Last week the US Central Bank again raised interest rates. This is in response to the US economy being so […]

Category Archives: Why Buy Gold and Silver

The first step on the precious metals path is to consider the questions Why buy gold and Why buy silver? You might then consider reading about protection from a bank failure and the escalating war on cash, or even the risk of derivatives.

The first step on the precious metals path is to consider the questions Why buy gold and Why buy silver? You might then consider reading about protection from a bank failure and the escalating war on cash, or even the risk of derivatives.

Plus check out our free Gold Ecourse, to learn more about gold and silver’s role as your financial insurance policy.

Must read articles about Why to Buy Gold and Silver

Why Buy Gold?

Your reason for buying gold is the first thing to consider. This article outlines 8 reasons to buy gold today. Plus another 6 timeless reasons to buy gold.

Why Buy Silver?

There is a lot of commonality in the reasons to buy gold and silver. But in this post you’ll discover 6 reasons you should specifically buy silver. Also learn about 3 factors that indicate silver should have more upside than gold.

Bank Failures: Could they happen in NZ? The Reserve Bank thinks so

See how a bank failure could occur in New Zealand. Learn how the Reserve Bank of New Zealand open bank resolution will affect you and put your savings at risk. Plus how you can prepare for a bank failure in New Zealand.

Kiwisaver and Bank Bail Ins: If a Bank Fails, Are Kiwisaver Funds Affected by the OBR?

Find out how Kiwisaver and bank bail ins work. See if your Kiwisaver funds would be affected if a New Zealand bank fails and customer accounts undergo a bail-in or “hair-cut”.

War on Cash: Implications for New Zealand

What are the real reasons for going cashless? What are the implications for New Zealand? See why hoarding something other than cash may be a good idea for emergencies…

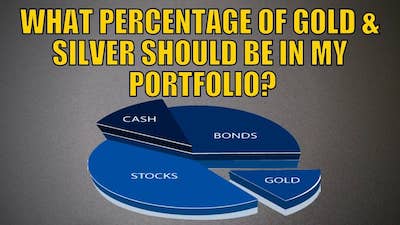

What Percentage of Gold and Silver Should Be in My Portfolio?

Here are factors to consider in deciding how much you should invest In precious metals. Plus some examples showing how specific percentages of allocation to gold can help balance and protect your portfolio…

Latest Articles

Before making any financial decision it’s always a good idea to consider both sides of the story. Silver is no […]

At the start of each year Saxo Bank publishes their “Saxo Bank Outrageous Predictions” It’s not intended to be a […]

In yesterday’s feature article, The Yield Curve Recession Predictor: Impact on Gold? we outline a timeframe for the next US and global […]

Bitcoin was modelled upon gold. So not surprisingly many people interested in Bitcoin and cryptocurrencies are also interested in buying […]

Share Markets plunged yesterday led by the US. In this article we’ll try and answer: What was the cause? What […]

Here’s the latest from our favourite Billionaire Hugo Salinas Price. You may not agree with all his conservative “old school” […]

2017 was a pretty good year for gold. Although the sentiment towards it has hardly been worse. In the west […]

New Zealand may soon not be the only developed country without bank deposit insurance, but with a policy of bank […]

Previously we’ve written 14 Reasons to Buy Gold. Here’s 28 more reasons we came across recently on Zerohedge… 28 Reasons to […]