Prices and Charts

NZD Gold Fairly Steady

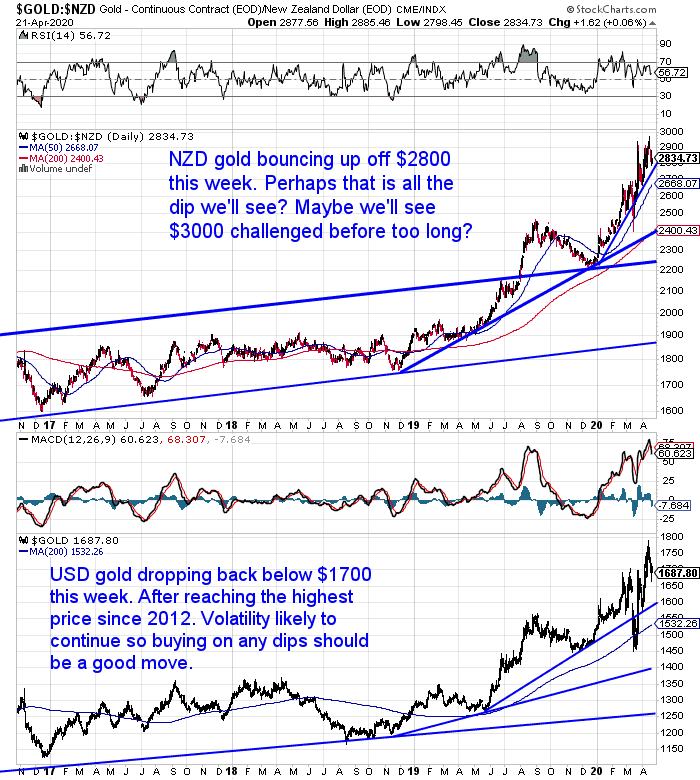

Gold in New Zealand Dollars was down about half a percent from last week. Gold bounced up off the $2800 mark. So there is a chance that is all the pull back we will see. Perhaps the $3000 mark will be challenged before too long?

At some point gold will return to touch at least the 50 day moving average. Layer in if you haven’t bought. Then as it is a bull market, buy the dips on any pullback.

NZD Silver Dipping Lower

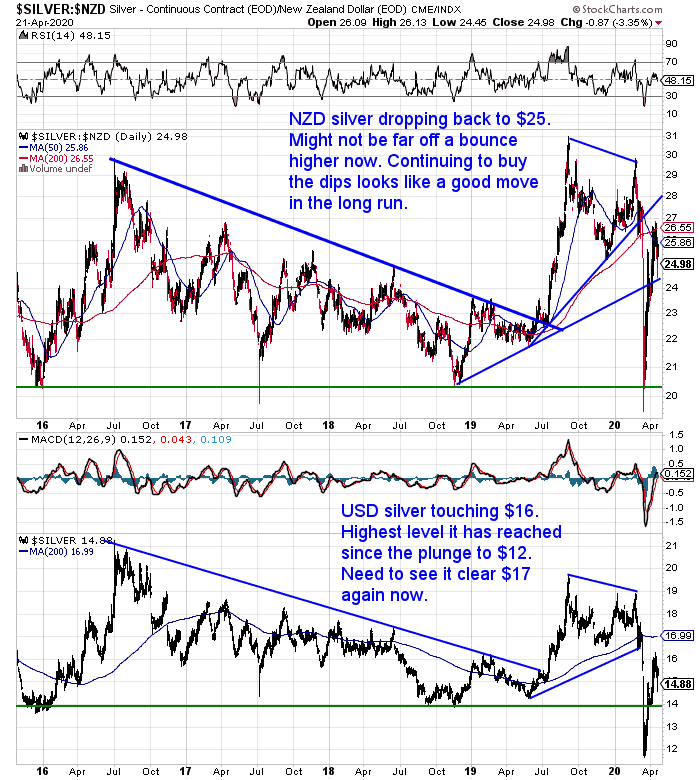

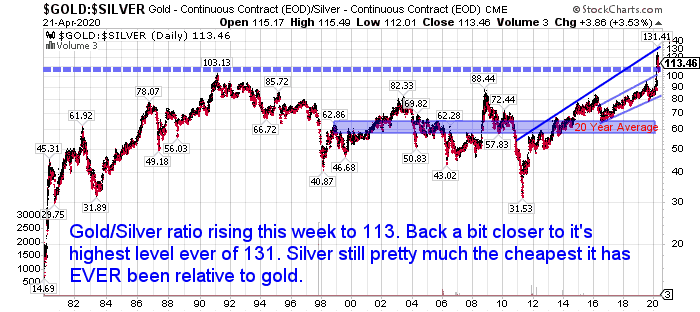

NZD silver was down about 3.5% for the week. Sitting around $25 currently. We may be close to seeing silver bounce higher from somewhere near current levels. As the gold to silver ratio chart further down shows, silver is still crazy cheap compared to gold. We still favour buying silver over gold – but having some of both is a good idea.

NZ Dollar Fails to Hold above 0.62

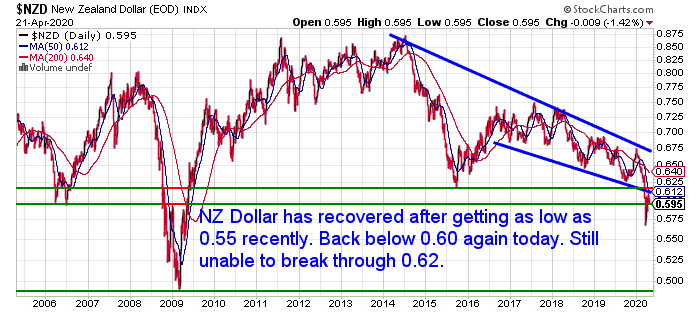

The NZ Dollar once again failed to get decisively above 0.60. We’d need to see that get back above 0.62 before any higher moves were on the cards.

Need Help Understanding the Charts?

Check out this post if any of the terms we use when discussing the gold, silver and NZ Dollar charts are unknown to you:

Continues below

—– OFFER FROM OUR SISTER COMPANY: Emergency Food NZ —–

Here’s how to always have clean fresh drinking water on hand.

The Sport Berkey Water Filter Bottle – $69 Delivered

Ideal for travel. Driving, camping, backpacking.

Free Shipping NZ Wide.

The Inverse Oil Shock – The Opposite of the 1970’s and The Gold to Oil Ratio

The big, actually massive, news this week was the crazy action in the oil futures market yesterday.

In case you hadn’t heard futures prices did the unheard of and went negative!

Unprecedented seems to be a term we are using far too regularly of late.

In this week’s feature article we look at what these unimaginably low oil prices mean for the global economy. How governments will react. We also look at the Gold to Oil Ratio and what this might be telling us.

SILVER AND COVID-19, CAPITALISM’S BLACK SWAN

Sandeep Jaitly shows us how silver demand has been growing despite the apparent lacklustre performance in price.

There’s also an argument why the stock market rout has likely only just begun. Sandeep theorises on how low many publicly traded companies could yet fall. Of course the level of this “fall” depends on how the central banks and governments react. As we wrote last week in NZers: Do You Hold Cash or Gold in the Coming [or Already Here?] Crisis?, while there is a good chance we see deflation, we can expect the central planners to come up with more ways to get currency into the economy. They may in the end unleash inflation or maybe a bad case of 70’s stagflation.

But it’s not all bad news. Darryl Schoon believes “The present order is failing. A better world is coming. Be patient.”

The rate things have changed in the last 6 weeks might mean we don’t have to be that patient either…

Your Questions Wanted

Remember, if you’ve got a specific question, be sure to send it in to be in the running for a 1oz silver coin.

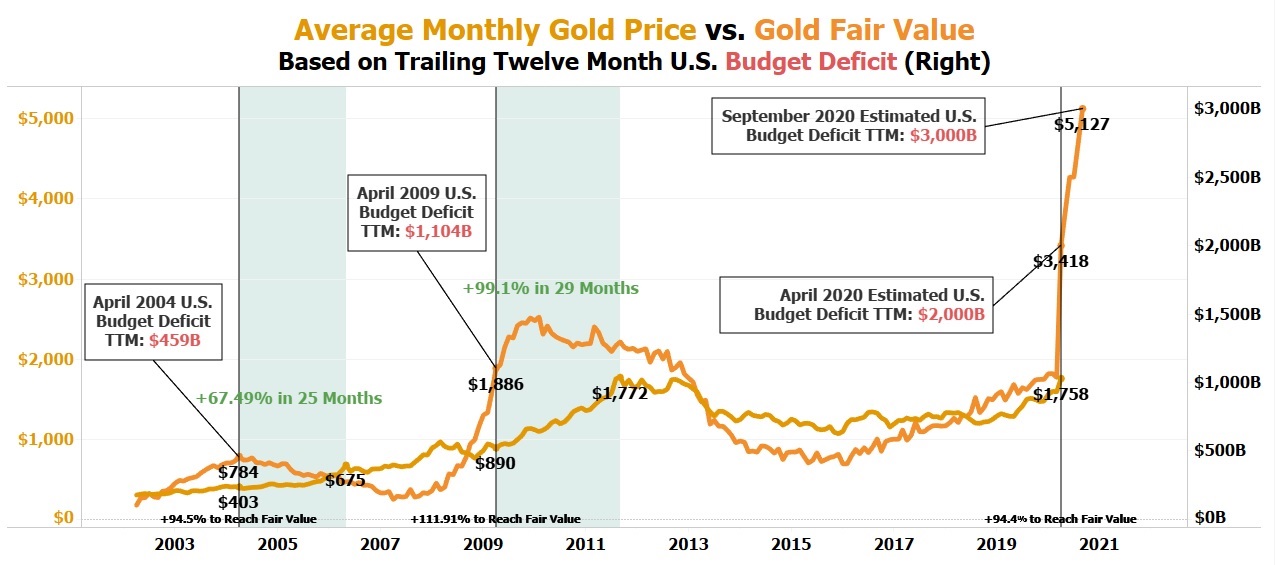

Gold’s Strong Correlation to the US Budget Deficit

We’ve featured many ways to value gold in the past. Just check out the How to Value Gold & Silver category on our blog for the most popular and useful. This includes gold vs money supply, gold vs housing, and gold vs shares to name just a few.

But here’s one we haven’t featured before. Gold compared to the US government budget deficit. Given the US dollar is the global reserve currency it makes sense that gold would track the deficit.

You can see in the chart below that gold has fairly closely tracked the US deficit.

NIA reports:

“…gold’s fair value is about to rapidly rise to based on the trailing twelve month U.S. budget deficit reaching $2 trillion this month and $3 trillion for the full fiscal year ending in September 2020!

Gold’s fair value based on the U.S. budget deficit is about to explode from $1,772 per oz today to $3,418 per oz at the end of April 2020 and $5,127 per oz at the end of September 2020!”

Source.

This move to match the deficit won’t necessarily happen overnight. But the chart shows that historically the 2 have tracked fairly closely and returned to meet each other anytime they have gotten out of whack. We fail to see how the US could reduce its deficit in a hurry. So more likely we’ll see gold move higher to track this instead. The first NIA number of $3418 might come about much faster than most people would imagine. Our guess is this could be within the next year.

Where Will the NZ Government Get the Money for its Dramatic Increase in Spending? Tax, Borrow or Just Print it?

Speaking of budget deficits. Even the mainstream media is contemplating questions like where will the NZ government get the money for the huge increase in spending? Tax, borrow or just print it?

Former NZ Herald economics editor Brian Fallow posed just such a question this week.

He points out an interesting exchange between MP David Seymour and the head of the NZ central bank:

“Seymour raised the question of what would happen when the time came for bonds to be redeemed. “I suspect politicians here as elsewhere will find it more attractive to tax less and spend more and roll over the bonds ad infinitum,” he said.

“In that case is it a tax on people who have New Zealand dollar savings, who find that their share of the New Zealand dollars in the world is less, and the goods and services they wish to buy cost more because you have inflated the currency?”

Orr replied: “Yes over time Government debt will either be paid back or rolled over. Since the days of Julius Vogel we have owed somebody something. Fortunately this time we start from a very low debt to GDP position and, judging from what we are seeing, we are going to get back to an average historical position.

“What we [the Reserve Bank] are doing is transferring those long-term IOUs into short-term cash. We are doing it through the secondary market, not buying it directly off the Government…It is a way of effectively monetising, or creating the cash for people to spend.”

Source.

Fallow points out that a balance must be made on not crowding out the private sector buyers of the NZ government bonds.

Remember, QE is the central bank creating currency to buy government bonds to keep interest rates low. We’re told by the central planners: “It’s okay because we will eventually sell off our bond holdings”.

However as David Seymour rightly pointed out. This is not that easy to do. The US Federal Reserve found that out. See: Federal Reserve Balance Sheet Reduction: Why is it Now Growing Again?

The RBNZ’s initial $30 billion QE equated to 35% of central government debt securities on issue at the start of March.

As we said last week, even ASB Thinks the RBNZ Will Also Expand QE.

Odds are the RBNZ will also find it difficult to stop QE, now that it has begun. Brian Fallow concludes:

“If the [RBNZ] sees 40% of the stock of bonds on issue as some kind of upper limit before crowding out becomes an issue, then as a matter of simple arithmetic if the stock of bonds on issue were, say, to roughly double from 25 to 50% of GDP, it could buy up 80% of the increase before reaching that level. That would require roughly doubling its QE “budget”.

Beyond that point direct monetary financing — currently a barely discernible dot on the horizon of possibility — might well loom larger as a prospect.”

We think the rate things are progressing, that dot may turn into a quite large boulder before too long. And the RBNZ will find itself in a similar position to the US central bank. Where it is directly monetising (a.k.a. printing) the government budget deficit.

David Seymour might not realise it (or maybe he does?), but his question to the RBNZ governor is a strong recommendation for the public to buy gold and silver.

Q.E. is “a tax on people who have New Zealand dollar savings, who find that their share of the New Zealand dollars in the world is less, and the goods and services they wish to buy cost more because [the RBNZ has] inflated the currency.”

Get in contact if you have any questions about how to protect yourself from RBNZ inflated currency by buying gold or silver.

- Email: orders@goldsurvivalguide.co.nz

- Phone: 0800 888 GOLD ( 0800 888 465 ) (or +64 9 2813898)

- or Shop Online with indicative pricing

— Prepared for the unexpected? —

Never worry about safe drinking water for you or your family again…

The Berkey Gravity Water Filter has been tried and tested in the harshest conditions. Time and again proven to be effective in providing safe drinking water all over the globe.

This filter will provide you and your family with over 22,700 litres of safe drinking water. It’s simple, lightweight, easy to use, and very cost effective.

Royal Berkey Water Filter

Shop the Range…

—–

|

Pingback: Negative Interests Rates in NZ by November? - Gold Survival Guide