Prices and Charts

Boring Sideways Trading Continues in Gold

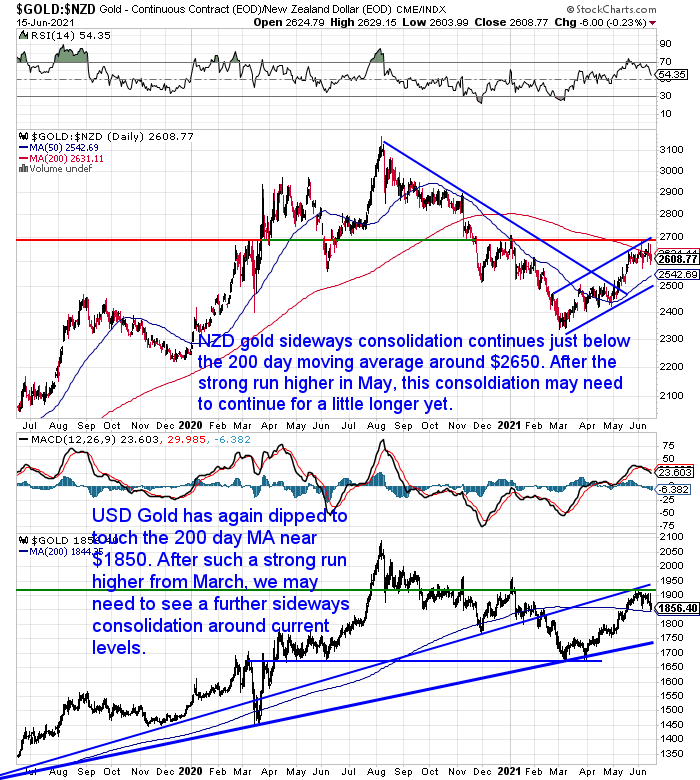

The sideways consolidation around $2600 continues in NZD gold. The price did dip lower over the past 7 days. However a weaker NZ dollar has meant the fall has been somewhat muted.

So NZD gold continues to hover just under the 200 day moving average. This consolidation since mid May has resulted in the RSI overbought/oversold indicator dropping from above 70 (overbought) to now be back to neutral (around 50).

Our guess is this consolidation continues for a few more weeks yet. That would get the 200 day moving average (MA) down closer to the 50 day MA.

Why Boring is Good (Again)

This current sideways trading reminds us very much of last July. Back then we wrote:

“…this boring sideways action in precious metals since April, is likely a good sign.“Gold and silver are rather boring at present. They continue to trade in these sideways patterns. As a result there is very little focus on precious metals. There is also reduced buying currently. These are the times a move higher often follows.”

Considering how well gold has performed since the start of the year (regardless of which currency you use), it’s surprising there hasn’t been more focus on gold.

But as noted above these are positive signs for a bull market. It’s called climbing the “wall of worry”. This is when a market continues to move higher, even while most people can come up with reasons why it should be pulling back.

There has been a noticeable drop off in buying of gold and silver in the past 2 weeks or so as well. We know from experience this is often when gold and silver can make decent moves.

So that’s why we are guessing we see a USD gold price break out before too long.”

Source.

If you look at the USD gold chart (lower half of the above chart) from July, you’ll see a clear 3 month long sideways consolidation. Followed by a serious breakout, which took the USD gold price up to the all time above US$2000.

So far this consolidation has only been about a month long. But as already noted it could carry on for a bit longer yet.

There is also reduced buying in precious metals currently. As we have noted many times before, this is often a good contrarian indicator. A lack of buying often indicates a good time to actually be buying!

Silver Outperforming Gold This Week

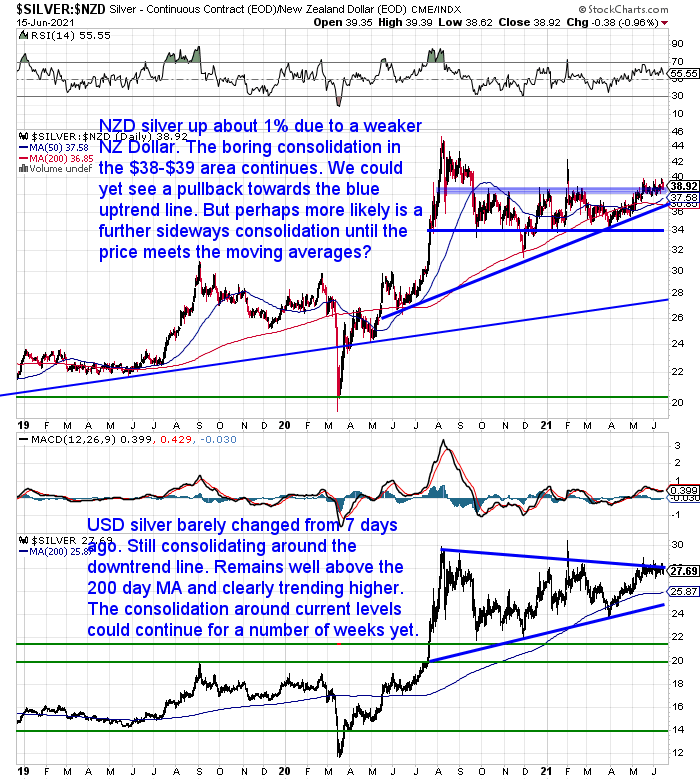

While gold was down for the week, silver in New Zealand dollars was up over 1%. Helped in large by the weaker Kiwi dollar.

The boring sideways consolidation in silver continues too. Like gold we think this could continue for a little longer yet.

That would result in even less focus on silver. This is what bull markets like to do. Move higher with as few people on board as possible.

So if you’re sitting on the sidelines waiting for a significant pullback, our guess is that may not happen. But as always… it’s just a guess.

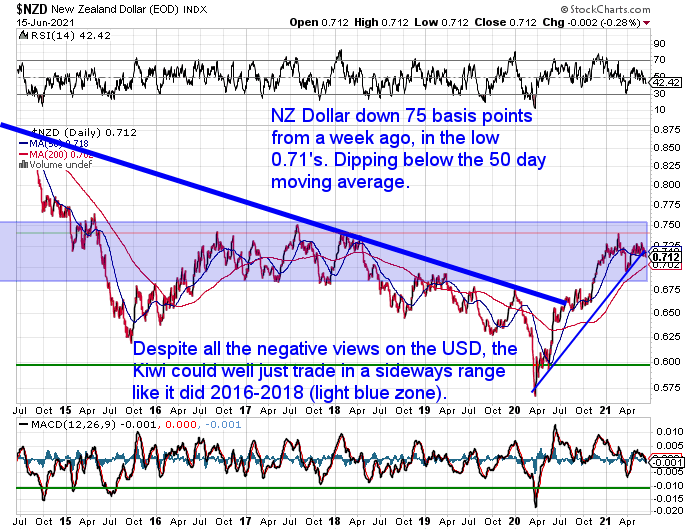

NZ Dollar Down Over 1%

As mentioned already the New Zealand dollar was down this week. The over 1% fall pushed the price just under the 50 day moving average (MA). So the Kiwi remains in the middle of the wide trading range we’ve shaded in blue. It could go either way from here. But over the medium term our guess is the Kiwi could just stay in this wide range. Much like it did in 2016-2018.

Need Help Understanding the Charts?

Check out this post if any of the terms we use when discussing the gold, silver and NZ Dollar charts are unknown to you:

Continues below

—– OFFER FROM OUR SISTER COMPANY: Emergency Food NZ —–

NEW: Certified Organic Long Life Emergency Food

This easy to carry bucket has 90 servings of organic breakfasts and mains

Free Shipping NZ Wide

Get Peace of Mind For Your Family NOW….

—–

Academic: RBNZ Currency Printing Will “End in a Train Wreck”. Modern Monetary Theory Would be Better?

A couple of weeks ago, we reported how the RBNZ Chief Economist had said the central bank might continue buying government bonds for some years, even once its currency printing (LSAP) programme ends in 2022.

We also discussed how the central bank could keep the currency printing going (which holds down interest rates) while also increasing interest rates via the Official Cash Rate (OCR). Even though they are meant to do the exact opposite of each other!

This week we read another report which featured a comment from a Senior associate at Victoria University of Wellington’s Institute of Governance and Policy Studies:

“He believed the continuation of a flawed quantitative easing programme would only end in a train wreck.”

However his alternative seems to have as many (if not more issues). We delve into this in detail in this week’s feature article:

Here’s what is covered:

- What is Modern Monetary Theory?

- 4 Arguments Against Modern Monetary Theory

- The Biggest Issue with Modern Monetary Theory

- Just Because We Disagree with MMT…

- MMT May Have Already Arrived in the USA

- How to Prepare for MMT

Your Questions Wanted

Remember, if you’ve got a specific question, be sure to send it in to be in the running for a 1oz silver coin.

More Thoughts on Inflation

The biggest debate in the financial world currently is whether the current rise in consumer price inflation is “transitory” or the beginning of something more significant and ongoing.

Here are a few thoughts we’ve come across, plus some musings of our own at the end.

Paul Tudor Jones Debunks “Transitory” Inflation

Paul Tudor Jones, the billionaire investor and founder of Tudor Investment Company, joined the hosts of CNBC’s Squawk Box for an early morning interview where he discussed the potential implications of whatever Fed Chairman Jerome Powell decides to tell the market on Wednesday, when he speaks after the central bank’s latest 2-day policy meeting.Jones began by making his position on The Fed’s narrative very clear:

“The idea that inflation is transitory, to me … that one just doesn’t work the way I see the world.”

“I think this Fed meeting could be the most important Fed meeting in Jay Powell’s career.”

“If they treat these numbers – which were material events, that were very material – with nonchalance, I think that’s a green light on the inflation trade,” Jones said in an interview on “Squawk Box”.

“I’d probably buy commodities, buy crypto, buy gold.”

Source.

Jim Rickards: “Heads I win, tails I don’t lose.”

Last month we shared Jim Rickards theory that Inflation won’t arrive – yet. He thought it may not arrive until 2023…

- The data does not show that we have entered an inflationary environment. I expect the environment to remain broadly deflationary until around 2023. Position yourself for short-term deflation, with the prospect of a sudden uptick in inflation.

- The market expects inflation in the short term, but I think the market is wrong.

- When inflation comes it will be with us for the long term.

- Money printing is not necessarily linked to inflation. We have not yet seen an uptick in money velocity, which is what determines inflation most directly

This week he expanded upon what the two scenarios might mean for gold:

“If inflation does not appear and rates retreat, gold will rally. If inflation does appear, rates may rise but gold will also rally on inflation fears.We have been stuck in a rut where inflation expectations are driving rates higher but no sustained inflation has appeared. That’s a tough environment for gold. Still, gold has held its own.

Technically, this is what we call an asymmetric trade.

Downside is limited because of residual inflation fears, but upside is huge because gold prices have been moving inversely to interest rates and a plunge in rates is likely to occur.

You can call it, “Heads I win, tails I don’t lose.” When it comes to investing, that’s as good as it gets.”

Bill Bonner: Federal Spending Will Push Monetary Inflation into Price Inflation

Bill Bonner explains how the monetary velocity Rickards referred to will likely pick up…

“Inflation?The trouble with the feds’ plan to “carry on spending,” is that it eventually comes crashing through the window like a rock.

We may not be able to live where we want (the United Nations says 4 million people have been forced to leave their homes in Venezuela because of the hyperinflation there, for example).

We may not be able to do what we want, either – businesses close… holidays are cancelled… projects are delayed, then forgotten.

And with whom? Under pressure… families get separated. Work teams are broken up.

Federal spending is the main way that monetary inflation (in the Fed’s balance sheet) gets transmitted to the economy and into consumer prices.

Then, once prices begin rising in a substantial and sustained manner, people all over the world take out their dollars and try to get rid of them.

That’s what causes the “velocity” of money to increase… giving “inflation” a life of its own.

We’re not there yet…

…but the feds are piling up the stones.”

Why Even if Inflation is “Transient” It Won’t Be. Huh?

All this talk of transient or temporary inflation got us thinking about what it means for the average person in the street.

The problem with calling inflation “transient” is that the official measure is always comparing it month on month, quarter on quarter, or year on year.

Let’s say today prices are up 5% compared to a year ago, then a year from now they have stabilised and are “only” up 2% from today’s levels. This would be what the central planners call “transient” inflation.

However the odds are those price rises will not be “transient” to the man or woman in the street.

Sure it might not be as bad as if they went up 5% every year. However the odds are the 5% price increases we have seen won’t go back down. They just might not rise as much. But the prices will still be higher than before all this started. So even “transient” inflation will be bad for anyone on a fixed income or where their outgoings are close to their income.

That’s why we like Jim Rickards coin toss analogy:

“Heads I win, tails I don’t lose.”

Gold and silver look like a pretty good bet currently.

Although, supplies of silver bars remain tight. Local suppliers still have no 1kg silver bars available, even on back order. The only local silver available are 5oz bars, but there is a 4-8 week wait for them.

But we currently have ABC serial numbered 1kg bars on a 2 week back order. These are actually cheaper than comparable bars we’ve seen advertised lately in the USA. So silver down under is well priced globally at the moment.

Also now in stock are 10oz and 500g ABC silver bars too. Phone or email to order them.

- Email: orders@goldsurvivalguide.co.nz

- Phone: 0800 888 GOLD ( 0800 888 465 ) (or +64 9 2813898)

- or Shop Online with indicative pricing

— Prepared for the unexpected? —

Here’s how to always have clean fresh drinking water on hand.

The Sport Berkey Water Filter Bottle – $69 Delivered

Ideal for travel. Driving, camping, backpacking.

Free Shipping NZ Wide.

|

Pingback: Interest Rates and Gold: If Interest Rates Rise What Happens to Gold? - Gold Survival Guide