A common argument is what will bring about the end of the current monetary system? Will it be hyperinflation as a result of excess currency creation and a loss of trust? Or will it be a deflationary collapse due to the massive levels of global debt? Darryl Schoon gives his version of events in this […]

Tag Archives: gold

Stewart Thomson was on the ball with his recent call that gold could likely find a bottom following the latest US jobs numbers announcement. That is exactly what happened with gold bouncing higher from just above US$1300 last week. So let’s check back in on what his latest thoughts are. He has some interesting thoughts on […]

How do you know that the world financial system has gone completely screwy? How about when an investing system that has provided safe steady returns for 29 years is now proving to be very risky and likely to get even riskier if the central planners and busy-bodies have their way. The following article outlines how […]

Today the price of gold in US Dollars is not that far above the level of US$1310 that Stewart Thomson identifies as a possible low before a further move higher for gold. The drop in price overnight was seemingly caused by a massive $1.5 Billion sale of gold futures at a low volume time of […]

To follow is an excellent article that shines a ray of hope for anyone that believes we are heading towards a more centralised world with bigger governments gaining even more control. Dan Denning previously wrote for Money Morning in Australia, after shifting there from the US. We heard him speak at the Gold Symposium in Sydney on […]

Negative interest rates aren’t in New Zealand and they won’t ever happen here will they? Well, the below article shows how some banks in some countries are charging them to customers even though negative interest rates are not widespread there yet. While our rates are well above zero currently, it seems like the prevailing trend […]

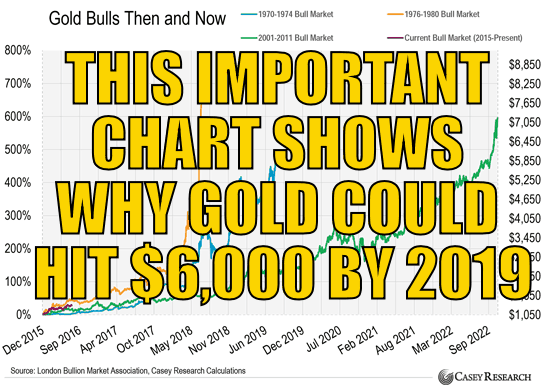

Check out this historical evidence that shows not only how much higher gold could go, but just as importantly how low it could fall and still not really matter in the long run… This Important Chart Shows Why Gold Could Hit $6,000 by 2019 By Justin Spittler Editor’s note: Today, in place of our usual […]

In this piece Jim Rickards hints at what he thinks might cause a much higher run in gold without actually covering it specifically. Read on to the end and we’ll be back to fill you in… The market has the technical setup for the greatest gold shock in history. When it rocks markets, gold will […]

The Bank of England – one of the world’s biggest central banks – just swung its “sledgehammer” in response to the volatility and shock caused by the recent Brexit vote. Learn about what else may yet happen in Britain and the impact this is having on gold… Why Doug Casey Thinks We Could See $5,000 […]

A seventh big name investor recently began singing the praises of gold. Read on to see why and how to follow his lead. Plus a chance to learn how to select gold stocks that may seriously outperform gold itself… Don’t Buy Another Gold Stock Until You Read This By Justin Spittler Today is a very special […]