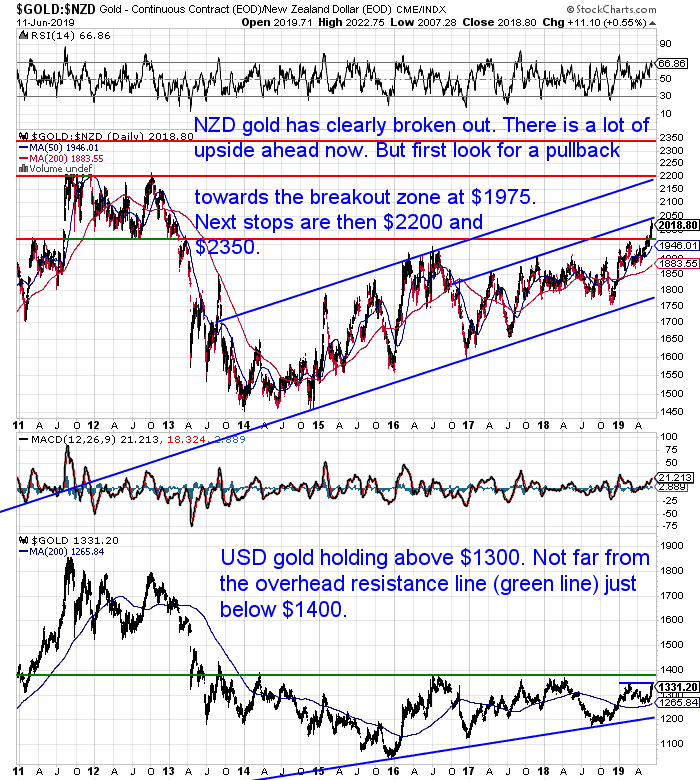

NZD Gold Holding Firm After Recent Breakout

Gold in NZ dollars is holding up nicely following the recent breakout to 6 year highs.

NZD gold touched the first blue uptrend line this week. So from here it would not be a surprise to see it pull back a bit. Particularly as we are close to overbought zone (above 70) in the RSI indicator.

Any pullback would possibly be down to the red horizontal line. This was previously the overhead resistance line. Now it will likely act as the support line. It would be reasonable to expect NZD gold to test this support line and likely to bounce off it. That could be a very good buying zone to watch for.

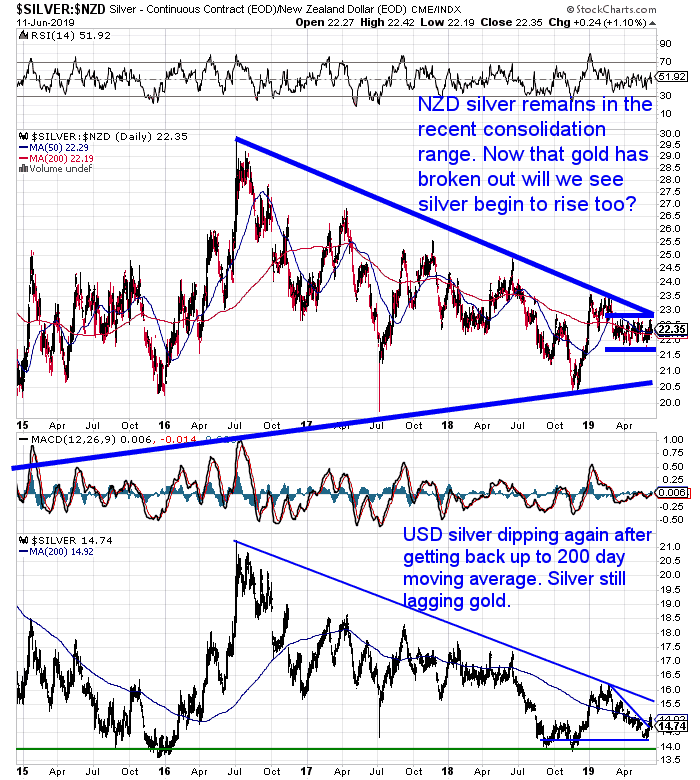

NZD Silver Still in Consolidation Zone

Silver in NZ Dollars again touched the overhead resistance line. Before once again dipping lower, to end the week hardly changed.

This giant flag formation continues to get more and more compressed. We expect a big move for silver eventually. But the timing as ever with silver is hard to predict.

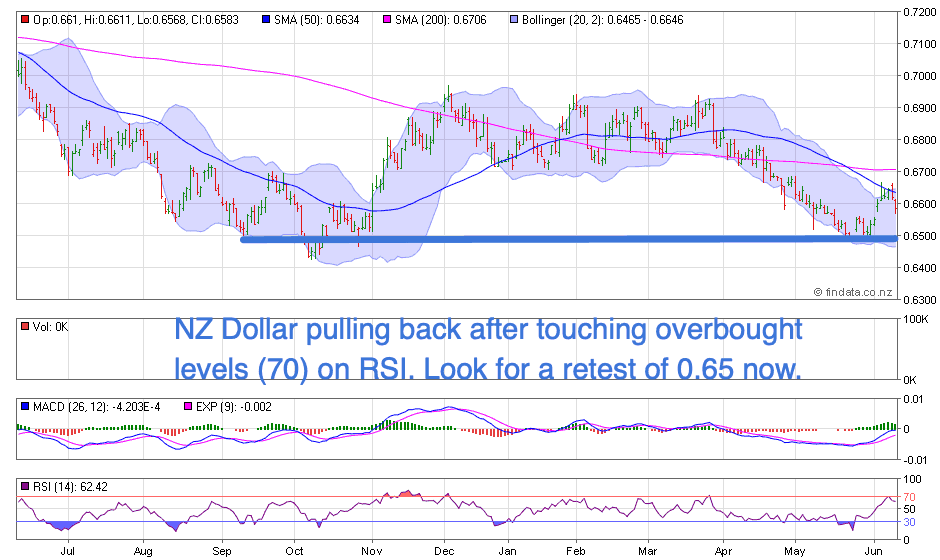

NZ Dollar Falling Again

The New Zealand Dollar is falling again this week. Down a quarter of a percent after touching overbought levels on the RSI.

Look for a retest of the 0.65 line now.

Need Help Understanding the Charts?

Check out this post if any of the terms we use when discussing the gold, silver and NZ Dollar charts are unknown to you:

Continues below

—– OFFER FROM OUR SISTER COMPANY: Emergency Food NZ —–

Preparation also means having basic supplies on hand.

Are you prepared for when the shelves are bare?

For just $240 you can have a 56 serving emergency food supply.

Free Shipping NZ Wide.

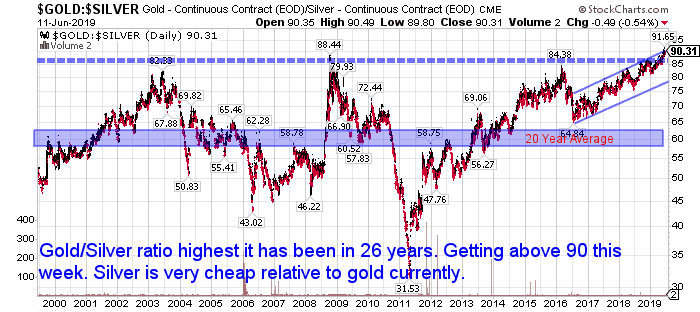

Gold Silver Ratio at New High

As we’ve said already silver continues to hover in the same consolidation range while gold breaks out higher.

As a result the Gold to Silver Ratio is now at a 26 year record high above 90.

We’ve updated a post on this and added a very interesting table. It shows the kind of returns that silver could have in store once the ratio reverses from the current historically high levels. And it will reverse, just as it has always done. Silver remains a fantastic buy, but patience is required.

Your Questions Wanted

Remember, if you’ve got a specific question, be sure to send it in to be in the running for a 1oz silver coin.

Gold vs Digital Currencies – Which One Should You Choose?

You may have noticed digital currencies have once again been rising recently.

So we thought it timely for a comparison between them and gold.

Which should you choose? Do you have to?

Reader Comment on Property versus Gold – Has Gold Really Performed That Well?

We received a very thoughtful reply to our recent article from reader JR: Comparing NZ Money Supply, Government Inflation Statistics, Property Prices, and Gold Prices for the Last 19 Years

We thought it worth sharing along with our response…

“While I’m an a metal investor and GSG customer, I tend to disagree in part of the article lately “Comparing NZ money supply”

Part four stated the percentage rise in house prices vs gold prices is almost the same.

4. Interestingly the above numbers show gold was not far behind property over the past 19 years in New Zealand.

Property went up almost 255% compared to gold rising 245%. And the gold numbers included a correction of over 35% in the past decade too.

Property gets all the headlines and gold is ignored.

Meanwhile property looks to be topping out in New Zealand. Whereas gold still has to rise over 18% to reach its all time high in NZ dollars.

So right now buying gold looks to have more upside than property in New Zealand.

I’m not sure leverage was taken into account with this calculation:

Option A.

Year 2000 – buy 100,000k in gold

X 245% = 245,000 (145,000 profit)

Option B.

Year 2000 – Borrow to buy a house

Borrow 80% on 100k (500k purchase price)

X 255% = $1,275,000

Minus interest @ 6% (380,000)

Minus rates, insurance etc (13,000)

Profit after deductions = $882,000

Vs $145,000?

Am I out somewhere?”

Our Reply:

Hi JR,

Yes you are correct I didn’t take leverage into account. But then we could argue you can leverage gold too. You could borrow and buy. Or you could use futures or options to gain leverage as well. In which case the returns on gold would also be magnified.

So I just kept it really simple and compared un-leveraged numbers.

Although granted it is common to leverage property. But not so common to leverage gold. And in fact gold’s role as the only financial asset without counterparty risk is usually a good reason not to leverage it!

So I won’t really argue with your numbers either. But as we point out in that article better to own real assets which include property and precious metals.

I guess we were more making the point it can be a good idea to have a bit of both – as you probably do by the sounds of it.

Thanks again for writing.

ANZ to RBNZ: Don’t Save You Bullets – US: Don’t Save With the ANZ!

This week we also had the ANZ bank telling the RBNZ “Don’t save your bullets”

“ANZ economists say the Reserve Bank should not wait for any potential global crisis before lowering interest rates further if it thinks more cuts are needed

The Reserve Bank should not hold back on making further interest rate cuts in case there’s a global crisis, economists at the country’s largest bank say.

“The last thing the RBNZ would want is for the economy to take a blow around the ears with growth already weak and inflation expectations falling.

“If cuts are needed, best to stimulate the economy now and get the economy in a position to weather the next storm.”

Source.

We’d say the odds favour the RBNZ following their advice. Short term interest rates are at record lows and likely to get lower. Any savings you have in the bank are likely to be worth less and less.

So don’t leave them all in there. Swap some for real assets that have stood the test of time.

Get in touch to discuss your different options. Or let us know any questions you have:

- Email: orders@goldsurvivalguide.co.nz

- Phone: 0800 888 GOLD ( 0800 888 465 ) (or +64 9 2813898)

- or Shop Online with indicative pricing

— Prepared for the unexpected? —

Never worry about safe drinking water for you or your family again…

The Berkey Gravity Water Filter has been tried and tested in the harshest conditions. Time and again proven to be effective in providing safe drinking water all over the globe.

This filter will provide you and your family with over 22,700 litres of safe drinking water. It’s simple, lightweight, easy to use, and very cost effective.

Royal Berkey Water Filter

Shop the Range…

—–

|