Darryl Schoon outlines why he believes the falling velocity of money means it’s likely deflation that we face for a while longer yet… THE SKY IS FALLING Chicken Little June 2020 The velocity of money is like blood pressure. If it is too high or too low, it can be fatal. Too high […]

Category Archives: Monetary System

This category is our catch all for some deep navel gazing!

We cover the gold standard and what transformations the global monetary system may take in the coming years. And how these changes would affect New Zealand.

Plus some random stuff like housing and money printing in New Zealand.

Must read articles about the Monetary System

If the US Dollar Was Again Linked to Gold, How Would This Affect New Zealand?

What’s the chance of a new gold standard happening? Read this and you’ll learn how a return to a gold standard would affect New Zealand and what you could do about it.

In a US Dollar Collapse Won’t The Rising NZ Dollar Cancel Out Any Gold/Silver Gains?

If the New Zealand Dollar were to keep rising against the US Dollar, how wil this affect any gains in gold and silver? Read on to find out…

Australia has 80 Tonnes of Gold, How Much Gold Does New Zealand Have?

Is the level of a countries gold reserves important? Learn how New Zealand’s gold reserves compare to Australia and what this means!

RBNZ: Now Actively Researching a Central Bank Digital Currency – Reading Between the Lines

See how the Reserve Bank of New Zealand is currently investigating central bank issued digital currencies. You’ll also learn what other central banks are up to in this space.

Why You Should Become Your Own Central Bank – Even if Your Nation’s Central Bank Has Gold Reserves

Why should you become your own central bank? Does it depend on how much gold your own nations central bank holds? You’ll discover the answer in this article along with other ways to mimic central banks in protecting your finances.

RBNZ Prepared to Print Money and Implement Negative Interest Rates in a Crisis

See how a Reserve Bank of New Zealand (RBNZ) bulletin outlines 5 unconventional monetary policy plans they could implement in case of a crisis, including negative interest rates and quantitative easing.

Latest Articles

A couple of weeks ago we reported on the prospect of negative interest rates arriving in New Zealand as soon as November. The Westpac chief economist expected the RBNZ to signal its change of plan in its August Monetary Policy Statement, and make a 75-point cut to -0.5% in November. Since then we’ve had a […]

Sandeep Jaitly shows us how silver demand has been growing despite the apparent lacklustre performance in price. There’s also an argument why the stock market rout has likely only just begun. Sandeep theorises on how low many publicly traded companies could yet fall. Of course the level of this “fall” depends on how the central […]

We’re at the end of the second week of the national Level 4 lockdown. So it’s worth reflecting on what will the impacts of the COVID19 lockdown be? This article covers: There are many theories as to where the virus started. Debate about how bad it will be and how much worse it could have […]

Are you at all confused about the difference between NZD and USD gold price (and silver price)? Here’s a question from a reader wanting some clarity on NZ Dollar versus USD Dollar precious metals prices: I am a little confused about the difference between the NZD and USD pricing though. Can you explain how the […]

We recently reported that in 2019 just about every asset class went up – including gold and silver. That is possibly evidence that we are in or entering Austrian economist Ludwig von Mises “crack-up boom”. Below Darryl Schoon discusses the goings on in the US Repo market and what he believes was the cause of […]

The New Zealand central bank is requiring New Zealand Banks to increase the amount of capital they hold. Why would they want to do this? Does the Reserve Bank of New Zealand (RBNZ) see some troubles looming on the horizon? Read on to find out… IMF’s Dire Warning on Global Economy In the Herald in […]

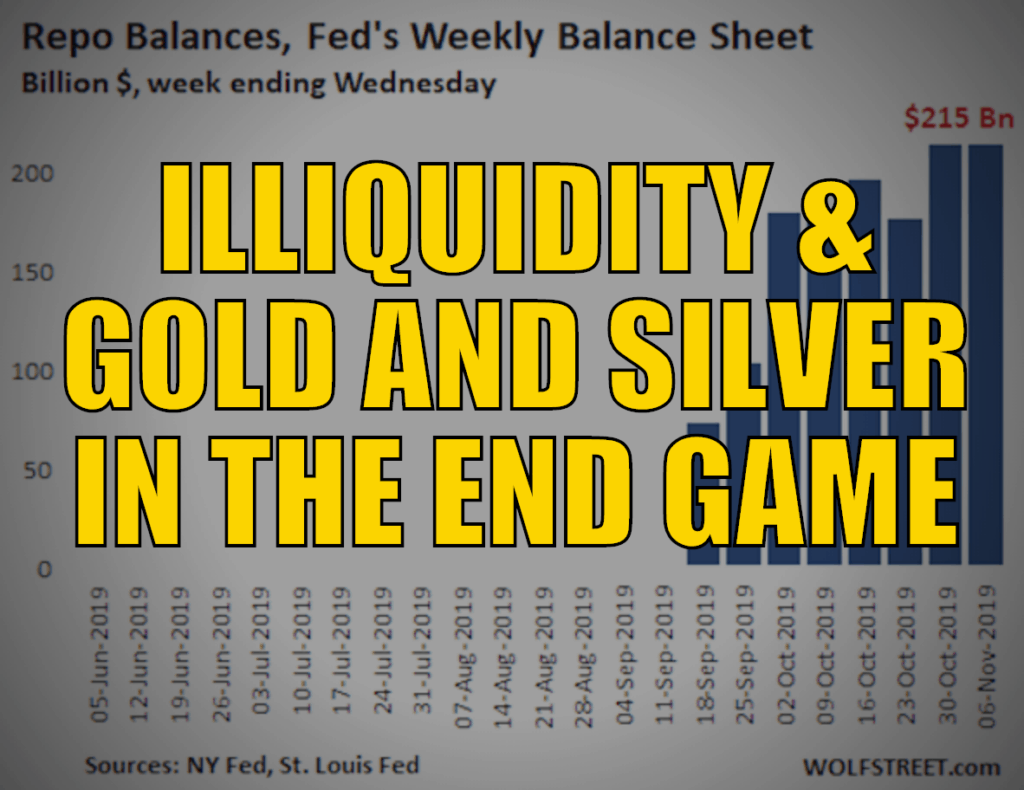

We haven’t heard from our friend Darryl Schoon in a while. But he’s back with some timely commentary on the US Federal Reserve Repo market. Are the current goings on similar to that of the liquidity crunch of 2007 in the lead up to the 2008 crisis?… Update: For the latest on the Repo market […]

Discover what the RBNZ Bank Financial Strength Dashboard is. Can it help you pick a “safe bank” in New Zealand? Hopefully by now you are aware that there is no deposit insurance in New Zealand banks. So if a bank fails in New Zealand you as a depositor run the risk of losing part or all […]

In September 2017 the US Federal Reserve announced that it would finally begin shrinking its $4.5 trillion balance sheet. So how has the Federal Reserve balance sheet reduction affected asset prices since then? How has the Fed stance on its balance sheet changed so far in 2019? What will happen next? Firstly, What is the […]