One of the most common questions people ask is: “Is now a good time to buy gold in New Zealand?” We have written in our FREE eCourse (which you can access here) how the time to buy is on dips not when the gold price is reaching or close to reaching new highs.

So what is the gold price doing now? Has the priced dipped? If so, does that make it a good time to buy gold now in 2023? Is there anything else to consider? Read on to find out…

Table of Contents

Estimated reading time: 8 minutes

NZ Dollar Gold Price Has Corrected – Good Time to Buy?

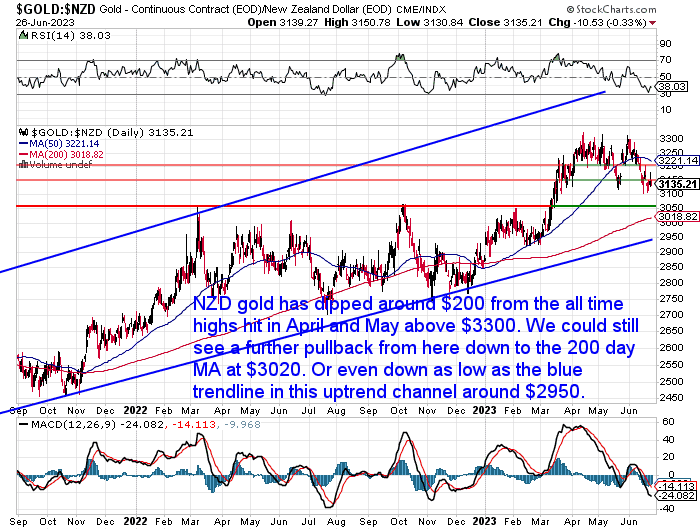

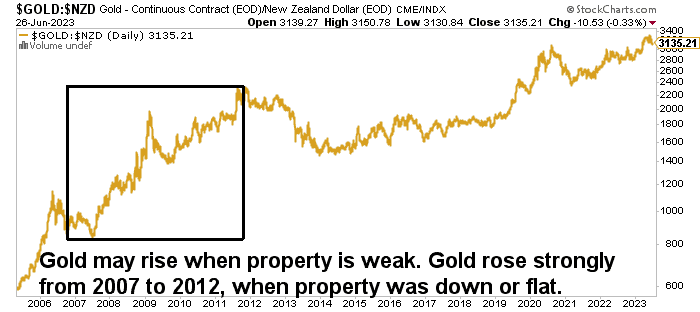

Below is a chart of gold priced in New Zealand Dollars.

In April of 2023, NZD gold reached a new all time high at $3,300. It touched this level again in late May. So you may be thinking after such a strong rise, now can’t be a good time to buy can it?

However, during the month of June the price has pulled back, dropping below the 50 day moving average (MA). Recently getting as low as $3,100 per ounce. It is up just a little from them right now. It would not be a surprise to see gold dip down a little further still. Maybe to the 2022 highs at $3050. Or just below that is the 200 day moving average (MA) at $3020. There is even a chance it could dip as low as the blue uptrend line in the uptrend channel currently around $2950.

So any further pullback from current levels could be one of those “buy the dip” opportunities.

>> Related: Why You Should Ignore the USD Gold Price When Buying in New Zealand

Longer Term – The Trend is Also Up

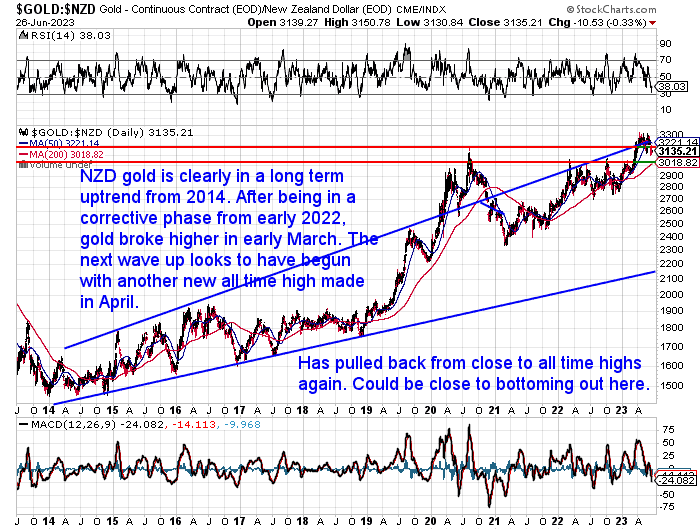

Also the “trend is our friend”. Longer term we can see the gold price has been rising steadily since 2014 (see the lower rising trend line in blue).

The shorter term chart above may make it seem like gold has only been rising for a couple of years. However, zoom out to a longer 10 year chart and gold is clearly in a long term uptrend.

The breakout in 2020 brought with it a new all time high. From August 2020 through to March 2021 gold underwent a steep correction. From there through until March of 2022 gold staged a comeback. Then for the next year gold was in a corrective phase. But in March 2023 gold broke out and headed to a new all time high. So this move higher indicates the next wave up has likely begun. Once the current correction is over we will likely see NZD gold head back towards $3,300 and beyond.

Other Indicators Showing Now is a Good Time to Buy Gold

Property and Stock Markets Are in a Downtrend

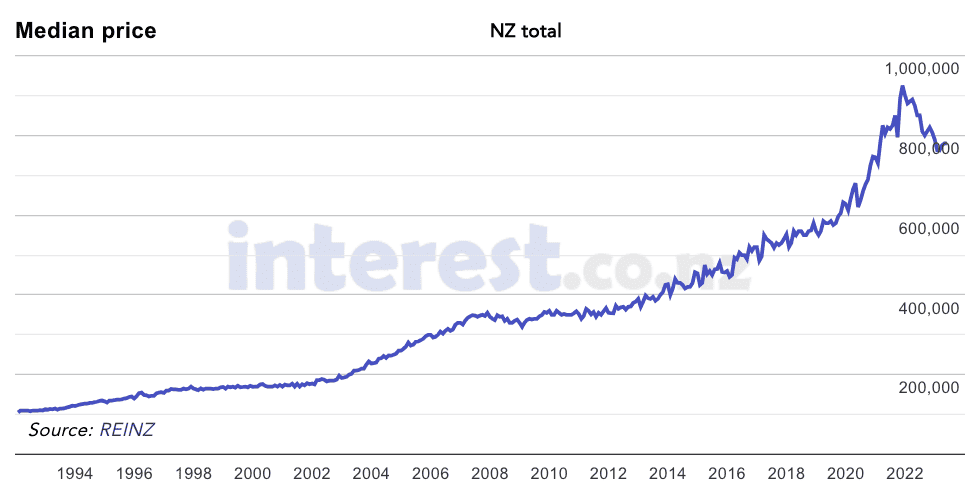

Record low interest rates and currency printing during Covid lockdowns stoked record high prices in NZ Real estate. But prices have been falling since the median New Zealand house price topped out in November 2021.

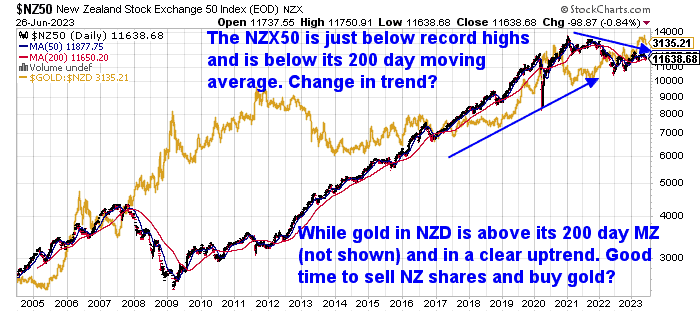

While the New Zealand share market has moved down from the all time high it set at the very start of 2021. The NZX50 has been rising since the middle of 2022. However there is a good chance this is just a bounce back in what ends up being a longer term downtrend.

Gold is a “non-correlated asset”. So often performs better when other assets such as shares and real estate are doing badly. This is exactly what happened from 2007 to 2012, when NZ housing was down or flat at best.

That likely makes now a good time to buy with real estate peaking in late 2021. Gold could be at the start of the next significant multi-year up-cycle. For more on gold vs property see: NZ Housing to Gold Ratio

>> Learn more: Why Gold Bullion is Your Financial Insurance

Seasonality: Closing in on the Time of Year When Gold Often Rises

Gold often bottoms during the middle of the year. Then rises through to year end. So the recent pullback could make this time of the year a good time to buy gold, before what is often the next move higher. See the link below for more detail on gold seasonality:

>> Learn more:Does Gold Seasonality Affect the NZ Dollar Gold Price?

Gold Sentiment – Most Negative Since February

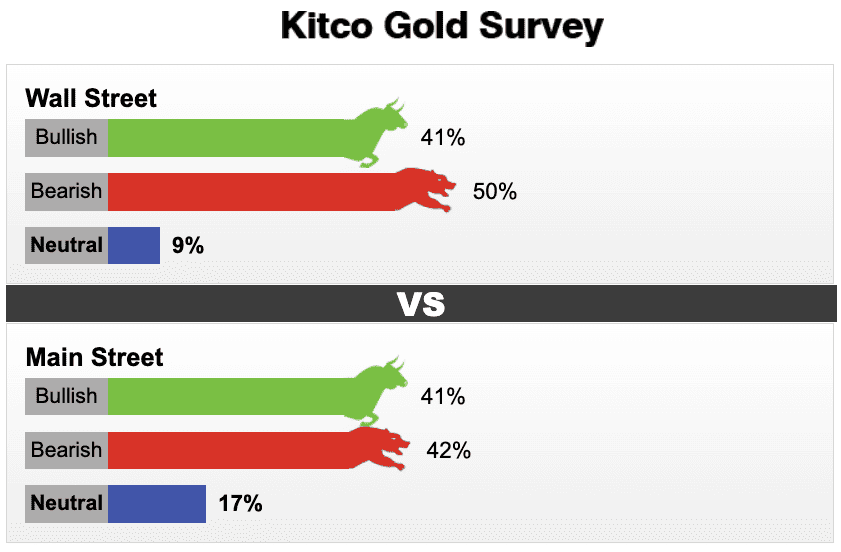

The latest Kitco News Weekly Gold Survey shifted into bearish mode for both Wall Street analysts and Main Street retail investors.

“This week, 22 Wall Street analysts participated in the Kitco News Gold Survey. Among the participants, 11 analysts, or 50%, were bearish on gold in the near term. At the same time, nine analysts, or 41%, were bullish for next week and two analysts, or 9%, saw prices trading sideways.

Meanwhile, 966 votes were cast in online polls. Of these, 395 respondents, or 41%, looked for gold to rise next week. Another 403, or 42%, said it would be lower, while 168 voters, or 17%, were neutral in the near term.”

Source.

Among the retail investors surveyed, bearish sentiment is at its highest level since mid February. Of note back then gold bottomed soon after at the end of February. So could this negative sentiment be a sign that gold is not far from turning back up?

Next Wave Up May Have Begun

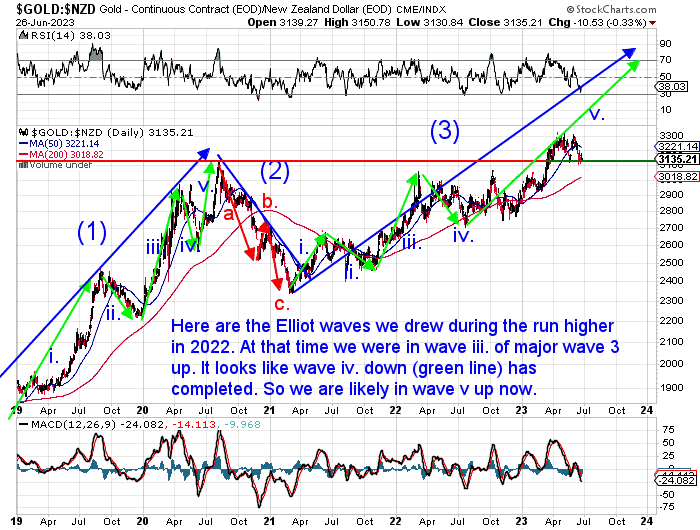

Below is a long term gold chart with what are known as Elliot waves drawn on it.

We actually drew these green lines on the chart back in the first quarter of 2022, when we thought we were overdue for a correction. That proved to be a pretty good guess. With a correction arriving soon after.

Our guess is that the down wave (iv) has now come to an end. Not only that but we are now into the next wave (v) up.

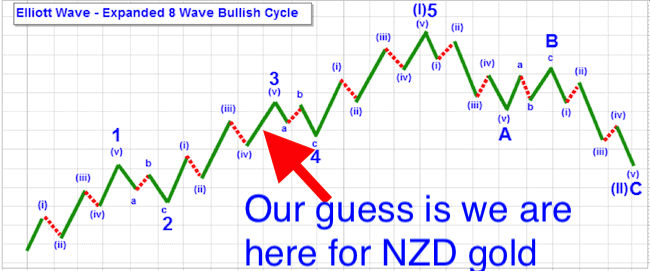

For a quick intro (or refresher) on Elliott wave theory, it contains 5 major waves. Up, down, up, down, up. Then 3 correction waves, down, up, down. Then within these major waves up are also 5 minor waves. So it is the minor wave (iv) down that was completed in July 2022. So wave (v) up will likely take gold to significantly higher new all time highs.

You can read a whole lot more about Elliott wave theory at this very well written stockcharts post.

Here is their example of a bullish cycle.

All These Factors Point to This Being A Good Time to Buy Gold

If you buy gold in New Zealand dollars now we don’t think you’ll regret this in the years to come. Gold certainly looks to be in a new bull market. There may be a bit more of a dip still to come but we are likely closer to the bottom than the top in this correction. Odds favour using any dip lower as a buying opportunity.

Many experts recommend a minimum of 5-15% of your assets should be allocated to physical gold. We also discuss this in more detail in our Free eCourse.

>> Read more:When to Buy Gold or Silver: The Ultimate Guide

NOTE: You can go to our Gold Prices page to see the very latest Silver and Gold prices in both NZ and US Dollars along with their respective gold charts.

Or head to our online shop to buy gold today.

If you need more information on the process of how to buy gold see: How to Buy and Invest in Gold and Silver >>

Editor’s note: this blog post was published in August 2018. Last updated 27 June 2023 with new charts and updated numbers and reasons.

Pingback: Why Buy Gold? Here's 14 Reasons to Buy Gold Now

Pingback: Dow Gold Ratio: How Does Gold Compare to Shares For the Past 100 Years? - Gold Survival Guide

Pingback: NZ Dollar Falls - Why is the NZ Dollar Weaker and Where to Now? - Gold Survival Guide

Pingback: Buying Precious Metals: Common Questions from First Time Buyers

Pingback: Are the Federal Reserve’s “Temporary” Money Injections Becoming Permanent? - Gold Survival Guide

Pingback: Central Bank: "If The Entire System Collapses, Gold Will Be Needed To Start Over" - Gold Survival Guide

Hi, Are the gold coin prices you advertise include gst?

Regards Thomas.

The gold coins we sell do not have GST on them as they are 99.9% or 99.99% pure.

See this post for more: https://goldsurvivalguide.co.nz/gold-purity-silver-purity/#h-gst-on-gold-and-silver-in-new-zealand-depends-on-the-purity

It’s important to be aware that some very well known coins are not GST exempt in New Zealand due to their purity being less than 99.5% pure gold.

So when these types of coins are purchased in New Zealand they will cost 15% more than other gold bullion coins that are 99.99% pure. Because GST is added to the sale price.

For example:

The South African Krugerrand – 22 Carat or 91.67% Pure

The American Gold Eagle – 22 Carat or 91.67% Pure

The British Gold Sovereign – 22 Carat or 91.67% Pure

Pingback: Website Visitors: Another Contrarian Buying Indicator - Gold Survival Guide

Pingback: How Much Might Gold Fall in the Next Crash? - Gold Survival Guide

Pingback: Ray Dalio: Great Disorder is Coming - Gold Survival Guide