A currency collapse can make everyday money worthless. In times like these, silver coins may become one of the few trusted ways to store and exchange value. We’ve seen signs of this before — during the COVID-19 outbreak, people rushed to withdraw cash. Now, global tensions are rising again. War in Europe, unrest in the Middle East, and a steady move away from the US dollar by major countries are all signals of growing risk.As nations push for de-dollarisation, trust in traditional currencies is falling. Could silver coins become useful in New Zealand too? In this article, we explore what might happen if our currency fails — and how silver could help protect your wealth.

Editors Note: This article was first published on 25 July 2017. It was last updated on 30 June 2025 to reflect current silver coin options, updated economic risks, and New Zealand’s evolving monetary environment.

Table of contents

- 1. What Is a Currency Collapse — and Could It Happen in New Zealand?

- 2. Why Silver Coins Could Be Trusted When Paper Money Fails

- 3. Would People Recognise Silver Coins in a Collapse?

- 4. Which Silver Coins Are Best for Barter or Trade?

- 5. Can You Really Use Silver Coins for Daily Transactions?

- 6. Other Assets That Might Be Useful in a Breakdown

- 7. Final Thoughts: Is It Worth Holding Silver Coins in NZ for Barter?

- FAQs: Using Silver Coins in a Currency Collapse

Estimated reading time: 12 minutes

1. What Is a Currency Collapse — and Could It Happen in New Zealand?

A currency collapse happens when a nation’s money rapidly loses its value — to the point where people no longer trust or use it. Prices skyrocket, wages can’t keep up, and everyday goods become unaffordable or unavailable. At its worst, a collapse can destroy savings, shut down banks, and lead to social unrest.

This usually stems from runaway inflation, excessive debt, or a sudden loss of confidence in a country’s financial system. We’ve seen it in places like Weimar Germany, Venezuela, and Zimbabwe — where paper money became so worthless it was used as fuel or scrap.

New Zealand has never experienced a full currency collapse, but that doesn’t mean it’s impossible. Like many developed nations, we rely heavily on imported goods, offshore funding, and public trust in our financial institutions. These global ties mean that if the wider system breaks — whether due to a financial crisis, war, or collapse of the US dollar — New Zealand would likely feel the shockwaves quickly.

We saw a glimpse of this vulnerability during COVID-19. The Reserve Bank injected billions into the economy to prevent a slowdown, and people rushed to withdraw cash. While that wasn’t a collapse, it was a reminder that trust in money can fade fast when fear sets in.That’s why some New Zealanders are asking: what would I use if the dollar stopped working? And that’s where silver coins come in.

2. Why Silver Coins Could Be Trusted When Paper Money Fails

In a currency collapse, trust disappears fast. If people lose confidence in paper money, they’ll quickly turn to something they believe holds real value. That’s where silver coins come in.

Silver has been used as money for thousands of years. Long before paper notes, people traded with silver because it was rare, durable, and widely accepted. Unlike modern currency, silver can’t be printed out of thin air. It’s a tangible asset — something you can hold, weigh, and verify.

In a breakdown, this physical quality matters. While digital money might vanish during a banking failure or power cut, a silver coin in your hand still has value.

What’s more, most bullion coins — like Canadian Silver Maples or US Silver Eagles — are marked with their weight and purity. A “1 oz .999 fine silver” stamp gives confidence to both buyers and sellers. That’s why these coins are often recognised and trusted around the world.

Precious Metals in Zimbabwe’s Currency Collapse

We’ve even seen this happen in modern times. In the early days of Zimbabwe’s currency collapse, people couldn’t use their national currency to buy food. Instead, they exchanged gold — by weight — for basic goods like cooking oil or soap. As one eyewitness put it:

“If you need cooking oil, you need to exchange for gold. If you need soap, you need to exchange for gold. Everything is gold, gold… no Zimbabwe dollars.”

The local shops stopped accepting paper money altogether — they only wanted gold. This shows how, in extreme situations, precious metals can return as real money when fiat collapses.

Even if shops or governments aren’t accepting silver directly, in a crisis, people often create their own systems of trade. In those systems, trusted silver coins could act as a store of value or a medium of exchange — especially when compared to paper that’s quickly losing worth.When trust in fiat money is gone, history shows that precious metals often step back in

3. Would People Recognise Silver Coins in a Collapse?

A common concern is whether silver coins would actually be recognised or accepted if the currency system broke down. After all, most people don’t handle silver bullion in daily life — and very few know what a real silver coin looks like.

But in a crisis, awareness can change quickly.

Most government-minted bullion coins are stamped with key details: “1 oz .999 fine silver”. This makes them easy to identify, even for those who’ve never used one before. Coins like the Canadian Silver Maple Leaf, US Silver Eagle, and Austrian Philharmonic are especially well-known and widely accepted around the world. Their consistent size, design, and markings help build confidence and trust in a trade.

Even if the average person doesn’t recognise a silver coin today, word spreads fast when cash becomes unreliable. During past crises, people learned quickly which items were useful for barter. In a New Zealand context, once it becomes clear which silver coins are pure and valuable, local markets or informal exchanges could emerge around them.

It’s also worth noting that older New Zealand coins minted before 1967 contained silver. These coins are already familiar to many Kiwis and may resurface in public use if trust in modern currency fades.So while silver coins aren’t part of everyday life today, they have the features needed to be recognised and used quickly if the monetary system fails.

4. Which Silver Coins Are Best for Barter or Trade?

Not all silver coins are created equal — especially when it comes to bartering during a currency collapse. Some are easier to recognise, trade, and verify than others. So, which ones are best to hold in New Zealand if the system breaks down?

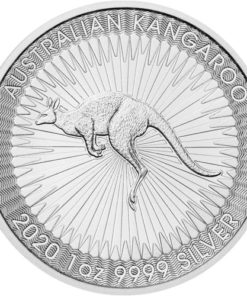

1 oz Government-Minted Bullion Coins

These are the most trusted and widely recognised worldwide. They’re stamped with their weight and purity, making them easy to verify:

- Canadian Silver Maple Leaf

- US Silver Eagle

- Austrian Silver Philharmonic

- UK Britannia

- Perth Mint Kangaroo

These coins are:

- .999 or .9999 fine silver

- Consistent in size and design

- Issued by reputable government mints

In a breakdown, these are likely to be the most tradable forms of silver due to global recognition.

Pre-1967 New Zealand Silver Coins (Junk Silver)

Before 1967, NZ coins contained silver:

- 50% silver content (shillings, florins, half crowns, etc.)

- Familiar look and feel for older generations

- Smaller denominations for small trades

These coins are useful for everyday transactions or small barters, though less pure than modern bullion. They are also pretty difficult to find these days.

Silver Rounds and Bars

Privately minted silver rounds (often 1 oz) or small bars can be good too, but:

- They may not carry the same recognition as government coins

- Purity and authenticity depend on the mint

- Harder to verify in a high-stress scenario

If buying these, stick with reputable names. For more on the bars vs coins debate see: Coins vs Bars in NZ: Should You Buy Gold or Silver — and in What Form?

Best Value National Mint Silver Coins Available Now

If you’re thinking about adding silver coins to your emergency holdings, we recommend choosing from trusted national mint bullion coins. These are widely recognised, easy to verify, and hold strong resale value.

The options below include some of the most popular and tradeable coins in New Zealand — such as the Austrian Philharmonic, Canadian Silver Maple, and UK Britannia.

We’ve grouped them into larger bulk boxes (for storage) and smaller tubes (ideal for trading). Availability and pricing can vary — so we’ve included only the best value options currently in stock.

Key Tip: In a crisis, recognisability and trust matter more than the lowest price per ounce. It’s better to have a slightly more expensive coin that others will accept than a cheap round no one recognises.

5. Can You Really Use Silver Coins for Daily Transactions?

It’s a fair question — could you actually buy goods and services with silver coins in a real-world breakdown?

The short answer is: yes, but not like you use money today.

In a full-blown currency collapse, the formal monetary system may no longer function. EFTPOS networks might go down. Banks could close temporarily. People would start to trade based on trust and need — and that’s where silver coins could step in.

But silver wouldn’t replace money overnight. Instead, it would likely become part of an informal or underground system. For example:

- You might trade a 1 oz silver coin for fuel, food, or repairs.

- A pre-1967 NZ coin might cover small barters like produce or basic supplies.

That said, silver isn’t perfect for everyday spending:

- It’s hard to divide (without damaging it or needing scales).

- Not everyone will accept it — especially early on.

- It’s better suited to larger-value trades than daily coffee runs. (but then you’re more likely to be buying groceries than doing a daily coffee run in a currency colapse)

Still, silver could play a critical role in medium-to-large barter exchanges, or as a store of value when fiat money is in freefall.

The key is to hold coins that are trusted and easy to recognise, so they’ll be more readily accepted if that time comes.

6. Other Assets That Might Be Useful in a Breakdown

When people think about bartering after a breakdown, items like tools, water, alcohol, or medicine often come to mind. These are practical and could be valuable — especially in local or short-term disruptions. But there’s debate about what would really be tradable and what might just take up space.

We explored this in more detail in our article:

Are Gold and Silver Coins Better Than Tradable Items Like Tools, Water and Wine?

What makes silver coins unique is that they’re compact, widely recognisable, and store value over time. You can’t say the same for petrol or rice — and you definitely can’t carry thousands of dollars worth of tools in your pocket.

How Silver Coins Compare to Other Tradeable Assets in a Collapse

| Item | Pros | Cons | Best Use In Crisis |

|---|---|---|---|

| Silver Coins | Durable, trusted, recognised | Less ideal for very small trades | Storing value, larger barters |

| Tools | Practical, high trade value | Heavy, may need upkeep | Skilled barter exchanges |

| Water | Essential for survival | Bulky, limited shelf life | Daily essentials |

| Alcohol | Universally desirable | Perishable, may not suit everyone | Luxury bartering item |

7. Final Thoughts: Is It Worth Holding Silver Coins in NZ for Barter?

While no one can say for certain if or when a currency collapse might happen, the risks in today’s world are rising. Economic shocks, global wars, debt crises, and declining trust in fiat money are all signs of a fragile system.

That’s why more New Zealanders are turning to silver coins as a form of wealth protection.

Silver is real, portable, and has held value for thousands of years. It doesn’t rely on power, the internet, or government policy to work. In fact, during times of crisis — when cash becomes scarce or loses value — silver has historically re-emerged as a trusted form of money.

And unlike gold, silver is more practical for everyday trade because of its smaller value per coin.

In New Zealand, where even our legal tender coins contain no precious metals, holding physical silver offers a simple way to protect a portion of your savings outside the system.

You don’t need to go all in. Even a few ounces of well-known coins — stored safely — could give you peace of mind if the unexpected happens.

Because in a currency collapse, being prepared beats being surprised.

If you’re not already a subscriber of ours then you should be! Our VIP subscribers are the first to hear about deals on silver coins.

Sign up below or go here to learn more. You’ll also get our free ebook “19 Nuggets of Knowledge on Gold and Silver”.

Related Reading

To learn more about the role gold and silver may play in the global monetary system check out these related articles:

- If/When the US Dollar Collapses, What Will Gold Be Priced In? – What a dollar collapse could mean for gold and silver worldwide.

- Best Gold for Trading in a Currency Collapse – The most tradable forms of gold to consider.

FAQs: Using Silver Coins in a Currency Collapse

Imagine waking up to news that the NZ dollar has collapsed overnight. Banks are closed. Supermarkets are cash-only. What now? For some Kiwis, silver coins might be the lifeline…

Yes. In a collapse, people often turn to assets they trust. Silver coins are tangible, widely recognised, and can’t be printed like paper money. History shows they often become valuable in barter systems when currencies fail.

The best silver coins are 1 oz government-minted bullion coins like Canadian Silver Maples, US Silver Eagles, Perth Mint Kangaroos, Austrian Philharmonics or Great Britain Britannias. In New Zealand, pre-1967 silver coins also have value and may be more familiar in a local collapse.

Coins with clear markings like “1 oz .999 fine silver” are easy to verify. During a crisis, public awareness tends to grow quickly. Trusted coin designs become known fast — especially when people stop trusting paper money.

Silver could be used for trade, but it’s better suited for medium or large-value exchanges. For smaller items, pre-1967 NZ coins or other barter goods may be more practical. Still, silver offers a strong store of value.

Yes. In Zimbabwe’s collapse, people used gold for basic goods like soap and cooking oil when their currency failed. In Venezuela and Germany, money became worthless. Precious metals often return as money in extreme cases.

Pingback: What to Make of Legal Tender (Face Value) Gold and Silver Coins? - Gold Survival Guide

Pingback: War on Cash: Implications for New Zealand - Gold Survival Guide

Pingback: Gold to Silver Ratio Update for 2017: Time to Buy Silver Again - Gold Survival Guide

Pingback: Why New Zealand Won’t Have Any Say in a Global Currency Reset - Gold Survival Guide

Pingback: Bullion Coins or Numismatic (Collectible) Coins? Which Should I Buy ? - Gold Survival Guide

Pingback: Why Buy Silver? Here's 21 Reasons to Buy Silver Now

Pingback: Should I Buy Gold or Silver? 7 Factors to Consider in Gold vs Silver - Gold Survival Guide

Pingback: What Type of Silver Bar Should I Buy? - The Ultimate Guide to Silver Bars - Gold Survival Guide

Pingback: Why is a 1oz PAMP Gold Lady Fortuna Minted Bar Worth Less Than a Canadian Gold Maple Coin? - Gold Survival Guide

Pingback: How to Win A Silver Coin Every Month - Gold Survival Guide

Pingback: What is the Best Type of Gold to Buy For Trading in a Currency Collapse? - Gold Survival Guide

Pingback: Societal Breakdown: Are Gold and Silver Coins Better Than Tradable Items Like Tools, Water and Wine? - Gold Survival Guide

Pingback: It’s Societal Collapse and Doomsday Week! - Gold Survival Guide

Pingback: Why You Should Become Your Own Central Bank - Even if Your Nation’s Central Bank Has Gold Reserves - Gold Survival Guide

In a currency collapse will paper still be valuable as a means of exchange? I see the lack of it in peoples hands today as they rely on digital money, therefore it could be valuable in the collapse along with precious metals? Should we hold some as well as Gold and Silver?

Yes particularly in the early stages of a crisis. Some physical cash may be very useful to have. We see evidence of this when ATM’s or EFTPOS systems fail in areas when there are outages. So definitely a good idea to have some cash hidden away just in case.

Q1. When can we stop calling fiat ‘money’?

Q2. Can Junk silver (pre-1965 us coins) be beneficial in an NZ market?

Q3. Why aren’t real money or currency (finances) taught in schools? Along with Taxes?

‘Hidden secrets of money’ should be on every schools curriculum.

Thanks for all the great work you’re doing.

Yes indeed all good points Steve.

Pingback: The Death of Term Deposits in New Zealand? - Gold Survival Guide

Pingback: What Were the Most Popular Articles on Gold and Silver in 2020? - Gold Survival Guide

Pingback: How Would Hyperinflation in The USA Affect New Zealand? - Gold Survival Guide

Pingback: If/When the US Dollar Collapses, What Will Gold be Priced in?

Pingback: NZ Gold Coins (and Silver Coins) or NZ Gold Bars (and Silver Bars): Which Should I Buy?

Pingback: NZD Gold Continues to Consolidate Above Uptrend Line - Gold Survival Guide

Pingback: Record High Interest Rates - What will Break First? - Gold Survival Guide

Pingback: Paulo Macro: Inflation Reality Check Coming - Gold Survival Guide

Pingback: What Good is a Bar of Gold When the Shelves are Empty?