This is an entertaining video of Peter Schiff’s presentation at the recent 2013 Money Show in Las Vegas. Schiff outlines why 2013 looks a lot like 2006 again with real estate and stock prices rising on the back of cheap money. He covers a lot of ground including: What assets will be dumped this time […]

Category Archives: Gold and Silver Videos

Here we feature videos on gold and silver and related topics.

We often summarise the content if you prefer not to watch the whole video. Plus give you our own views on the videos too.

Must read articles about the Gold Silver Videos

Gold Backing to Debt Ratio: A Reset Like in 1934 and 1980 Would Mean $21,000 Gold

In this article you’ll learn about the gold backing to debt ratio. And what the gold price would need to be at today to match two previous periods of debt reset…

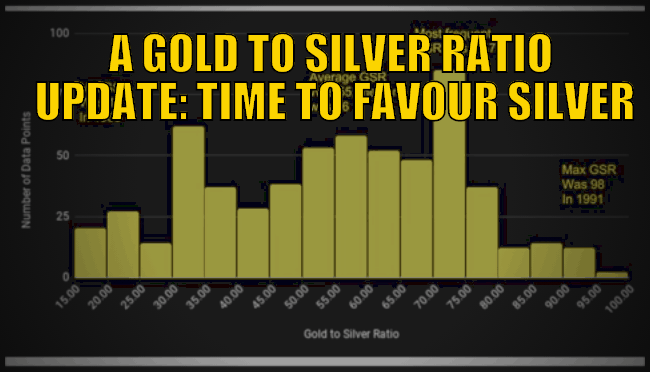

A Gold to Silver Ratio Video Update: Time to Favour Silver

This video gives a detailed statistical analysis of the gold to silver ratio. It’s a different take to what we have written recently here: Using the Gold Silver Ratio to Time Buying Silver.

Silver Versus the World (and Exter’s Inverted Liquidity Pyramid)

What is the value of all the silver in the world versus other assets? See a demonstration using a fantastic infographic. You’ll learn about Exter’s Inverted liquidity pyramid and why silver should be at the very bottom of this pyram

Presentation – Gold & Silver: Wealth Insurance with Upside

See many of the reasons to buy gold and silver for protection. But also discover the potential upside that exists in these precious metals.

The Biggest Monetary Transformation Since WWII

Every 30 to 40 years the world has a new monetary system. And the global dollar standard is the worst design of all these systems — yet it’s 45 years old. So it’s way overdue for its own demise. And when this one crumbles, everyone is going to feel it.

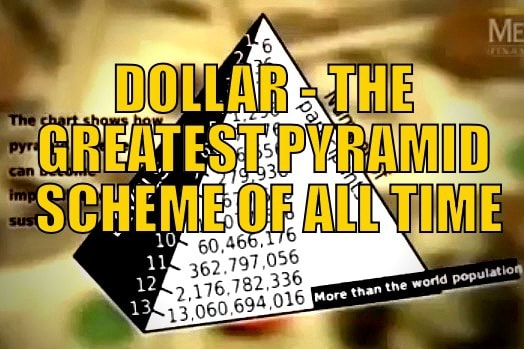

Dollar – The Greatest Pyramid Scheme Of All Time

Knowing your monetary history can help gain insight into where we may be heading. This video covers: The classical gold standard; The impact of WWI and WWII; The transformation to the “Bretton Woods” standard; Nixons severing of the final link to gold of the US dollar; The current “Dollar Standard” and its inherent problems.

Latest Articles

We have a lot of respect for Alistair Macleods point of view. This a great interview where his matter of fact approach contrasts nicely to Max Keisers outrageousness. In the interview they cover a lot of ground including: Why most analysts looking at the supply of gold get it wrong Why the move out of […]

Last night we just finished reading a very interesting piece by Grant Williams in his ‘Things that make you go Hmm” newsletter available for free subscription. He gives a great run down of the likely pitfalls of the Bank Of Japan’s massive money printing they announced last week. This prompted us to take a look […]

We’ve followed J.S. Kim’s writing for a while. Here’s a timely video of his on the bank deposit theft being discussed in Cyprus and how we’ve all been suffering theft – it is merely a lot more subtle… With all the scorn and indignation over the IMF and ECB’s attempt to steal anywhere from 9.9% […]

Last week we posted the first part of this Keiser Report video interview with Professor Antal Fekete. So below is the part 2, which focuses more on silver than gold this time. Max Kesier manages to cover a fair bit of ground with the Professor in this interview also. Including: How it took from 1879 […]

We’ve featured the writings of Professor Antal Fekete many times in these pages before. Why? Simply because we have learnt so much from him over the past few years both from reading his various writings but also from seeing him in person a number of times. But it’s not often we get to see a […]

We watched this video a week ago and now it’s available to a wider audience and is worth a watch. For a change we see Doug Casey interviewing someone else, as it’s usually him on the receiving end of the questions… Doug Casey Interviews Peter Schiff on Gold, Inflation, and Interest Rates By Doug Casey, […]

Here’s a video from Chris Duane where he outlines 11 factors that might ignite the silver market. He has some very interesting views and his videos are always informative and easy to watch. This one covers areas such as: When procrastination silver buyers will rush in. Why silver retailers will sell out. Why […]

This makes it 2 in a row for G Edward Griffin, author of one of our favourite books. Following on from the previous video of an interview with him, this one is part of his presentation at the recent Casey Research Summit… Is the Federal Reserve really doing such a bad job… or does it actually […]

“Legalized Plunder – Why we have all been had, fooled and deceived…. and the surprising reason we keep asking for more of the same bad medicine” Author G Edward Griffin was pilloried from all sides when his book The Creature from Jekyll Island was first published in 1994. [Editors note: If you’ve not yet read […]