There continues to be much discussion about how much higher interest rates will go. Such as whether or not the Reserve bank of New Zealand is close to pausing on its interest rate increases? However, today you’ll see why it is the real interest rate that we need to keep track of…

Table of Contents

- How Do Real Interest Rates Differ From the Overnight Cash Rate (OCR) that the Reserve Bank Fiddles With?

- Why is the “After Inflation” Interest Rate So Important?

- So What is the Real Interest Rate in New Zealand Currently?

- How do you Calculate the Real Interest Rate?

- The Relationship Between Gold and Real Interest Rates

- But What if We Get Higher Inflation and So Interest Rates Start to Rise?

- Where to Next for Real Interest Rates in New Zealand?

Estimated reading time: 9 minutes

Interest Rates in New Zealand have risen sharply off the historic lows they were at up until September 2021. Although the increases over the past year have only taken the Official Cash Rate (OCR) up to the level it was at in 2015. See chart below.

What will the Reserve Bank of New Zealand do in coming months? Are rates likely heading even higher? Or will the next move by the New Zealand central bank be to pause and look at the effects or the rate increases so far?

Our guess is whatever the central bank does will be either too early or too late. As that is what happens when you have a bunch of old men trying to decide on the price of money instead of the markets.

However, obviously the interest rate has a bearing for those New Zealanders with a mortgage and businesses with loans. But rather than focussing on the central bank announcement every quarter, we think there is a much more important interest rate to keep an eye on.

That is, what is the current “Real Interest Rate” in New Zealand?

How Do Real Interest Rates Differ From the Overnight Cash Rate (OCR) that the Reserve Bank Fiddles With?

What are real interest rates?

The real interest rate is the nominal interest rate, less the current rate of inflation.

The nominal interest rate simply refers to the quoted interest rate on the likes of a government bond or central bank set interest rate. The current rate of inflation is shown by the government consumer price index (CPI).

Why is the “After Inflation” Interest Rate So Important?

Why is this so important?

Because it shows you what return you are getting on your money after inflation. When this number gets below 2% and in particular below zero (also known then as a Negative Real Interest Rate) this is when it is an especially good time to hold gold.

Why is that?

Because when interest rates are very low, there is then no “opportunity cost” in holding gold. This simply means you are not missing out on returns elsewhere – such as interest in a bank account.

As the gold haters like to remind you, gold pays you no interest. But when the bank pays you no interest (or next to none) it makes sense to swap your cash for gold instead. Because in this kind of environment, you stand a much better chance of maintaining your wealth and your purchasing power with gold.

Likewise, even when nominal interest rates are higher, if inflation rates are higher still, you are also getting no return after inflation.

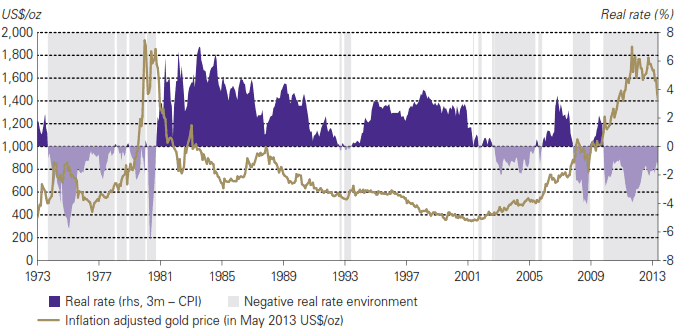

The chart below shows this relationship between US real interest rates and the gold price in US Dollars..

Source: gold.org

So What is the Real Interest Rate in New Zealand Currently?

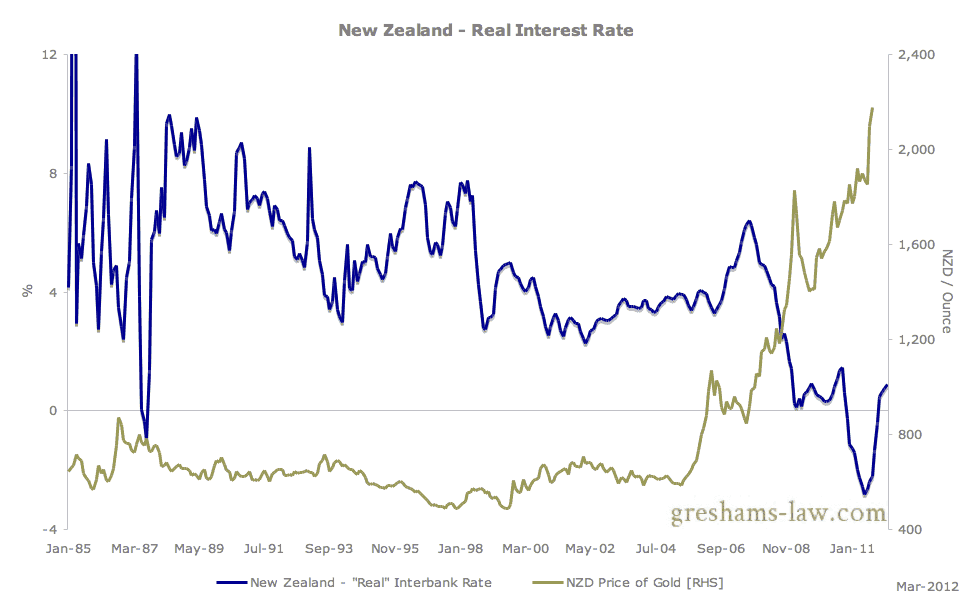

Previously we were able to simply refer to the excellent charts available on Greshams-law.com. These had the benefit of plotting real interest rates in various countries including New Zealand. Unfortunately that site no longer seems to be running. So the most up to date chart we have from them only runs until 2012:

How do you Calculate the Real Interest Rate?

The definition from Greshams-Law.com for ‘real’ interest rates, was the short-term inter-bank rate minus the year-on-year growth in the consumer price index. The CPI rate comes from the OECD statistics. Therefore this data is only as good as each government CPI measure, which likely means inflation is actually higher than this!

For more on this see: Comparing NZ Money Supply, Government Inflation Statistics, Property Prices, and Gold Prices for the Last 19 Years

Sometimes we see other measures such as a 3 month bond or even a longer dated bond, such as a year, used. These will of course usually give a slightly higher interest rate than the interbank lending rates which are an overnight rate.

However the difference is not too significant. Right now it is only 0.78% between the interbank lending rate and the 90 day Bank Bill Rate in New Zealand (Source). The important thing we are looking for in analysing real interest rates is the direction they are heading – the trend.

So we’ll stick with the interbank rate. It also has the advantage of going a long way back compared to some New Zealand government bond data.

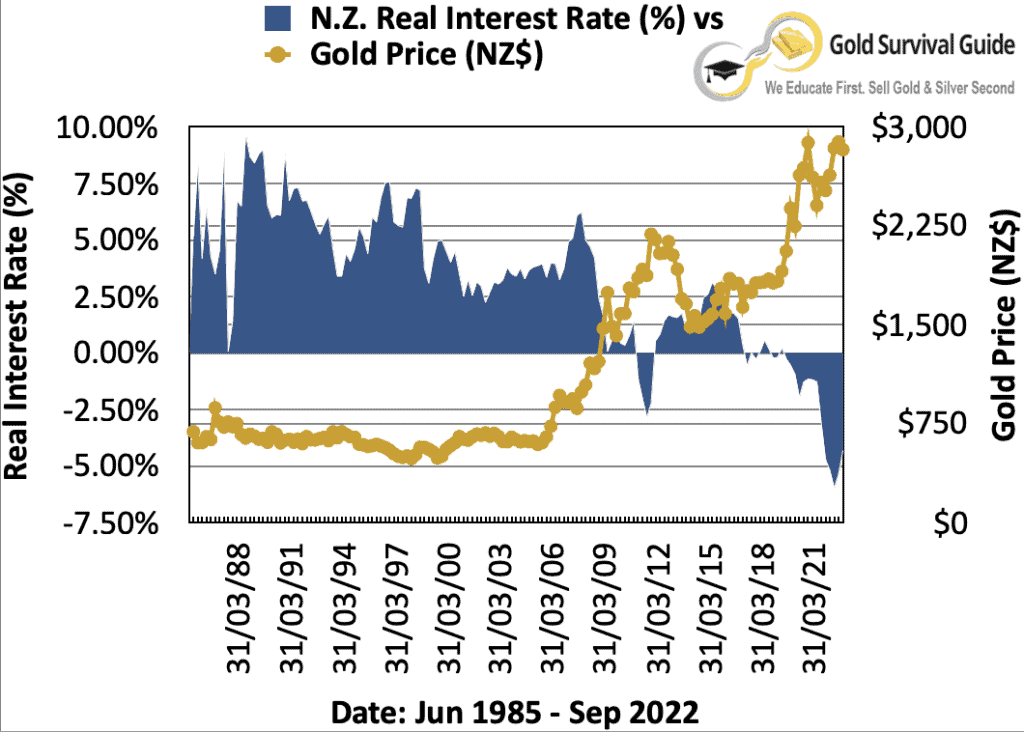

The below chart shows real interest rates along with the local New Zealand Dollar gold price each quarter. (A reminder, real interest rates are the interbank lending rate, less the change in the Consumer Price Index (CPI) from a year prior). Our chart only goes back to 1985. As that is as far as the RBNZ monthly data on wholesale interest rates goes. The latest CPI data available is for the September Quarter. So the chart runs until September 2022.

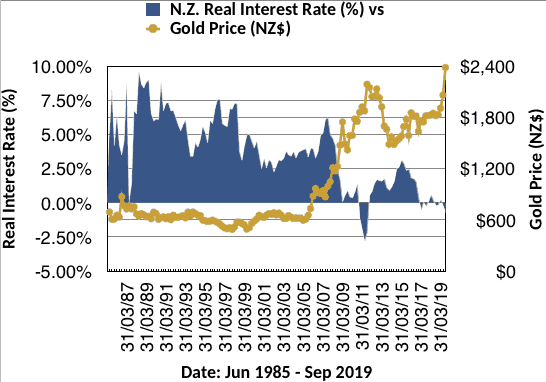

Here is the chart as of September 2019 to show how much more negative rates have become in the past 3 years since then.

Source: RBNZ, Stats NZ, World Gold Council

The Relationship Between Gold and Real Interest Rates

To our eye there appears to be a pretty solid inverse relationship between real interest rates and the gold price in New Zealand dollars.

Throughout the 1980’s and 90’s the gold price was fairly flat or down, as real interest rates remained high. Averaging perhaps around 5%.

In the early 2000’s gold started to rise as real interest rates moved down towards 2.5%. Then they fell sharply, first down to zero and then even lower to -2.50%. This was when the NZD gold price really moved higher. Going from under $1000 to peak at over $2100 in 2011.

But then the “after inflation interest rate” started to head higher. During this time gold was correcting lower. In 2015 the real interest got back briefly above 3% before turning lower. This is also about the time when the NZD gold price also started to resumed its upwards trend.

Since then the inverse relationship has continued.

You can see that over the past few years, the NZ dollar gold price has been trending up, while real interest rates have been trending down. This is the very relationship we discussed earlier. That is, when real interest rates are negative – or close to it – gold generally performs well as there is no opportunity cost in holding gold.

Real interest rates once again dipped into negative territory in recent years. In 2020 they went even more negative. While gold in NZ Dollars hit a new record high over $3000.

Are you already worrying about low returns in the bank? These numbers show they are already negative, especially once withholding tax is taken into account.

But What if We Get Higher Inflation and So Interest Rates Start to Rise?

The talk from economists has over the past year suddenly switched to how much higher interest rates could go. (They keep revising up their expected interest rate peaks).

This is what happened in the 1970’s – interest rates were very high, in the teens in fact. But inflation was even higher and so gold was rising while nominal interest rates were rising. But in fact real interest rates remained negative.

So ignore any comment about how rising interest rates are bad for gold as it is the Real Interest Rate that matters.

Where to Next for Real Interest Rates in New Zealand?

In recent months we have seen the gold price falling or going sideways, along with real interest rates getting less negative. They have dropped from a high of almost -6% in March 2022 to -4.3% in September. This has prompted some to think the bull run in gold is over.

However we’d say this a bit premature.

Why?

It seems unlikely that the OCR will be lifted high enough to return inflation to a level less than the level of current interest rates. At the end of the inflationary 1970’s it took interest rates being held at 3% higher than inflation to get the inflation genie back in the bottle. And this continued for many years not just months.

If central banks were to attempt this we’d see more than just a recession or slow down. With current dept levels there’d likely be a massive crash in many markets: Real Estate, stock markets, and bond markets. There are already warnings in bonds markets. See this excellent post for why a crash in bond markets could be likely.

So we’d guess it’s much more likely that central bankers will put up with a long period of high inflation rather than risk a huge crash. We’d expect them to cut interest rates and even revert to more currency printing. Thus likely stoking a second wave of inflation.

Therefore this current turn up in real interest rates could just be temporary before we see a “double dip”.

We’d say it makes sense to keep an eye on this chart. In the long run real interest rates may get even more negative than they have been.

So it’s likely that gold in NZD will remain the place to be while this is going on. While it might not be a straight line higher, we think there will be much higher gold prices in New Zealand dollars to come yet. Have you bought gold yet? Check the range of gold and silver to buy here.

Be sure to sign up to our weekly article updates below. We’ll keep you informed on topics like this relevant to the New Zealand buyer of gold.

Editors Note: This article was first published 8 May 2012. Last updated 8 November 2022 to include all new charts with latest New Zealand data. Plus new commentary.

Pingback: Kiwi Dollar Takes a Dive and Helps Out Precious Metals | Gold Prices | Gold Investing Guide

Pingback: Gold, Silver and NZ Dollar Exchange Rates: Another Reader Question | Gold Prices | Gold Investing Guide

Pingback: What is Causing the Falling NZD Gold Price? | Gold Prices | Gold Investing Guide

Pingback: 3 Gold Myths - Gold Prices | Gold Investing Guide - Gold Prices | Gold Investing Guide

Pingback: Why Buy Gold? Here's 14 Reasons to Buy Gold Now

Pingback: Bank Economists Change Their Tune - Again - Gold Survival Guide

Pingback: Could Negative Interest Rates Be in Store for New Zealand? - Gold Survival Guide

Pingback: Latest on Real Interest Rates in NZ and Their Relationship to Gold

Pingback: Real Interest Rates Getting Negative - Inflation Also Rising in NZ - Gold Survival Guide

Pingback: The Biggest Take-Away From this Years LBMA Event in China - Gold Survival Guide

Pingback: Does Gold and Silver Need to be Assayed When You Sell It? - Gold Survival Guide

Pingback: What Might Support the Gold Price in 2020? - Gold Survival Guide

Pingback: Gold Confiscation - Could it happen in New Zealand?

Pingback: What Would Negative Interest Rates Mean for New Zealand? - Gold Survival Guide

Pingback: When Will You Know It's Time to Sell Gold?

Pingback: Lower the Odds of the Theft of Your Gold and Silver - Gold Survival Guide

Pingback: Gold Can Benefit From Both a Crisis or a Boom - Gold Survival Guide

Pingback: Rising Long Term Interest Rates Give Markets a Scare - Gold Survival Guide

Pingback: What's Next for Gold and Silver in New Zealand Dollars?

Pingback: Gold - a Leading Indicator for Bond Yields Topping Out? - Gold Survival Guide

Pingback: How Would Hyperinflation in the USA Affect New Zealand? - Gold Survival Guide

Pingback: RBNZ Ends Q.E./Currency Printing Early. How Will This Impact Precious Metals Prices? – Gold Survival Guide

Pingback: Are Positive Economic Numbers Merely the Result of Rising Prices? - Gold Survival Guide

Pingback: Interest Rates and Gold: If Interest Rates Rise What Happens to Gold? - Gold Survival Guide

Pingback: Here's Why Central Banks Won’t Tighten Hard Enough and Long Enough - Gold Survival Guide

Pingback: Cracks in US Treasury Bond? Will This Prompt More Buying of Precious Metals? - Gold Survival Guide

Pingback: Gold & Silver Performance: 2022 in Review & Our Punts for 2023 - Gold Survival Guide

Pingback: A Worldwide “Glut” of Unsold Properties? - Gold Survival Guide

Pingback: The NZD Gold Price vs Inflation: Analysing the Performance and Break-Even Potential - Gold Survival Guide