Here’s everything you need to know when it comes to deciding between local NZ gold and silver and imported PAMP Suisse Gold and silver…

Table of contents

- Are Local NZ Gold and Silver Bars the Better Option Because They’re More Popular?

- PAMP Suisse Gold/Silver Bullion vs Local NZ Gold/Silver Bullion: What Do They Have in Common?

- Now, How is PAMP Bullion Different to Local Gold & Silver Bullion?

- June 2021 Update: PAMP Silver Not Currently Available. Here’s an Alternative

- So How Do I Decide Between PAMP Bullion Bars and Local Bullion Bars?

From the first time buyer of gold or silver, a question we often get is: “How do I choose between buying PAMP Suisse gold and silver bars versus local New Zealand refined gold and silver bars?”

A short answer would be that local New Zealand refined gold and silver bars are bought by the majority of our clients. With PAMP being the one of the next most popular but a fair way behind.

(If you prefer to watch than read here is the video version of this article:

Choosing Between PAMP Suisse Gold & Silver vs Local NZ Gold & Silver Bars: Video)

Are Local NZ Gold and Silver Bars the Better Option Because They’re More Popular?

Our thoughts are – it depends.

But before we get to why it depends, maybe we should start by firstly outlining the differences between the products. As then the pros and cons for purchasing each will be more obvious.

Actually on second thoughts we should first say what they have in common.

PAMP Suisse Gold/Silver Bullion vs Local NZ Gold/Silver Bullion: What Do They Have in Common?

For gold, both the PAMP Lady Fortuna 1oz bar and the local gold 1 oz bar are both 99.99% pure – four 9’s in industry speak. For silver the PAMP 1kg bar and the local NZ silver 1kg bar are both 99.9% pure or three 9’s. So both local gold/silver and PAMP gold/silver contain the same amount of silver or gold in each unit.

Now, How is PAMP Bullion Different to Local Gold & Silver Bullion?

Compared to local New Zealand bars, PAMP gold and silver bars have 3 major differences:

- PAMP bars have an assay certificate and individual serial numbers

- PAMP bars are manufactured in Switzerland and are better recognised worldwide

- PAMP bars cost more to buy per bar

A bit more detail on each of these 3 differences…

1. PAMP Bars Have an Assay Certificate and Individual Serial Numbers

The PAMP gold and PAMP silver bars both come with an assay certificate from PAMP confirming the purity along with an individual serial number on each bar. If your silver bars were ever stolen, the unique serial number may assist with identifying them if the thieves tried to resell them to a refiner.

Local silver and gold bars do not come with an assay certificate or individual serial numbers. However local gold and silver bars/ingots are stamped with the suppliers “hallmark” and with either 9999 for gold (four 9’s or 99.99% pure) or 999 for silver (three 9’s or 99.9% pure).

Also, to ensure purity, the local New Zealand suppliers we use, regularly exchange metal with other companies locally and in Australia. When this happens the metal is assayed again.

So if there was ever a problem with purity they would be found out very quickly. Because reputation is everything, this would put them out of business. They are family owned and run businesses, conservative by nature and have been around for 30-50 years. Supplying precious metals to private investors but also to Jewellers in New Zealand.

2. PAMP Bars Are Manufactured in Switzerland and Are Better Recognised Worldwide

PAMP Suisse gold and silver bars are manufactured in Switzerland by Produits Artistiques de Métaux Précieux (PAMP). The Swiss refiner has more than half the world market for gold bullion bars weighing less than 50 gms. They have gained a reputation as one of the world’s premier gold refiners and are an instantly recognisable and respected worldwide brand.

So PAMP gold and silver bars are well recognised and easily resold worldwide. Be it Europe, USA or even Asia, without the need to be assayed.

While not relevant from a logical perspective, the PAMP Lady Fortuna Gold Bar is also probably one of the most attractive bars we have seen, if not the most attractive.

Local New Zealand gold and silver bars are well recognised and readily bought and sold in New Zealand and Australia (and for one supplier in Thailand as well). The suppliers will readily buy back the bars and they can also be bought and sold on the likes of TradeMe.

However they may not be so easily exchanged for cash in other parts of the world without first requiring assaying. When selling the PAMP gold back to the supplier, you will also likely get no more than a local bar. But it will still be under the spot price. So the spread (the difference between the price to buy and the price to sell) will likely be more for PAMP than for local gold. Selling privately is a bit more hit and miss. You may get no more than a local New Zealand product – it would just come down to the individual buyer.

3. PAMP Bars Cost More to Buy Per Bar

PAMP gold bars cost another $69 per 1 oz bar more. For silver bars, a further $60 per 1kg bar. This is on top of the percentage mark up over the spot price of gold or silver.

So generally speaking if you bought 50 oz’s of PAMP gold, for the same money you’d get more than one extra ounce of local gold – 51.32 oz’s to be exact.

For silver the difference can be even more pronounced as when you buy 25kg’s of silver or more the local price is even cheaper. Buying 75 kgs of PAMP amounts to approximately $102,257. Spend the same amount on local NZ silver 1kg bars and you’d get 77.5kgs instead. So around 2.5 kgs more silver.

You can see and compare todays indicative prices for each product on our products page.

June 2021 Update: PAMP Silver Not Currently Available. Here’s an Alternative

In 2020 there was a huge surge in demand for silver due to the crash in markets caused by the COVID19 shutdowns. As a result there have been no PAMP silver bars available since then.

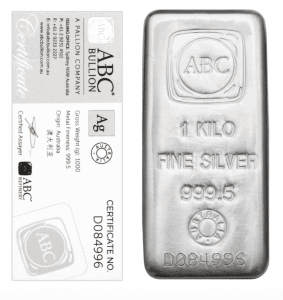

As an alternative to PAMP silver bars, we now have available ABC 1kg silver cast bars.

Like PAMP, ABC Bullion also offers individual certificates of authentication with all 1kg and 100oz silver cast bars. Also like PAMP the bars carry individual serial numbers. These certificates, specify the individual bar numbers, weight, origin and metal fineness (purity).

ABC Refinery, the manufacturer of ABC Bullion branded products, is the only independent London Bullion Market Association (LBMA) accredited and Shanghai Gold Exchange (SGE) accredited gold refinery in Australia.

Accreditation by LBMA and/or SGE makes the ABC products tradable internationally without additional cost for assaying. Just like PAMP silver bars.

You can check out the ABC bars available in our online store here.

So How Do I Decide Between PAMP Bullion Bars and Local Bullion Bars?

The first and main question to ask yourself is when the time comes, where do you intend to sell the gold or silver bullion?

If it’s in New Zealand then the lower priced local gold and silver bars may be as good an option for you. As you’ll get more gold or silver for you buck. As noted already, if you’re buying many ounces of gold or kilograms of silver the extra $45-69 per bar can start to add up.

However, if you may wish to sell overseas, then the more recognisable PAMP products may be the better option. Of course when it comes to silver you’ll have to consider whether you would try and lug say 20 kilos of silver around the airports with you! Gold is much more portable of course (one of the characteristics that makes it money). So a PAMP 1oz bar can make a great travel insurance product. At today’s prices a bit under NZ$2700 that can be easily hidden on your person, in a pocket etc. Often a great gift for a travelling son or daughter. An emergency back up they can’t easily blow on beer in a London pub but if necessary can turn into cash!

(If you’re worried about travelling with gold then check out this post: Carrying Gold into a Foreign Country. What are the Rules?)

Just like anything else, individual circumstances mean that the best option will differ from person to person. In the end you’ll have to make up your own mind.

Maybe Buy Some PAMP Bars and Some Local Bars

Much like if you can’t decide between gold and silver themselves, then an option may be to have a “bob each way” and get a bit of both. Some local gold or silver to get the best price and therefore the most physical metal possible. And some PAMP products in case you relocate overseas. If you travel, then definitely consider a few PAMP Lady Fortuna gold bars as some emergency money in case of theft or a lost wallet or purse while overseas.

If you’d like to compare the difference in price today between local and PAMP bullion, head over to our online gold and silver store which has today’s indicative pricing or call David on 0800 888 465 (or +64 9 281 3898 outside NZ).

If you found this article informative, then sign up below. That way you’ll stay up to date with goings on in gold and silver in New Zealand.

Read more: Why is a 1oz PAMP Gold Lady Fortuna Minted Bar Worth Less Than a Canadian Gold Maple Coin?

Editors Note: This post was originally published 5 June 2012. Last updated 29 June 2021 to include current pricing.

Pingback: Gold not liquid enough for the RBNZ | Gold Prices | Gold Investing Guide

Pingback: Buying Precious Metals: Common Questions from First Time Buyers | Gold Prices | Gold Investing Guide

Pingback: Choosing Between PAMP Suisse Gold & Silver vs Local NZ Gold & Silver Bars: Video | Gold Prices | Gold Investing Guide

What can you offer in the way of storage of precious metals in NZ, or if you cant store, do you have any recommendations of different options?

Regards

R

Hi R,

We’ve sent you a personal reply by email.

Pingback: Interest Rates and Gold: If Interest Rates Rise What Happens to Gold? - Gold Survival Guide

Pingback: What Type of Gold Bar Should I Buy? - Gold Survival Guide

Pingback: NZ Gold Coins (and Silver Coins) or NZ Gold Bars (and Silver Bars): Which Should I Buy?

Pingback: What Type of Silver Bar Should I Buy? - The Ultimate Guide to Silver Bars - Gold Survival Guide

Pingback: Derivatives - a Beginner's Guide to “Financial Weapons of Mass Destruction”

Pingback: Does Gold and Silver Need to be Assayed When You Sell It? - Gold Survival Guide

Pingback: Carrying Gold into a Foreign Country. What are the Rules? - Gold Survival Guide

Is availability also a factor? I understand there is currently a 2+ weeks’ wait for local gold – is the delivery delay the same on PAMP?

No there is no wait currently on local gold. Same with PAMP. Both are in stock. Silver is a different story though. PAMP silver bars aren’t available to order currently at all. In local silver bars there are only 5oz bars available with a 4-8 week delay. However we do have Australian ABC 10oz, 500g and 1kg silver bars available. The first 2 in stock and the 1kg on back order – about a week to 10 days.

Pingback: RBNZ 3rd Largest Holder of Sovereign Bonds & Central Banks Are Trapped - Gold Survival Guide

Pingback: Runaway House Prices: The ‘Winners and Losers’ From the Pandemic - Gold Survival Guide