In this article you’ll learn about the various gold standards and exchange rate regimes over the past 200 years. Along with what the options may be instead of a return to a gold standard...

Table of contents

Estimated reading time: 10 minutes

Calls For a New Gold Standard

Back in 2010 we had the World Bank head Robert Zoellick calling for debate on a new gold standard.

While in 2022 a US congressman introduced a gold standard bill as inflation surged higher in the USA.

Then news items purporting that the BRICS countries may soon launch a BRICS currency which may be backed or linked to gold have been circulating in recent months. We have been saying to take these with a decent helping of salt. As any such move is likely some time away yet.

However they do show that a return to gold is not an impossibility. Also shown by the fact that global central bank gold buying in the first 6 months of 2023 reached a first-half record of 387t. Central banks appear to be preparing for a world where the US dollar is no longer at the centre of the global monetary system.

But what do we all think of when the term “The Gold Standard” is bandied about? Just what is meant by this?

200 Years of Monetary History

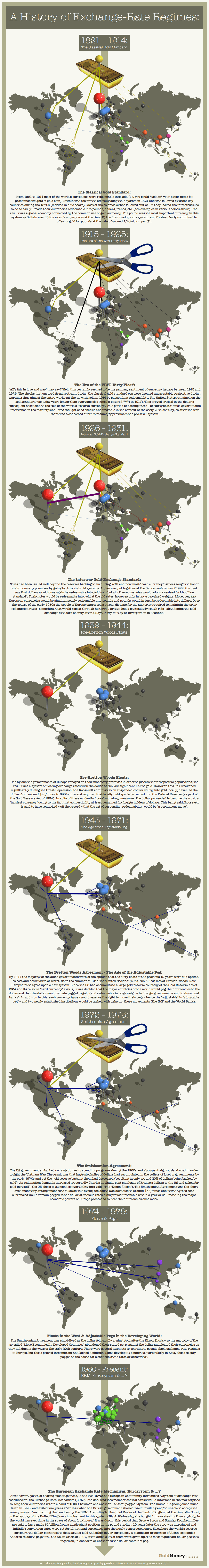

There have been a number of monetary systems in place in the past 200 years. The below infographic from GoldMoney gives a visual representation of how the global monetary system has operated and differed for the last 2 centuries.

Source. Hat tips to greshams-law.com (co-producer), IMF (many sources), Jim Trott, Eric Rauchway / Dartmouth, eh.net (many sources), and the St Louis Fed.

The classical gold standard – sometimes referred to as the gold coin standard – is in our opinion the best of the government instigated gold standards of the past 200 years. Under this system, you could cash in your paper money for defined amounts of gold. Click the image above to read a full description of it and other systems.

Read more: Trump and the Gold Standard: What’s His Aim With Trade Wars? – Could We Return to a Gold Standard?

The Unadulterated Gold Standard

The classical gold standard is perhaps also most similar to what The Gold Standard Institute (TGSI) refers to as the “Unadulterated Gold Standard”. Although not strictly one and the same. Rather we’ll leave it to the TGSI’s Phillip Barton to explain one of the chief benefits of the unadulterated gold standard:

“[The unadulterated gold standard] means either circulating gold (or silver) coins, or that circulating banknotes are redeemable for gold (or silver) coin upon demand – 100% backing. It is only the unadulterated Gold Standard that can permanently constrain the excesses of government. With gold in use as money, the government loses its most coveted yet destructive tool – the ability to inflate away the value of the people’s money. The unadulterated Gold Standard means that all government expenditure has to come out of taxation.

Paper money that is not wholly backed by gold allows politicians to inflate the money supply and, by this means, covertly pay for their vote-buying largesse. This encourages people to vote for the politicians who promise to spend the most. Inflation is not possible under the unadulterated Gold Standard, and people understand that all government expenditure can only be funded by an increase in their own personal taxation. This encourages the far healthier reverse vector of people voting for the politicians who promise to spend the least. The revenue raising limitations of the unadulterated gold standard also ensures that it is very difficult for governments to put the country into debt by borrowing.”

Source.

The Trouble With Any Gold Standard

The issue with putting in place a gold standard of any type is that most people only see this as being possible via governments. The problem with a government system, even one as effective as the classical gold standard, is there is nothing to stop governments leaving the standard when it serves them. This is exactly what occurred during WWI. When the handbrake on government spending, that was the gold standard, was removed to fund the war.

So how can we get the benefits of a gold standard without the downside of the ability of governments to renege on it when it suits them?

Other Options Than a Government Defined Gold Standard – A Free Market for Money

The only answer would be to remove the government monopoly on money – a very far out thought for most people today!

This is what Austrian Economist Friedrich Hayek, referred to as the denationalisation of money. Ex-US congressman Ron Paul also has been calling for this for sometime. A system based on private coinage and currency that would compete with government-issued money. Dr Paul has stated we don’t need to get rid of the dollar, just let private money compete with it. Of course, he knows full well that if private money was allowed to circulate alongside government money, a couple millennia of monetary history shows private gold and silver coin would win out over fiat currency before very long.

Richard M. Ebeling at the American Institute for Economic Research covers this very topic in Separating Money From the State, the Ultimate Policy Reform. Ebeling writes how we need:

“…a reform of the monetary and banking system that does not stop with restrictions on Federal Reserve discretionary policy over money or interest rates, such as under the classical or traditional government-managed gold standard. It points in the direction of an end goal of separating the monetary and banking system from government control and oversight, and in its place putting a system of private, competitive free banking — a truly market-based money and banking system. (See my article “Free Banking and the Case Against Central Banking.”)

Only by this institutional means can a society be safe and secure from a political leader who is just not happy with central bank monetary and interest rate policy and would want to make such policy whatever he considers good and desirable by putting it into his own capricious hands.

Only by such a separation of money from the state can a society also be safe and secure from the arrogance and hubris of those “experts” — those monetary central planners — who presume to know what interest rates should be, independent of market-based supply and demand relationships between savers and investors in a competitive banking setting. (See my article “Interest Rates Need to Tell the Truth.”)

Only by such a denationalization of the monetary system can a society be free from the recurring cycle of booms and busts, the waves of inflations followed by recessions, and the socially destabilizing periods of economy-wide unemployment, which easily plays into the hands of political demagogues and power lusters offering interventionist panaceas to cure problems caused by earlier government policies. (See my eBook Monetary Central Planning and the State.)

Until then, our society will be subject to the consequences of those “experts” and political second-guessers who presume to know how money and the economy should be planned better than letting money be sorted out through the free interactions of all of us as suppliers and demanders in the marketplace.”

Source.

The problem is how to get there? The founders of the Gold Standard Institute believe it is through education. That we must make people as aware as we can of the options, so that when “it all falls down”, we can be sure to pick up the right pieces when we put things back together.

What Do We Think About The Gold Standard?

We believe technology shows us that the free market knows best. In a world of constantly rising prices, what industry has seen prices doing the complete opposite year after year? Consumer technology of course. Computers, TV’s and more recently smartphones and tablets have shown they can get constantly smaller, faster and more powerful, all while falling in price.

It’s no surprise that this is also an area with very little government intrusion! There is not a government regulatory body required to stipulate that all computers must have a USB port to allow connection of peripheral equipment (although they EU has forced Apple to stop using their proprietary lightning connector on their phones in the future- governments can’t help but meddle!). Or that TV’s should all have HDMI plugs so that components from different manufacturers will work together. The free market has determined which technology worked best and they have eventually become widely used, until superseded by something better. All the while we consumers get better equipment for a lower price.

We believe money could work just the same. We don’t need national currencies. If the free market was left to decide we believe money would be weights of silver and gold for the reasons a guy by the name of Aristotle outlined a couple of years back.

That is money must be durable, portable, divisible, consistent, and have intrinsic value of itself. And gold and silver have proven to be the only elements to date which satisfy all these criteria.

Paper money could well exist too but these would likely be certificates redeemable 100% in gold and silver.

Technology May Play A Part Too

Having mentioned technology already, if the free market was left to it, technology would likely play a major part in free market money too.

We wouldn’t all necessarily carry around gold and silver coins, or even paper certificates. Instead blockchain and cryptocurrencies may play a role. Perhaps with gold or silver backed cryptocurrencies? Many of these are in the early stages currently.

Futurist George Gilder writes:

“As Nathan Lewis showed in his books, Gold: The Monetary Polaris and Gold: The Final Standard, there is no relationship between the amount of the world’s gold and the amount of money. If the price of gold is fixed, money can grow to any needed level in response to the commitments of entrepreneurs to profitable projects. During the Industrial Revolution, while the amount of the world’s gold merely rose merely 3.4 times, the US money supply rose 163-fold.

Instead, in the absence of a digital gold standard, investors around the world will continue the move toward blockchain-based digital currencies, ultimately rooted in time.

…The entrepreneurs who best fuse the ascent of information technology with the stability of gold will create a new technology gold standard for both the internet and the world economy.”

Source.

The Return of “Gold Banks”?

We could also see the emergence of actual “gold banks” once again. Where you paid the bank to store your gold or silver and they paid you to lend a portion of it out. See: Why Fractional Reserve Banking is Not the Problem

But you wonder, what would stop these new gold banks from doing just as governments have done?

Perhaps other entities would pop up to monitor them?

Perhaps nothing would stop them and people would have to learn how to keep a check on where their money was held, instead of blindly trusting that it was safe as we currently do?

We certainly don’t profess to hold all the answers, but we are sure there must be a better way than what we experience now. But also a better way than simply returning to the past too.

So rather than a return to a gold standard perhaps we can dream of an evolution to free market money – likely gold and silver money. Not a step back, which is what we mostly see written about when it comes to the gold standard in the mainstream. Where they often make the argument that there is “not enough gold in the world to return to a gold standard“. (Of course the answer simply is that the price is not high enough currently). Perhaps we can learn from the past and improve upon it like Apple, Samsung and the like do with technology. The only question – is society up for it when it comes to money?

What do you think? Could free market money work? Leave your opinion below…

Editors Note: This article was first published 4 September 2012. Updated 30 June 2020 with digital currency information and latest quotes form George Gilder. Lats updated 22 August 2023.

Pingback: Double Whammy for Buyers of Gold and Silver in NZ | Gold Prices | Gold Investing Guide

Pingback: Inflation vs Deflation vs Stagflation | Gold Prices | Gold Investing Guide

Pingback: Is There a Best Way to Return to a Gold Standard? | Gold Prices | Gold Investing Guide

Pingback: 3 Factors That Could Take Gold Higher From Here | Gold Prices | Gold Investing Guide

Pingback: How will it all end? | Gold Prices | Gold Investing Guide

Pingback: RBNZ Forward Guidance and Other Bunkum | Gold Prices | Gold Investing Guide

Pingback: Gold Prices | Gold Investing Guide - Gold Prices | Gold Investing Guide

Pingback: Gold Prices | Gold Investing Guide Big move in Gold and Silver Coincides With Indicators of a Likely Bottom - Gold Prices | Gold Investing Guide

Pingback: Could Gold and Bitcoin Work (and Rise) Together? - Gold Survival Guide

Pingback: Our Thoughts on Bitcoin - Gold Survival Guide

Pingback: The Silver Ruble Coin for Russia - Gold Survival Guide - Gold Survival Guide

Pingback: Dollar - The Greatest Pyramid Scheme Of All Time - Gold Survival Guide - Gold Survival Guide

Pingback: Freegold and the Mechanism of the Gold Reset as a Product of the Market Place - Gold Survival Guide

Pingback: How Unbacked Fiat Money Corrupts Society - Gold Survival Guide

Pingback: Is the Limited Issue Cook Islands Gold Note a Good Investment? - Gold Survival Guide

Pingback: If the US Dollar Was Again Linked to Gold, How Would This Affect New Zealand? - Gold Survival Guide

Pingback: Dow Gold Ratio: How Does Gold Compare to Shares For the Past 100 Years? - Gold Survival Guide

Pingback: Is The Return To A Gold Standard Inevitable? What Might it Look Like? - Gold Survival Guide

Pingback: John Butler in Auckland: "Remonetisation of gold is inevitable"

Pingback: When Will You Know It's Time to Sell Gold?

Pingback: The Fourth Turning and Gold: What’s Still to Come in This Crisis? - Gold Survival Guide

Pingback: No Escape: The Fed Bail Out of the Entire Global Dollar System Will Destroy the Dollar as the Global Reserve Currency - Gold Survival Guide

Pingback: Why Will Gold Still be Valuable in the Future? - Gold Survival Guide

Pingback: RBNZ: Now Actively Researching a Central Bank Digital Currency – Reading Between the Lines - Gold Survival Guide

Pingback: What Might a BRICS Currency System Mean for NZ? - Gold Survival Guide

Pingback: Singapore Increases Gold Reserves by 48% Since Dec 2022 - Gold Survival Guide

Pingback: If/When the US Dollar Collapses, What Will Gold be Priced in?

Pingback: If New Zealand Introduces a Central Bank Digital Currency, How Will This Affect Gold and Silver - Gold Survival Guide