Prices and Charts

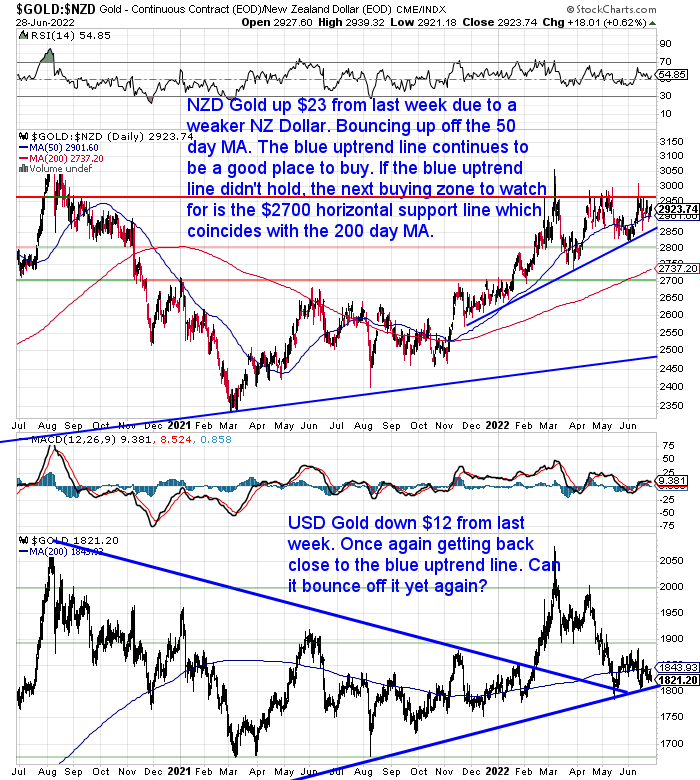

Weaker NZ Dollar Boosts Local Gold Price

Gold in New Zealand dollars was up $23 from a week ago, bouncing up off the 50 day moving average. But that was solely due to a markedly weaker NZ Dollar. As Gold in US dollars was actually down $12 for the week.

For NZD Gold, the blue uptrend line remains the key thing to watch. That has proven multiple times this late in 2021 to be a great place to buy. So any return there is likely an excellent buying opportunity again.

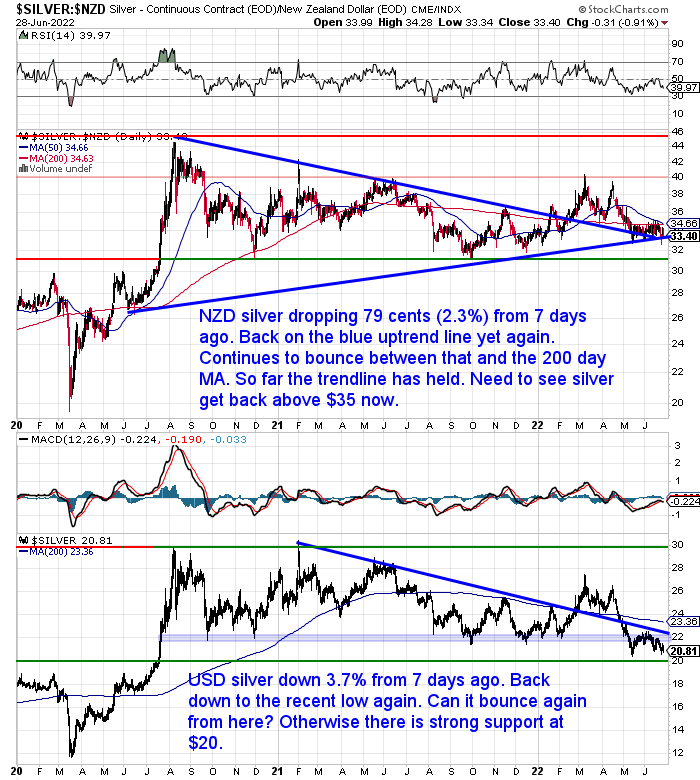

NZD Silver Down over 2%

However, the weaker Kiwi dollar was not enough to get NZD silver into the green for the past 7 days. It was down 79 cents or 2.3% and is now sitting right on the blue uptrend line.

For the last 2 months silver has just bounced back and forth between the blue uptrend line and the 200 day moving average (MA). So the question now is can NZD silver again bounce up from the blue uptrend line? Otherwise there is strong support at $32 and $31.

Then if silver manages to bounce, we’re still watching for it to get back above $35 and out of the compressed trading range.

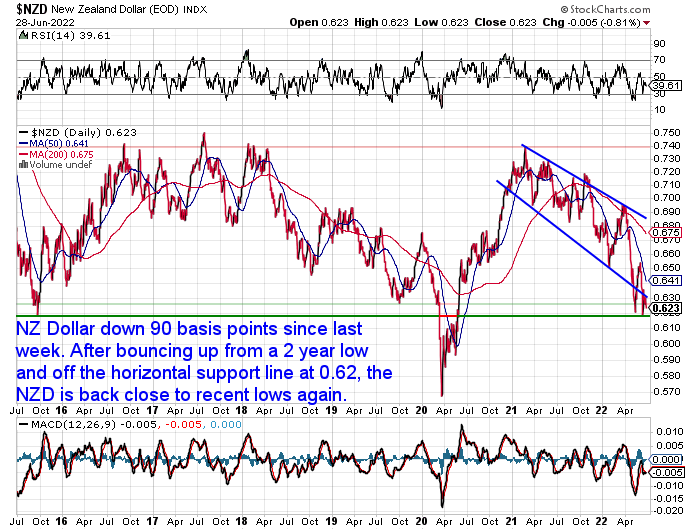

NZ Dollar Down Almost 1.5%

As noted already the New Zealand Dollar took a hit this week. Down almost 1.5%.

After bouncing up from a 2 year low at 0.62, the Kiwi didn’t manage to get back clearly above the blue downtrend line.

It is now back close to those 2 year lows. Look for a bounce up again from there perhaps?

But overall the giant 7 year sideways trading range, mostly between 0.62 and 0.74 continues.

Need Help Understanding the Charts?

Check out this post if any of the terms we use when discussing the gold, silver and NZ Dollar charts are unknown to you:

Continues below

—– OFFER FROM OUR SISTER COMPANY: Emergency Food NZ —–

Long Life Emergency Food – Back in Stock

These easy to carry and store buckets mean you won’t have to worry about the shelves being bare…

Free Shipping NZ Wide*

Get Peace of Mind For Your Family NOW….

—–

Could Silver Be Worth More Than Gold? 2022 Update

You may have heard about the increasing uses for silver in industrial applications. The rise in industrial use is often used to argue that the price of silver will rise significantly. Thus equaling or even overtaking gold. But could this really happen?

This post covers this topic in depth including:

- The gold to silver ratio over 3 centuries

- Some historical evidence of silver being worth more than gold

- Silver industrial demand versus investment demand

- Could Silver Be Worth More Than Gold Due to:

- Peak Silver?

- Increasing Institutional Investment Demand?

- Increasing Photovoltaic Demand?

- Our thoughts on whether silver could be worth more than gold

Your Questions Wanted

Remember, if you’ve got a specific question, be sure to send it in to be in the running for a 1oz silver coin.

Russian Gold Ban – Will the “Law of Unintended Consequences” Strike Again?

The big news this week in international finance was the announcement that the US, UK, Japan and Canada will ban Russian gold imports.

“US President Joe Biden announced Sunday that the United States will ban Russian gold, the country’s second most valuable export after energy. Gold exports were worth £12.6 billion ($15.5 billion) to the Russian economy in 2021, according to the UK government.

“…The United States has imposed unprecedented costs on Putin to deny him the revenue he needs to fund his war against Ukraine,” Biden said in a tweet on Sunday. “Together, the G7 will announce that we will ban the import of Russian gold, a major export that rakes in tens of billions of dollars for Russia,” he added.

British Prime Minister Boris Johnson said Sunday that the ban will hit Putin hard.

“The measures we have announced today will directly hit Russian oligarchs and strike at the heart of Putin’s war machine,” Johnson was quoted as saying in a statement issued by Downing Street on Sunday.”

Source.

Our immediate thoughts were that the law of unintended consequences is likely to come into play here. Although the law of unintended consequences implies some sort of unknown or unexpected effects of a decision. So perhaps it is more like the law of ignorance at play here?

Jim Rickards points out:

“The stupidity never ends. Biden declares an end to imports of Russian gold. Seems not to know that Russia is among the world’s top gold producers and is buying its own gold for rubles as part of a plan to end dollar hegemony. Biden’s a sanctions amateur.”

Source.

So the aim was to “deny [Putin] the revenue he needs to fund his war against Ukraine”. The more likely effect of this is that the Russia central bank will just continue to buy gold from its gold miners. While other countries friendly to Russia may buy any excess gold, possibly at a discount to world prices.

Also as this ZeroHedge article points out, G7 nations buy very little gold from Russia anyway:

“…the biggest buyers of gold in recent years have not been G7 countries (United States, France, Canada, Germany, Japan, the United Kingdom and Italy), many of whom naively sold much if not all their gold in the recent past and have refused or simply don’t have the funds to restock; instead purchases have all been by developing nation central banks (like India and Turkey, and of course China which however has a habit of only revealing its true gold inventory every decade or so) who have been quietly preparing to do what Russia is doing by dedollarizing and instead allocating capital into a counterparty-free asset.

Source.

It also points out that Russia mines close to 10% of gold globally. How will the removal of this from western supply chains affect the price in the west? Will we see a 2 tier price for gold like we are for oil?

The other potentially even more significant factor is that it will likely speed up the end of the US dollar as global reserve currency. This is what Rickards was referring to in his tweet referencing Russia’s “plan to end dollar hegemony.” All these moves are steadily reducing the amount of transactions in US Dollars and forcing more nations to look at other means of transacting between themselves. The USA leaders continue to shoot themselves in the foot.

So Much Information! Where to Start for Those New to Precious Metals?

A recent question in from someone who has been referred to our website was:

“Someone has referred me to you for learning about an alternative currency option to our current monetary system. Can you advise a learning path or direction please?”

Our website has a lot of information. It is broken down into different categories depending upon what it is you are wanting to know. See those categories on our blog here.

The below links are taken from an email that gets sent to people soon after they subscribe to any of our reports or our weekly newsletter. It highlights some recommended articles to read and in what order to do so…

You have available to you New Zealand’s largest and most comprehensive repository of information on gold and silver.

So here’s a list of past articles we’ve written with a focus on buying gold (and silver) in New Zealand.

If you read them in the order written it should give you an even better grounding in precious metals.

Why buy gold?

Why buy silver?

What percentage of gold and silver should be in my portfolio?

Valuing NZ housing, the sharemarket in gold. Plus the gold to silver ratio

Could Silver Be Worth More Than Gold?

How Do You Value Gold – What Price Could Gold Reach?

Some help working out when to buy

Some simple methods to determine lower risk times to buy

Understanding exchange rates and why you should ignore the USD gold price when buying gold in New Zealand

If you’re ready to buy, you can check out the different types of products available here in our online shop.

This page explains the process to purchase gold and silver and gives some articles to read as well.

You can also sign up for our free gold ecourse here.

Have a skim through some of that and then you can also give us a call on 0800 888 465 for any further guidance.

Likewise if you are ready for quote these are the ways you can contact us.

- Email: orders@goldsurvivalguide.co.nz

- Phone: 0800 888 GOLD ( 0800 888 465 ) (or +64 9 2813898)

- or Shop Online with indicative pricing

— Prepared for the unexpected? —

Never worry about safe drinking water for you or your family again…

The Berkey Gravity Water Filter has been tried and tested in the harshest conditions. Time and again proven to be effective in providing safe drinking water all over the globe.

This filter will provide you and your family with over 22,700 litres of safe drinking water. It’s simple, lightweight, easy to use, and very cost effective.

—–

|

Pingback: Everything is Falling - Including Gold - Gold Survival Guide