Prices and Charts

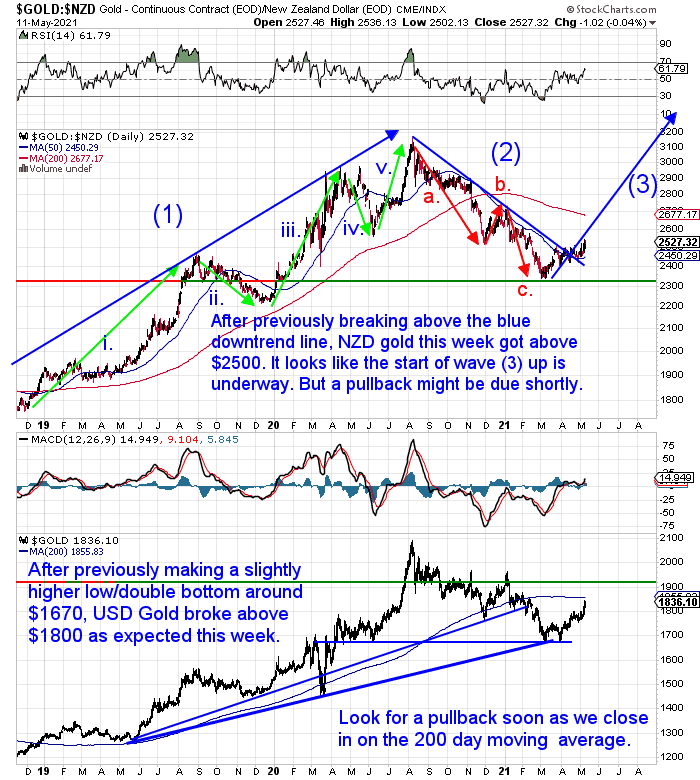

NZD Gold Breaks $2500 (USD Gold Breaks $1800)

Gold in New Zealand dollars this week broke through the $2500 dollar mark we said to watch for last week. An uptrend is clearly in place and the next leg up is underway. The coming months should see a return to the all time high just above NZ$3100. Then onwards and upwards from there. Although, in the shorter term gold is nearing overbought, so we should expect a pullback before too long.

Turning to the USD chart (lower half), it broke clearly through $1800 this past week. Today as global share markets fell, gold also dipped back down into the low $1800’s. However it immediately bounced back to finish US trading a little higher than yesterday. Another good sign. USD gold is getting close to the 200 day moving average line now though. So we should also expect a pullback from near there.

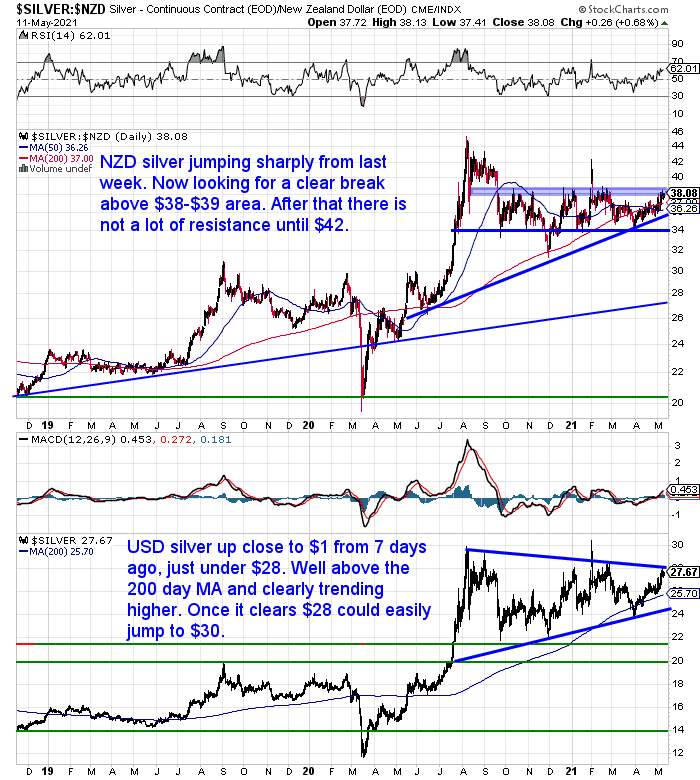

NZD Silver up 2%

Silver in New Zealand dollars out performed gold this week. Up 2% versus gold’s 1.38%. We’re now watching for a clear break above the $38-39 region. Once silver is through that region, there is not much resistance until $42. Then last year’s high of $45 would be the next stop.

While silver in US dollars surged by close to $1 over the past 7 days. Once it clears the next resistance level of $28 silver could well jump to $30 in short order.

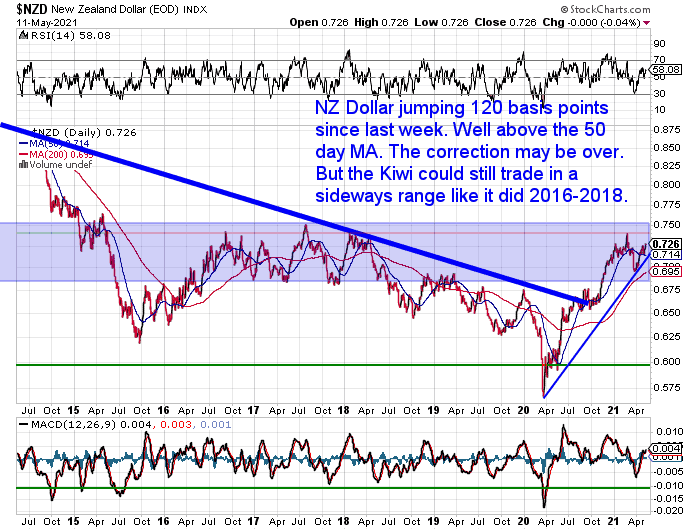

NZ Dollar Moves Up Off the 50 Day Moving Average

The New Zealand dollar rose 120 basis points this week. Putting a bit of a dent in the rise of local gold and silver prices. The Kiwi is now well above the 50 day moving average. Although as we said last week, a sideways trading range would not surprise us now.

This gels with a commentary on the NZ dollar from Roger J Kerr this week, where he said there are a number of handbrakes adversely impacting on the NZ economy.

“Do not expect the RBNZ to waiver from their existing stance that current inflation increases are temporary, not permanent, the NZ economy still faces global risks and that it is far too early to be indicating when and how monetary stimulus will be unwound.

The RBNZ statement therefore will be neutral for the NZD/USD exchange rate at the time. The future direction of the Kiwi dollar over coming months appears totally reliant on US dollar movements globally. It is extremely difficult to sustain an argument that the USD will be weakening in the face of rising US bond yields and stronger US economic data.”

Source.

Need Help Understanding the Charts?

Check out this post if any of the terms we use when discussing the gold, silver and NZ Dollar charts are unknown to you:

Continues below

—– OFFER FROM OUR SISTER COMPANY: Emergency Food NZ —–

NEW: Certified Organic Long Life Emergency Food

This easy to carry bucket has 90 servings of organic breakfasts and mains

Free Shipping NZ Wide

Get Peace of Mind For Your Family NOW….

—– Measuring NZ House Prices in Silver -Trends Since 1968

Following on from last week’s article on the housing to gold ratio, today we take a look at silver versus New Zealand (and US) house prices.

You’ll see how NZ house prices have varied over the past 50 years when priced in silver.

Also covered is:

- NZ Housing to Silver Ratio Bottomed in 1980 at 1000 ozs

- The Ratio Peaked in 2003-2005 at Almost 30,000 ozs

- How Many Ounces of Silver to Buy the Average NZ House Today?

- How Does the Housing to Silver Ratio in New Zealand Compare to the USA?

- Here’s Another Way of Thinking About Silver…

- How to Buy a Median Priced House in NZ Freehold, for Only $48,636…

- Is the 1970’s Repeating?

US Consumers and Finance Professionals: High Inflation Isn’t “Transitory”

Last week we pointed out how even the likes of Bank of America are warning to expect very high – but “transitory” inflation in the US. This was due to the massive surge in the mentions of inflation in the earnings calls of US listed companies.

Other measures are showing this may not be “transitory”.

“…inflation pressures are unmistakably building, with Bloomberg’s Vince Cignarella noting that the five-year/five-year inflation swap is above 2.5% and rising: “that’s the highest since January 2018 and just 10 basis points below levels we saw in January 2017.”

Why is this important? As Cignarella explains, “Inflation swaps are used by financial professionals to mitigate/hedge the risk of inflation and are considered reasonably accurate estimates for the break-even rate for the period in question. They’re also helpful to central banks and dealers who are trying to determine the market’s future inflation expectations.”

In short, the market is looking at all the signals and is growing convinced that whatever “this” is, it is not transitory.

And it’s not just finance pros who are calling the Fed’s bluff…

…over the next year consumers anticipate gasoline prices jumping 9.18%, food prices gaining 5.79%, medical costs surging 9.13%, the price of a college education climbing 5.93%, and rent prices increasing 9.49%!

Source.

Those numbers don’t sound very “transitory”!

Your Questions Wanted

Remember, if you’ve got a specific question, be sure to send it in to be in the running for a 1oz silver coin.

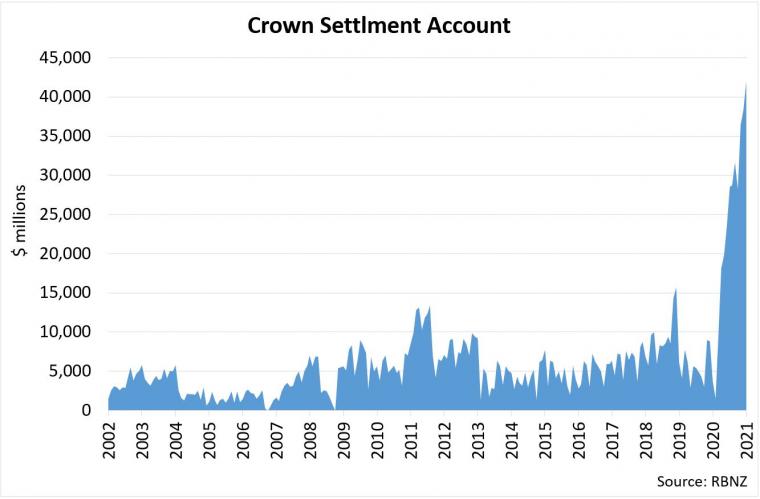

Could a Record High NZ Crown Settlement Account Boost Inflation in NZ?

How about here down under?

We’ve been writing about the risk of inflation for a while now. Back in February we discussed it in detail. See: Inflation in 2021 and Beyond: What’s Different to 2009?

But surely things are different here? We haven’t had the lengthy business closures that the US has. We haven’t spent trillions. Although our government hasn’t been slow to throw money around too.

A news item we saw this week got us thinking. Even though there was no mention of inflation in it.

“Finance Minister Grant Robertson is preparing this year’s Budget with a war chest at his disposal.

The Government had $42 billion of cash effectively sitting in its bank account with the Reserve Bank (RBNZ) as at March, according to the latest available data.

The Crown Settlement Account is flush with cash because the Government has been borrowing more than it has been spending on the COVID-19 recovery.

This is partly due to the New Zealand economy doing better than expected, and partly due to it taking time to get the money out the door for the likes of infrastructure projects.

The Crown Settlement Account, provided by the RBNZ for the Government, via Treasury, to use to deposit surplus funds into, is at a record high.

Source.

The Government having $42 billion sitting in its account with the RBNZ does not mean its books are in surplus.”

A couple of bank economists then go on to explain how they believe the government will issue less debt over the next few years as NZ weathers the COVID-19 storm better than expected.

But they think this will happen slowly, so the government won’t be eating into its cash in the Crown Settlement Account.

However there is also another issue to consider:

“A sudden halt or wind-back in government bond issuance would hamper the RBNZ’s ability to keep using its LSAP programme to put downward pressure on interest rates.

To date, it has bought $50 billion of NZGBs and nearly $2 billion of Local Government Funding Agency Bonds.

The rate at which the RBNZ has been buying bonds has largely mirrored the rate at which Treasury has been issuing them.”

Recall the LSAP is just central banker speak for currency printing. So if there are significantly less government bonds issued, the RBNZ will have to curtail its LSAP currency printing program.

But will they want to do this? As the article says, the idea behind the LSAP program is to keep interest rates low.

However, as we pointed out last year when the LSAP was started, currency printing is like the Hotel California – You can check out but you can never leave. Once you lever interest rates down and everyone cranks up their debt levels, it becomes very difficult to take the cocaine away and let rates rise again.

But back to our idea on inflation we mentioned at the start. The article finished with:

“…one might question why the RBNZ would seek to do more to stimulate the economy by lowering interest rates, if the Government is sitting on cash it could release into the economy to provide this stimulus.”

In the Crown Settlement accounts balance of $42 billion, there is 25 billion dollars more now than at any prior peak. We can’t see the government just letting this slowly get whittled down with its regular spending. Can you?

Here’s our bet…

The government is sure to come up with even more new infrastructure and stimulus plans and use the settlement account money to fund them. That way the RBNZ can continue with it’s LSAP as planned and not spook everyone that interest rates could rise. That way house prices can also stay nice and high.

This is an economy where ANZ economists say the strains in the economy are already starting to show as the economy tries to grow faster than it physically can, given shortages of both goods and labour.

“A gobsmacking net 80% of firms surveyed expect higher prices ahead. So, a net 58% of firms expect to raise prices.”Source.

Our guess is you ain’t seen nothing yet. Higher prices for the everyday necessities are coming. And we wouldn’t bet on them being “transitory” either. And if the government does release this $42 billion into the economy inflation may be higher than expected.

Have you got your inflation hedges in place? Silver might be a good one for that. Even though it’s hard to come by at the moment. We currently have ABC serial numbered 1kg bars on a 2 week back order. These are actually cheaper than comparable bars we’ve seen advertised lately in the USA.

- Email: orders@goldsurvivalguide.co.nz

- Phone: 0800 888 GOLD ( 0800 888 465 ) (or +64 9 2813898)

- or Shop Online with indicative pricing

— Prepared for the unexpected? —

Here’s how to always have clean fresh drinking water on hand.

The Sport Berkey Water Filter Bottle – $69 Delivered

Ideal for travel. Driving, camping, backpacking.

Free Shipping NZ Wide.

—–

|

Pingback: When Did New Zealand Switch to Fiat Currency? How Has the New Zealand Monetary System Changed Over the Past Century? - Gold Survival Guide

Pingback: CPI Jumps to Highest Level Since 1987 - Gold Survival Guide