Could silver, often seen as gold’s “little brother,” one day become more valuable than gold? It sounds unlikely. After all, gold has always worn the crown when it comes to precious metals. But the idea isn’t as crazy as it seems — and in today’s economic environment, it’s worth taking a closer look.

In this article, we explore the facts, history, and future possibilities behind silver’s value. Whether you’re a seasoned bullion buyer or just curious about the metals market, this guide will give you a clear picture of where silver stands — and where it could go.

Table of contents

- Quick Summary: Could Silver Be Worth More Than Gold?

- What Determines the Value of Gold and Silver?

- A Look at the Gold-to-Silver Ratio (GSR)

- When Silver Rivalled Gold: The 1919–1920 Silver Boom

- Could Silver Be the New Gold?

- Could Silver Ever Be More Valuable Than Gold?

- Should You Invest More in Silver Than Gold?

- What Has to Change for Silver to Overtake Gold?

- Final Thoughts: Is Silver Undervalued?

- FAQ: What People Ask ChatGPT (And Us) About Silver vs Gold

- Want Updates on the Gold-to-Silver Ratio?

- Related Articles from Gold Survival Guide:

Estimated reading time: 12 minutes

Quick Summary: Could Silver Be Worth More Than Gold?

- Historically, gold has always been more valuable than silver — but the gold-to-silver ratio has swung wildly over time.

- Silver has growing industrial demand in green technologies and electronics.

- Gold is more established as money, especially for central banks and large investors.

- It is unlikely silver will become more expensive than gold long-term, but short-term surges could close the gap under specific conditions.

- The key is not whether silver overtakes gold — but whether silver is currently undervalued and has more upside.

What Determines the Value of Gold and Silver?

Gold and silver are both monetary metals — but their value is influenced by different factors.

| Gold | Silver |

|---|---|

| Store of value | Industrial + monetary use |

| Central bank reserves | Solar, EVs, electronics |

| Inflation hedge | Volatile but with upside |

| Smaller market moves | Higher price swings |

Gold is prized for its stability, while silver is known for its volatility — which is both a risk and an opportunity.

A Look at the Gold-to-Silver Ratio (GSR)

The gold-to-silver ratio tells us how many ounces of silver it takes to buy one ounce of gold.

- Historical Average: Around 40 to 60

- Peak in 2020: Over 120

- As of October 2025: ~85 (check our live gold/silver charts for updates)

A high ratio suggests silver is undervalued relative to gold, and many investors use this as a signal to accumulate more silver.

Interestingly, history shows there have been brief moments when silver came close — or even, on some measures, surpassed gold.

When Silver Rivalled Gold: The 1919–1920 Silver Boom

While silver has almost always traded far below gold, there was a brief moment in modern history when the two metals nearly met in price. During the post–World War I monetary turmoil of 1919–1920, inflation, government gold controls, and industrial shortages drove silver to unprecedented highs.

Historical newspapers from that period captured the astonishment of markets as silver’s bullion value briefly surpassed gold’s on several local measures.

What the Newspapers Reported

1. Silver Coins Worth More Than Gold Coins

“For the first time in history, silver coin, of the leading nations of Europe sold at a higher price than gold coin. This of course does not mean that silver is more valuable than gold, merely a silver dollar or shilling is worth more than a gold dollar or shilling.”

— Mohave County Miner and Our Mineral Wealth, Arizona, January 24, 1920

In other words, silver coins — measured by their metal content — were briefly worth more in bullion than equivalent gold coins.

2. “Silver the World Sensation”

A headline from the same paper described silver as “the world sensation in 1919–1920.” Global markets were witnessing an inversion not seen in centuries, as silver’s relative value soared while gold’s remained fixed by post-war monetary controls.

3. The “Cheap Gold Dollar” Debate

In the United States, the populist leader William Jennings Bryan famously commented on this reversal, writing:

“Are the New York financiers living up to their claims of honesty that they made so vociferously in 1896, or are they paying their debts in a cheap gold dollar?”

… “With the bullion in a silver dollar worth five cents more than bullion in a gold dollar the cross of gold does not look so yellow and the crown not so thorny as it was.”

— The Commoner, Lincoln, Nebraska, December 1, 1919

Bryan’s remarks mocked the establishment that once derided his call for “free silver,” pointing out that for a brief time, the silver dollar was actually more valuable than the gold one.

4. The British Coin Example

Contemporary reporting also showed how widespread this anomaly became:

“Silver coinage throughout the world is worth more at bullion value than the par value of gold coin. For instance, 5,900 British shilling coins contain just 1,000 troy ounces pure silver, but are worth 6,929 shillings at the market price of 77 pence for British silver bullion.”

— Mohave County Miner and Our Mineral Wealth, January 24, 1920

That equated to a 17% premium for silver bullion over the gold coin equivalent — an extraordinary distortion caused by post-war currency instability.

5. “For a Silver Mine Today Is More Valuable Than a Gold Mine”

“For a silver mine today is more valuable than a gold mine.”

— Archer Wall Douglas, The Independent, April–June 1920

Even industry observers acknowledged how unusual the situation had become — a reversal that would not be seen again in the century that followed.

What Caused the 1919–1920 Silver Surge?

Economists attribute this short-lived parity to a mix of:

- Post-war currency inflation and monetary reform

- Export restrictions on gold and fixed exchange rates

- Industrial and monetary demand for silver in Asia

- Speculative trading amid uncertainty about global recovery

By 1921, as gold regained convertibility and silver prices fell, the ratio normalised — but the event remains one of the only times in modern history when silver briefly outshone gold.

A Historical Reminder

These episodes show that the gold–silver ratio is never static. When governments interfere with money supply, or industrial demand surges, silver can move violently — sometimes narrowing the gap dramatically.

For a deeper look at how the gold–silver ratio is calculated and what it signals today, see our updated guide: Gold–Silver Ratio Guide

Editorial Note

All historical quotations are drawn from early 20th-century newspaper archives originally compiled by the now-archived Don’t Tread On Me blog. Sources include The Commoner (1919), Mohave County Miner (1920), and The Independent (1920).

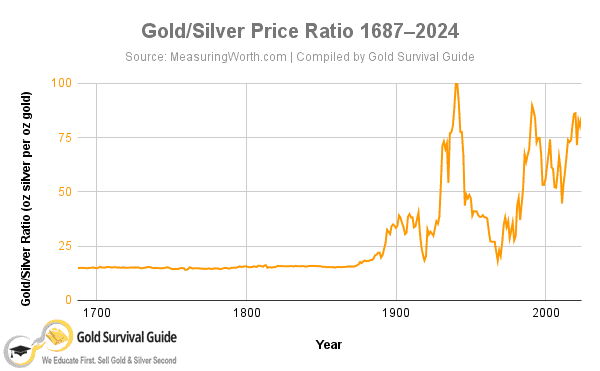

Chart: Gold/Silver Price Ratio Over the Last 300 Years

The relationship between gold and silver has never been static.This chart shows how the gold-to-silver ratio has changed over more than three centuries — from near parity in the late 1600s to the extreme highs of over 120:1 seen in 2020. Today we still remain far above the levels seen for most of recorded history.

As the chart shows, long stretches of history have seen the ratio around 15:1 to 40:1 — far below recent averages.

If the ratio ever reverts toward its historical mean, silver prices would have to rise dramatically relative to gold.

That’s why some analysts argue that silver remains one of the most undervalued assets in the metals market today.

Could Silver Be the New Gold?

Silver has some unique drivers that are not just monetary:

- Industrial demand is booming, especially in:

- Solar panels

- Electric vehicles

- Electronics

- AI/data infrastructure

- Solar panels

- De-dollarization: Countries moving away from USD may look for alternative hard assets.

- Fiat currency concerns: Silver is still seen as a hedge against inflation — especially for smaller investors.

These factors are giving silver strong tailwinds, even if gold still dominates the monetary narrative.

Reader Question

“I’ve heard a lot about how useful silver is and the many different purposes it’s used for, whereas gold is mainly just precious.

Will the usefulness of silver ever cause it to become a more desirable asset (i.e. more valuable) than gold?”

That’s an excellent question — and it’s one that highlights the core difference between the two metals.

Silver’s usefulness gives it powerful industrial demand drivers — in solar panels, electric vehicles, and electronics — which can push its price higher in times of strong economic growth.

Gold, on the other hand, derives most of its value from monetary and investment demand — it’s prized not for use, but for trust.

So while silver’s industrial appeal gives it more potential upside in boom periods, gold’s unique role as a monetary reserve and store of value is what keeps it consistently more valuable overall.

Supply, Scarcity, and Institutional Demand

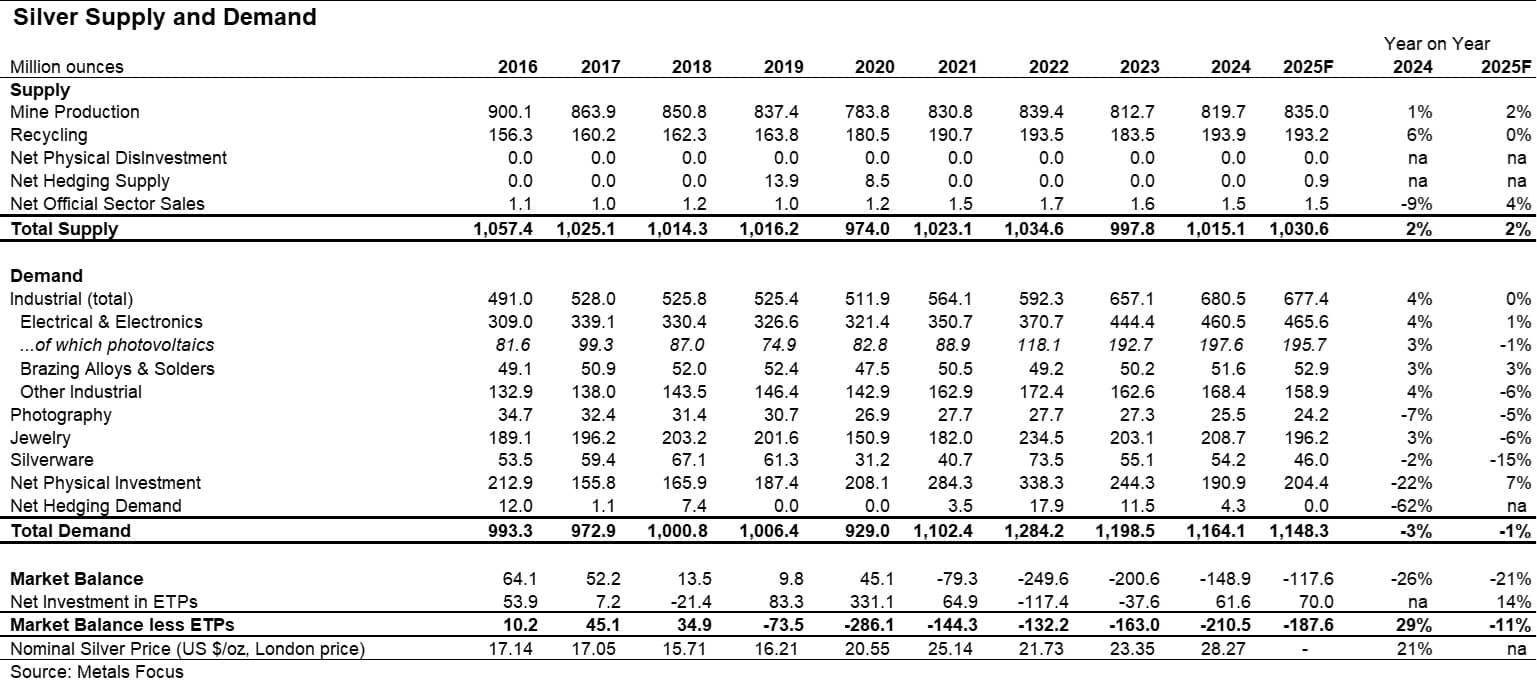

Beyond technology and monetary factors, supply and investment trends could also shape silver’s long-term value.

According to the latest World Silver Survey from the Silver Institute, global silver demand continues to outpace supply — driven by record industrial use and resilient investor interest.

Mine production has slipped slightly in recent years, while demand for silver in solar panels, electric vehicles, and electronics keeps rising.

Many analysts warn of a potential “peak silver” scenario later this decade, as ore grades decline and fewer new mines come online.At the same time, institutional investors — from large asset managers to family offices — are beginning to view silver as an undervalued hedge, increasing allocations to bullion, ETFs, and silver-backed funds.

Could Silver Ever Be More Valuable Than Gold?

Let’s look at the facts.

Why It’s Unlikely Long-Term

- Gold’s monetary stock far exceeds silver’s.

Although global silver mining output is roughly ten times higher than gold’s by weight, the vast majority of silver ever mined has been consumed industrially and is no longer recoverable. Nearly all gold ever mined still exists and can return to the market — making gold’s available supply for monetary use much larger. - Central banks hold gold, not silver.

Gold remains the dominant reserve asset, supporting currencies and financial stability worldwide. Silver hasn’t been used as an official monetary reserve for decades. (Although recent reports show this could be changing). - Gold is easier to store and transport.

Concentrated value (1kg of gold ≈ 80kg of silver) makes gold the preferred metal for central banks and high-net-worth investors.

This structural difference in how each metal circulates through the market is best explained by their contrasting stock-to-flow ratios.

The Stock-to-Flow Ratio: Why Gold Stays the Monetary King

Another key reason gold is unlikely to fall below silver in value lies in its stock-to-flow ratio — a measure comparing the total amount of metal above ground (stock) to the new supply mined each year (flow).

Gold’s ratio is the highest of any element on Earth — roughly 80:1, meaning its available above-ground stock equals about 80 years of current annual production.

Silver’s stock-to-flow ratio is far lower, around 5:1, because much of it is used industrially and not recoverable.

This immense stability makes gold uniquely suited as a monetary metal.

Even if global gold mining doubled (an almost impossible feat), the new flow of gold entering the market would still only increase total supply by about 2–3% per year.

By contrast, silver’s much smaller stockpile relative to its flow means its price can swing more sharply with shifts in industrial demand or mine output.

As Philip Barton of the Gold Standard Institute notes, this enduring stability in gold’s stock-to-flow ratio is one of the clearest reasons gold has always served as money — while silver, though precious, behaves more like a hybrid of monetary and industrial metal.

In any future monetary reset or rebalancing, both metals may rise — but gold’s vastly higher stock-to-flow ratio will likely ensure it retains the higher price.

When It Could Happen Short-Term:

- Extreme demand shock in silver (e.g. solar, EV explosion)

- Suppressed gold price due to government interventions

- Currency collapse triggering a rush to all metals

- Scarcity or mining disruptions in silver supply

Historical Predictions and the Gold-to-Silver Ratio

Over the years, many silver advocates have argued that the gold-to-silver ratio could one day return to its ancient 1-to-1 balance.

A popular 2011 analysis famously listed eleven reasons why silver might someday trade at parity with gold — from dwindling mine supply and rising industrial use to silver’s long history as money.

In that same analysis, the author noted that while the classic monetary ratio historically hovered around 1:16, and the natural mining ratio was closer to 1:10, the market ratio had already soared above 40:1.

Today, with the ratio still near 80:1, the same argument — that silver remains deeply undervalued compared to gold — continues to resonate among silver advocates.

While those earlier forecasts proved overly optimistic, many of the underlying themes remain relevant today: tightening supply, industrial growth, and a persistent imbalance between market price and historical precedent.

(See earlier chart: “Gold/Silver Price Ratio 1687–2024” — illustrating how the modern ratio remains far above historic levels.)

Should You Invest More in Silver Than Gold?

That depends on your goals.

| Goal | Consider |

|---|---|

| Preserve wealth | 🟡 Gold |

| Growth potential | ⚪ Silver |

| Portfolio balance | Mix of both |

| Inflation hedge | Both — but silver may offer more upside in a recovery phase |

Silver is often seen as “gold on steroids” — when precious metals rise, silver tends to outperform gold in percentage terms. But the reverse is true in a downturn.

Tip: Many investors buy gold for stability, and silver for accumulation and potential. Think of it as offensive and defensive assets working together.

What Has to Change for Silver to Overtake Gold?

To see silver worth more than gold, you’d need a fundamental shift in the monetary system. Here’s what that might include:

- Silver becoming accepted by central banks as reserve assets

- Widespread monetary use of silver coins (as in centuries past)

- Gold confiscation or restriction, pushing demand into silver

- Silver becoming scarcer due to industrial consumption outpacing mining

These aren’t impossible — but they’re extreme scenarios.

Final Thoughts: Is Silver Undervalued?

The real question isn’t “Will silver beat gold?”

It’s: “Is silver undervalued right now?”

And the answer, based on history and ratios, seems to be: Yes.If the gold/silver ratio returns to more traditional levels (e.g. 60), and gold stays steady or rises, silver could see major percentage gains.

FAQ: What People Ask ChatGPT (And Us) About Silver vs Gold

Not likely long-term, but short-term events could cause a brief inversion.

Silver is more abundant, more industrial, and less monetarily accepted by institutions.

If you’re looking for upside, silver may offer more value. But gold is more stable.

Industrial demand surge, dollar devaluation, mining shortages, or gold restrictions.

Want Updates on the Gold-to-Silver Ratio?

Subscribe to our Free Daily Price Alert Email

We’ll send you live price charts, commentary, and market-moving news.

Related Articles from Gold Survival Guide:

Editors Note: This post was originally published 5 September 2017. Fully updated 7 October 2025 with latest charts, numbers and supply and demand data.

Pingback: Gold to Silver Ratio Update for 2017: Time to Buy Silver Again - Gold Survival Guide

Pingback: Why is Silver Lagging Gold? - Gold Survival Guide

Pingback: Why Buy Silver? Here's 21 Reasons to Buy Silver Now

Pingback: Bullish Indicator: Large Silver Speculators First Net Short Position in Memory - Gold Survival Guide

Pingback: Should I Buy Gold or Silver? 7 Factors to Consider in Gold vs Silver - Gold Survival Guide

Pingback: Buy Silver in New Zealand

Pingback: When to Buy Gold or Silver: The Ultimate Guide (Updated) - Gold Survival Guide

Pingback: The “Time Price” - Why Gold is Money and Will Continue to Be - Gold Survival Guide

Pingback: What is the Best Type of Gold to Buy For Trading in a Currency Collapse? - Gold Survival Guide

Pingback: Why Fractional Reserve Banking is Not the Problem

Pingback: Gold at New All Time High in NZD - 7 Year High in USD - Gold Survival Guide

Pingback: CoronaVirus Spreads Into Italy - Sharemarkets Plunge - Gold Survival Guide

Pingback: Everything is Falling - Including Gold - Gold Survival Guide

Pingback: Is the New Zealand Economy Worse Off than Others in the OECD? - Gold Survival Guide

Pingback: What Might a BRICS Currency System Mean for NZ? - Gold Survival Guide