This article explores the fascinating world of historical cycles, outlining a potential timeline for when gold and silver might culminate their current growth phase and reach full valuation. It also looks at property cycles to see how these might interact and compare to precious metals cycles.

This article covers:

Estimated reading time: 10 minutes

Where in the Real Estate Cycle are New Zealand House Prices?

The concept of long term cycles and how history at least rhymes, if not repeats, is a topic we find really interesting. Even if it is somewhat hard to explain exactly why these cycles repeat.

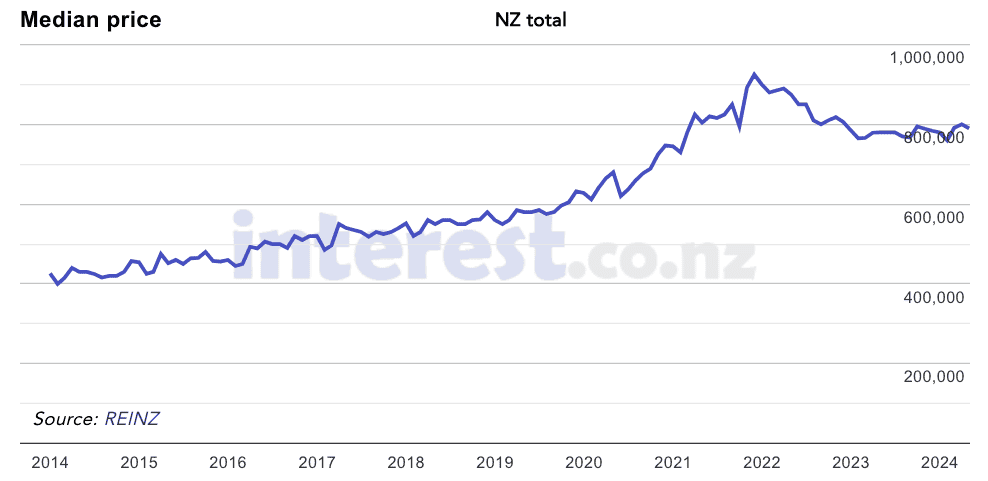

So where are New Zealand house prices currently at in their longer term cycle?

Source. Interest.co.nz

After a small dip following the COVID19 lockdowns in 2020, it was off to the races again for residential real estate in New Zealand. Record low interest rates, coupled with government wage subsidies and the RBNZ quantitative easing boosted house prices significantly higher over the next 2 years. With the New Zealand median house price peaking at $925,000 in November 2021. Then, for the past year or so, prices have been creeping sideways, but have possibly bottomed out.

So it looks as if NZ real estate prices are in a phase of sideways movement or slow growth.

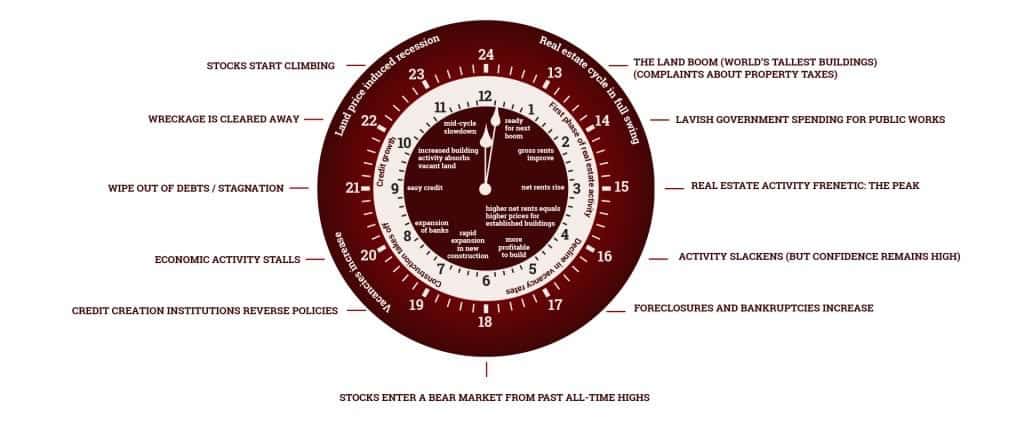

The 18 Year Real Estate Cycle or “Property Clock”

In a 2017 article, we talked about the possibility of a “mega bubble” to come. This “mega bubble” fits with the interesting ideas of Australian Phil Anderson. He has an 18 year real estate cycle or “property clock”. He writes:

“One of the major topics I’ve spent studying over the last thirty years is what I call the 18 year real estate cycle. It’s a regular pattern that’s repeated throughout over 200 years of US history, and even longer in the UK.

This makes the economy a lot more predictable than most people assume. It also gives you incredible insight into which sectors you should be trading.

It gives you a valuable timing guide when to be in and out of asset markets. I was 100% in cash during the GFC thanks to this pattern.

US real estate bottomed out in 2011. Real estate cycle history suggests we’ll get an overall 14-year up move in US real estate until around 2024/5. Then we’ll get another collapse around 2026 like 2008. The boom-bust cycle comes from the property market.

I can tell you one thing. The real estate cycle continues to turn. It’s all happening right before our eyes, and as per my Cycles, Trends and Forecasts property clock.”

Phil Anderson’s cycles work stems from the idea that all economic progress is capitalised into land values. Any technological gain increases the price of land, rather than actually leading to increased standards of living for everyone. As does any infrastructure improvements.

It’s what is called the “economic rent”. Which we all pay through higher land and therefore housing prices. Interesting stuff taken mainly from an old guy from the 1800’s by the name of David Ricardo. While his ideas in cycles are from another not quite so – but still old – guy, W.D. Gann.

So to summarise this 18 year property clock cycle it is:

- 7 good years

- 1 negative year

- 7 good years

- 3.5 negative years

Therefore the current cycle would be:

- Negative years (3.5 down) 2008 (GFC) + 3.5 = late 2011

- Growth years (7 up or sideways) 2011 + 7 = 2018

- Negative Year (1 down) 2018 +1 = 2019

- Growth years (7 up or sideways) 2019 + 7 = 2026

- Next big crash (3.5 down) 2026 + 3.5 = 2030

This cycle is for the USA. With the idea being that generally the USA leads the rest of the world.

Of course you’ll also find plenty arguing against this theory. Here’s someone arguing the real estate clock does not work in Australia: The 18 Year Real Estate Clock Myth

But as this cycle is based upon the US economy, it acts more as a guide. Different parts of the world will rise more than others. Therefore they will fall at slightly different times too. But he argues the US still remains the main driver of the cycle.

To us it seems like the massive government intervention during COVID19 may have boosted things higher earlier in the 7 year up or sideways cycle. So perhaps property prices will rise from here through to 2026?

Gold Cycles

Next let’s take a look at gold cycles and see how the current cycle in gold and silver compares to the previous 1970s bull market.

The 1970’s Gold Bull Market Cycle

The 1970’s gold bull market ran from 1970 to 1980. This saw the gold price rise from 1970 through until 1974. Then there was a correction that lasted almost 2 years. Before gold then powered higher for the remainder of the decade.

The Gold Bull Market Cycle Since 2000

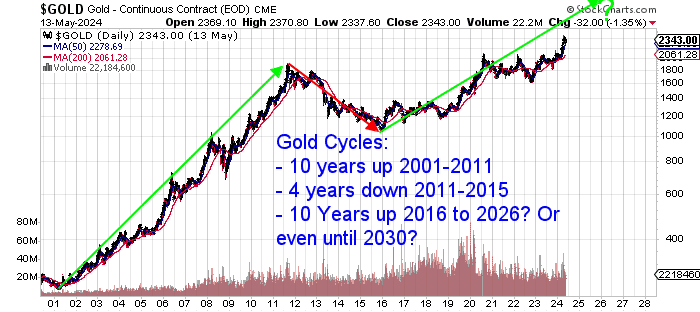

Compare the 70’s to the current gold bull market cycle and there are some interesting similarities.

- The current bull market has been roughly double that of the 1970’s in terms of time.

- It saw a rise from 2001 to 2011. This was 10 years or roughly double the 4 year rise of the early 1970’s.

- Then the correction from 2011 to late 2015 lasted just over 4 years. Again around double the 1970’s almost 2 year correction.

Now look at the rises in percentage terms.

From the 2001 low up until June 2019, gold had risen about 560% ($250 to $1400). Comparing this to the 1970’s, this is similar to the rise up until 1977.

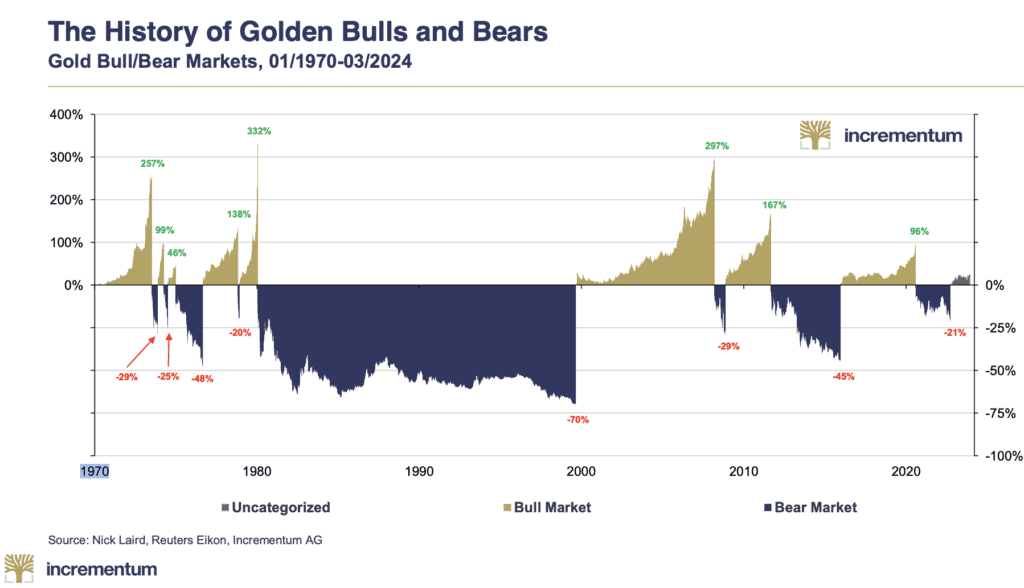

Gold Cycles: Gold Bull and Bear Markets 1970 to 2024

Ronni Stoeferle of Incrementums recent 2024 Chartbook featured an excellent chart comparing the smaller individual waves up and down in gold (bull and bear markets) from 1970 until today.

See the full Preview Chartbook – In Gold We Trust report 2024.

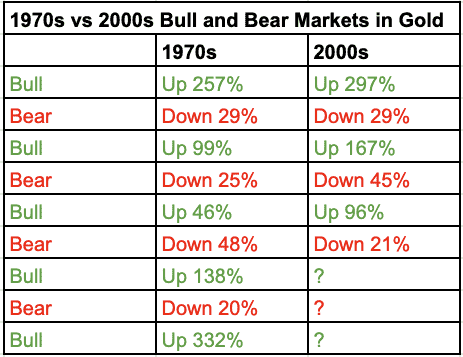

The 2000s bull and bear markets in gold look very similar in occurence and size to that of the 1970’s. Below is a table directly comparing each of the bull and bear moves in gold in the 1970s to the corresponding wave in the 2000s.

The 1970s had 5 ups and 4 downs. So far in the 2000s we’ve had 3 ups and 3 downs. Interestingly the 3 ups have been larger percentages than their corresponding bull markets in the 1970s. So if there are 2 bull or up stages left and they are also bigger than the 1970s last 2 waves up, then the moves will be in excess of 138% and 332%!

When Will Gold and Silver Reach their Peak Valuations?

We don’t think it’s too over the top to assume that there is still another leg (or maybe 2?) higher to come in this gold and silver cycle. If precious metals follow a similar script to the 1970’s, that could mean at least 5 or so years of higher prices to come for gold.

Where Might the Gold Price End Up at the End of This Cycle?

Gold began the 1970s at US$35 an ounce. It reached US$850 in 1980. So an increase of almost 25 times.

Whereas gold began the current bull market cycle at US$250 an ounce. A 25-fold increase would give us an eventual target of US$6,250.

However the final “price” will likely depend on just how many new currency units (dollars, pounds, euros, reminbi) are created in the next number of years. With the way things are going, this next leg of the gold bull market could make the later half of the 1970’s pale in comparison.

Read more: How Do You Value Gold | What Price Could it Reach?

The 18 Year Property Cycle and the Current Precious Metals Cycle

How does the current 18 year property cycle gel with our thoughts on the possible current precious metals cycle we are in?

As explained above the current gold bull market has looked like this:

- 10 years up 2001 to 2011

- 4 years down 2011 to 2015

- Still in progress: 10 Years up 2016 to 2026? Or even longer to 2030?

This would line up with Phil Anderson’s projected mega peak in property around 2026 and the mega crash/crisis to follow through to around 2030. Although this will likely be on an even bigger scale than the 2008 crisis. Why? Because there will be much more debt required to inflate property all the way until 2026!

But if there is a mega crash/crisis that runs through until around 2030, Gold could quite likely then reach peak valuation against property around 2030. As property prices would be correcting in this 2026-2030 period, we might expect gold to continue to rise during such a correction like it did post 2008. So this final leg up in gold might last even longer than 10 years.

Or perhaps a gold revaluation (See: Does a Gold Revaluation to US$10,000 With All Major Countries Make Sense?) or remonetisation of gold could cause gold to remain at heightened levels rather than falling after 2030?

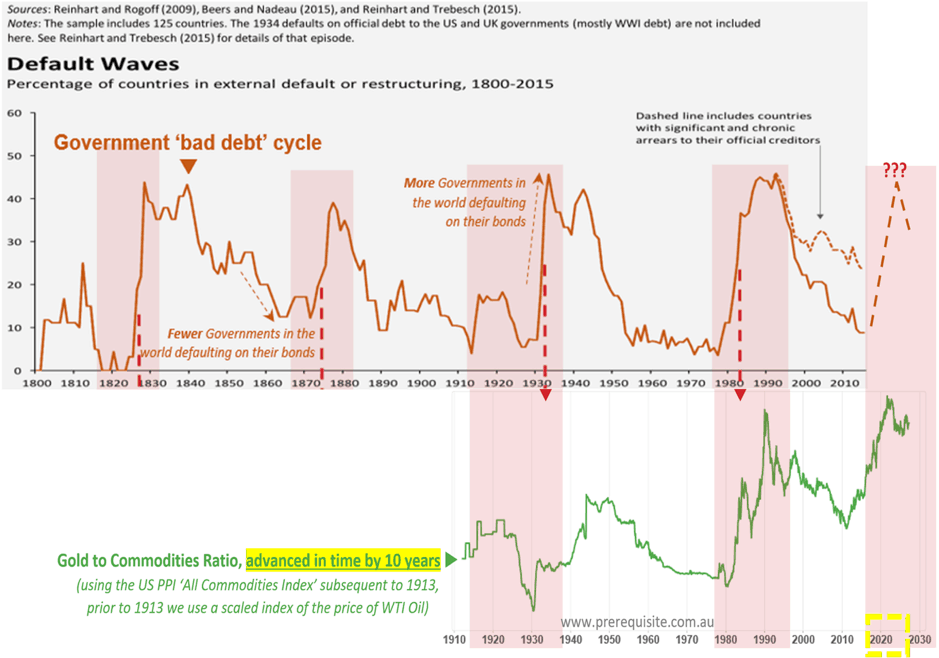

Sovereign Default Cycles and Gold

Here’s another very interesting comparison that shows a similar timescale for a coming sovereign default crisis. We received this in an email from Kerry Stevenson who runs the Gold and Alternative Investments Conference (GAIC) in Australia. An event we’ve attended many times over the years.

Daniel Want was a keynote presenter at the 2019 GAIC. His presentation was on “The Next Sovereign Default Cycle”.

His “Sovereign Default Cycle” peak in the “mid 2020s” correlates very closely in timing to the property and gold peaks we’ve already discussed:

In our upcoming Presentation we are going to try to anticipate the timeframes we may be looking at for the peaks of two key cycles, the first being the private-sector asset impairment cycle, the second being the broader sovereign-default cycle.

When thinking about how we might gain some ‘leading cyclical insight’ into the Global Sovereign Default Cycle (using Reinhart & Rogoff’s chart below), we realised at a first-principles level that ‘in theory’ conditions that give rise to Sovereign Default Risks are reasonably observable by many different participants well in advance of any actual Sovereign Default occurring for a country.

Therefore, somewhat in keeping with Exter’s inverted pyramid capital flow theory, you should be able to see money start progressively heading for the safety of Gold ahead of when the Sovereign Defaults started to manifest themselves. [GSG Editors note: Are we starting to see this already with more and more central banks adding to the gold reserves?]

When we had a look at the data (by ‘deflating’ Gold by Commodity prices thereby seeing the ‘real demand’ or ‘real price’ of Gold) it was no surprise to see almost a near-perfect 10 year leading relationship of the ratio of Gold to Commodities (see green line in below chart).

This mode of analysis would suggest the next Global Sovereign Default Cycle is likely to peak in the early to mid 2020s roughly*.

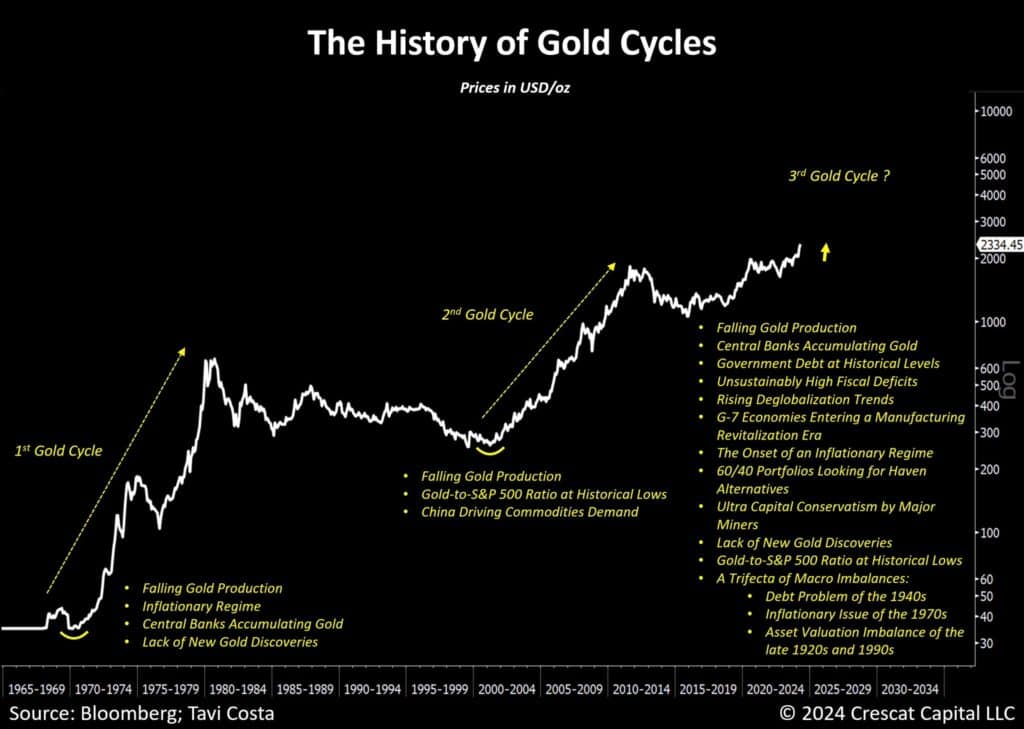

The Third Gold Cycle Up – Bigger Than the Previous Two?

Here’s a couple of recent charts, that show we are likely at the start of the third major up wave in gold since the 19070s. First from Tavi Costa of Crescat Capital, this chart lists the similarities between this 3rd gold cycle to both of the previous two. However, the current cycle also has many other factors driving it, some of which are similar to the 1920s, 1940s and 1990s. So perhaps this up cycle will be even larger than the last 2?

“We could witness gold prices soaring to unprecedented “stupid” levels in the coming decade, as these long-term imbalances inevitably exert significant upward pressure on the metal.”

Tavi Costa

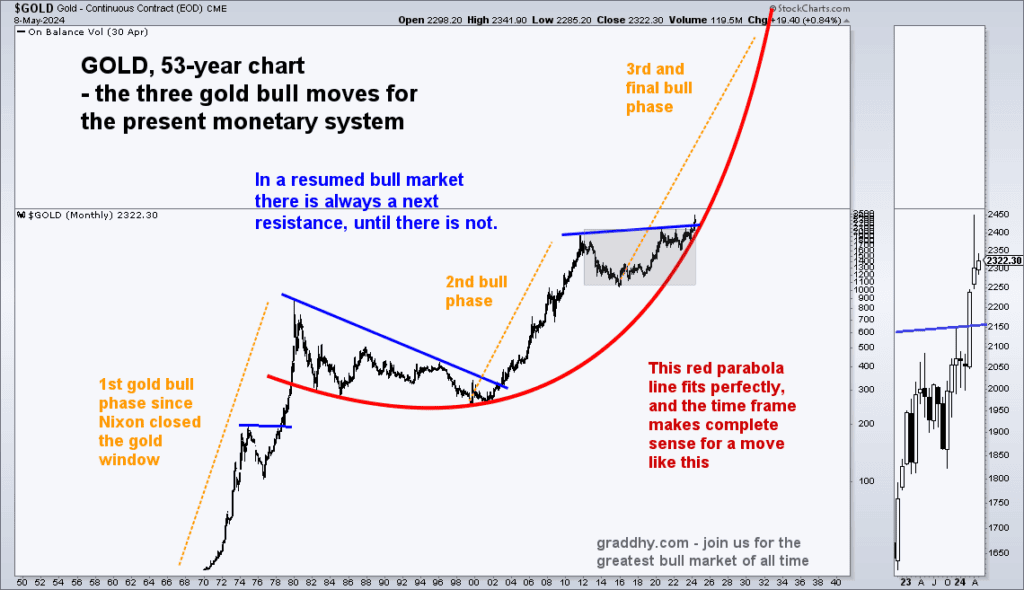

Next up is Graddhy out of Sweden who says:

“$GOLD This very simple chart WILL play out.

Doubting this will be the biggest mistake in your lifetime.”

His projected timing for the completion of this third and final bull phase also seems to align with around 2030.

Prepare for a Repeat of the 1970’s?

If indeed the coming 5 or 6 years rhymes with the later half of the 1970’s, we could see stagflation push property prices up. But, at the same time, also push precious metals prices higher. This is exactly what happened in the 1970’s. However gold and silver actually rose more in comparison to property.

See the NZ Housing to Gold Ratio for more on this topic: NZ Housing to Gold Ratio

Predictions based on cycles have some merit, given that it is human nature to repeat the same mistakes. But of course there are no guarantees.

Interestingly now seems to have a lot in common with just after the mid 1970’s when stagflaton really started to arrive. Learn more: Could Stagflation Happen Again?

If we see a repeat that would make now a very good time to take a position in gold and silver. It would also make it a good time to diversify to some extent out of property. Particularly here in New Zealand where the previous price rises have been some of the largest in the world.

Go here to see what precious metals products are available: Buy Gold and Silver Bullion

You might also want to check out: How Does Gold Compare to Shares For the Past 100 Years?

Or: Silver Cycles and War Cycles

Editors Note: This article was first published on 7 November 2017. Updated 3 October 2018 to include latest Auckland and New Zealand house price charts and 2001 to 2018 gold cycle chart. Last updated 14 May 2024 with latest numbers and charts.

Pingback: The Next Great Bull Market in Gold Has Begun - Gold Survival Guide

Pingback: Share Market Plunge - How is New Zealand Affected and What's Next? - Gold Survival Guide

Pingback: The Yield Curve Recession Predictor: Impact on Gold? - Gold Survival Guide

Pingback: The Next Gold Bull Market Looms - Gold Survival Guide

Pingback: What to Do With Your Money When Doom Awaits - Asset Allocation - Gold Survival Guide

Pingback: Where Are We in the Psychology of the Silver Market Cycle? - Gold Survival Guide

Pingback: Massive 5% Rise in NZ Gold This Week - Gold Survival Guide

Pingback: Central Bank: "If The Entire System Collapses, Gold Will Be Needed To Start Over" - Gold Survival Guide

Pingback: Why Buy Gold? Here's 15 Reasons to Buy Gold Now

Pingback: Will This Coming Decade Resemble the 1970’s? - Gold Survival Guide

Pingback: The Fourth Turning and Gold: What’s Still to Come in This Crisis? - Gold Survival Guide

Pingback: NZ Housing to Gold Ratio 1962 - 2019: Measuring House Prices in Gold

Pingback: Record Gold Imports into New Zealand as Investors Seek Haven - Gold Survival Guide

Pingback: When Did New Zealand Switch to Fiat Currency? How Has the New Zealand Monetary System Changed Over the Past Century? - Gold Survival Guide

Pingback: Reader Question: Will New Zealand Property Prices Ever Fall? - Gold Survival Guide

Pingback: What Price Could Silver Reach? - Gold Survival Guide

Pingback: Another Sovereign Wealth Fund (Already) Bought Gold - Gold Survival Guide